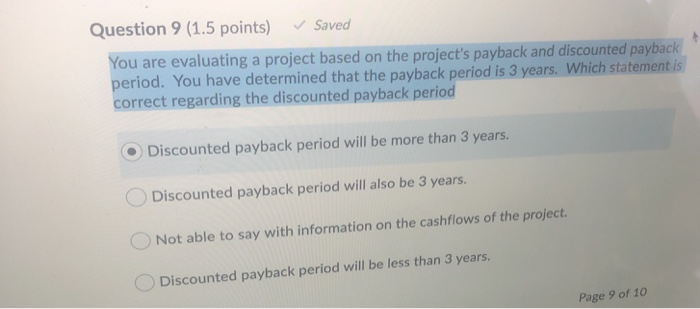

Question: Question 9 (1.5 points) Saved You are evaluating a project based on the project's payback and discounted payback period. You have determined that the payback

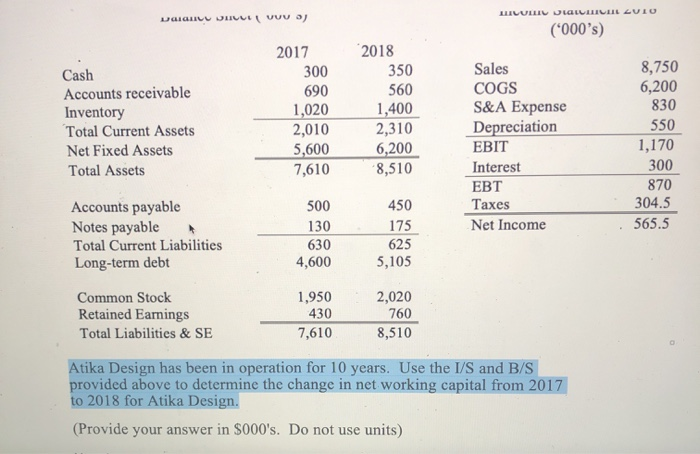

Question 9 (1.5 points) Saved You are evaluating a project based on the project's payback and discounted payback period. You have determined that the payback period is 3 years. Which statement is correct regarding the discounted payback period Discounted payback period will be more than 3 years. Discounted payback period will also be 3 years. Not able to say with information on the cashflows of the project. Discounted payback period will be less than 3 years. Page 9 of 10 LLILULLIU LOLLLLLL LULU DALILU DIVULI VUVO) (*000's) Cash Accounts receivable Inventory Total Current Assets Net Fixed Assets Total Assets 2017 300 690 1,020 2,010 5,600 7,610 2018 350 560 1,400 2,310 6,200 8,510 Sales COGS S&A Expense Depreciation EBIT Interest EBT Taxes Net Income 8,750 6,200 830 550 1,170 300 870 304.5 565.5 Accounts payable Notes payable Total Current Liabilities Long-term debt 500 130 630 4,600 450 175 625 5,105 Common Stock 1,950 2,020 Retained Earnings 430 760 Total Liabilities & SE 7,610 8,510 Atika Design has been in operation for 10 years. Use the I/S and B/S provided above to determine the change in net working capital from 2017 to 2018 for Atika Design. (Provide your answer in $000's. Do not use units)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts