Question: Question 9 ( 2 5 points ) Marcus Laramore operates a proprietorship that sells sports memorabilia. It has been in operation for several years and

Question points

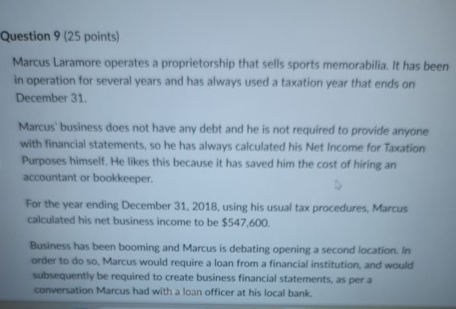

Marcus Laramore operates a proprietorship that sells sports memorabilia. It has been in operation for several years and has always used a taxation year that ends on December

Marcus' business does not have any debt and he is not required to provide anyone with financial statements, so he has always calculated his Net Income for Taxation Purposes himself. He likes this because it has saved him the cost of hiring an accountant or bookkeeper.

For the year ending December using his usual tax procedures, Marcus calculated his net business income to be $

Business has been booming and Marcus is debating opening a second location. In order to do so Marcus would require a loan from a financial institution, and would subsequently be required to create business financial statements, as per a comversation Marcus had with a loan officer at his locat bank.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock