Question: Question 9 2 pts A trader owns a commodity as part of a long-term investment portfolio. The trader can buy the commodity spot for $980

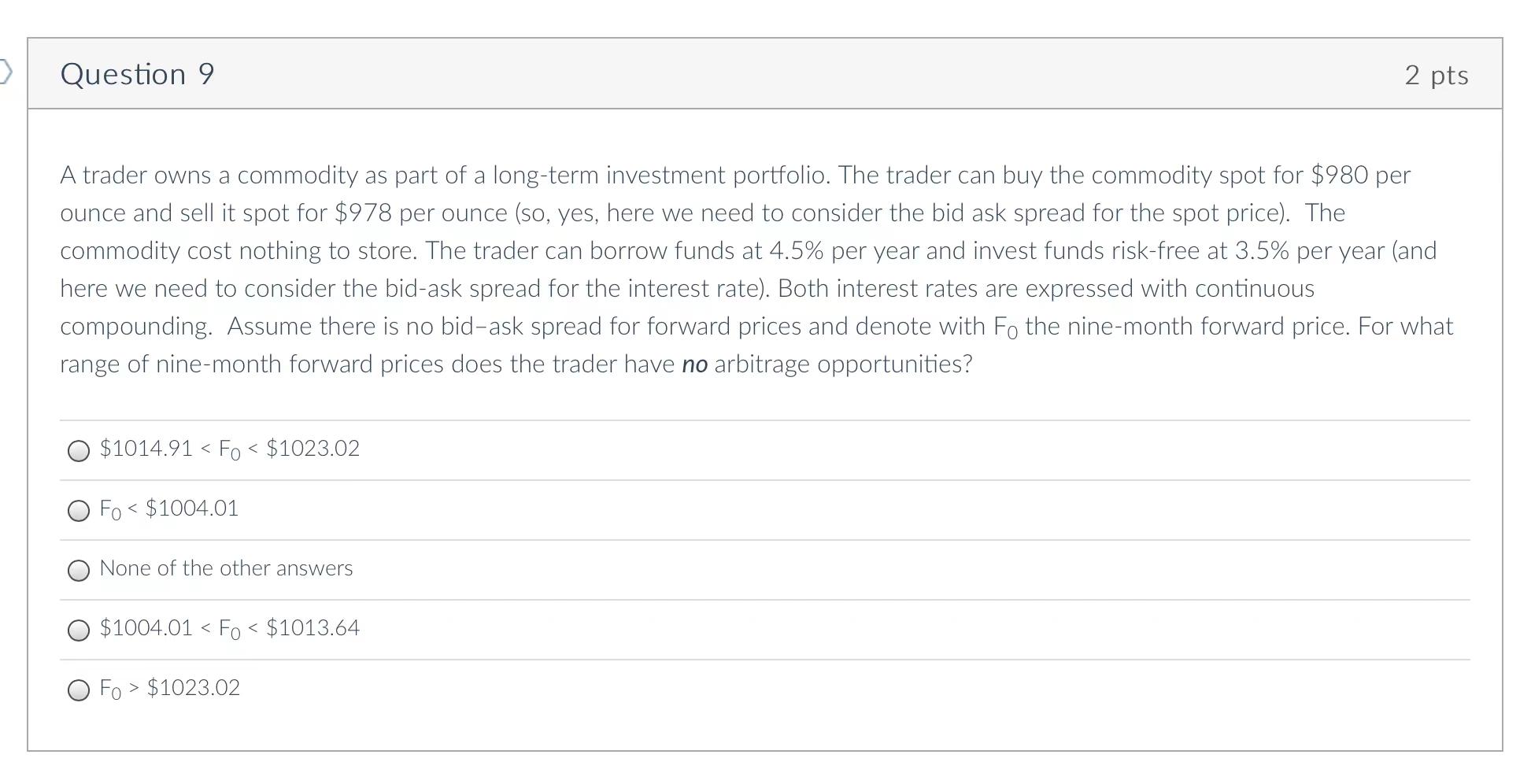

Question 9 2 pts A trader owns a commodity as part of a long-term investment portfolio. The trader can buy the commodity spot for $980 per ounce and sell it spot for $978 per ounce (so, yes, here we need to consider the bid ask spread for the spot price). The commodity cost nothing to store. The trader can borrow funds at 4.5% per year and invest funds risk-free at 3.5% per year (and here we need to consider the bid-ask spread for the interest rate). Both interest rates are expressed with continuous compounding. Assume there is no bid-ask spread for forward prices and denote with Fo the nine-month forward price. For what range of nine-month forward prices does the trader have no arbitrage opportunities? $1014.91 $1023.02

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts