Question: Question 9 2 pts Pertinent information for two alternatives A and B is shown below. If i=10%/year and the effective income tax rate is 35%,

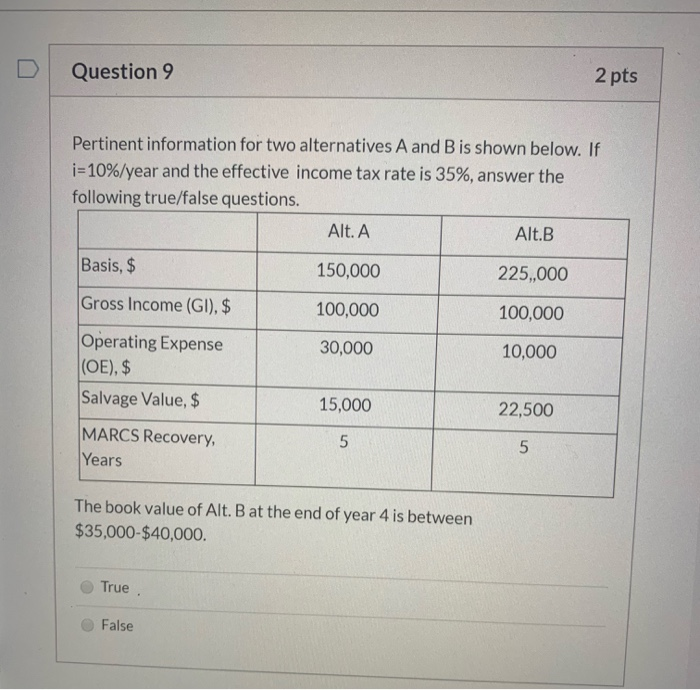

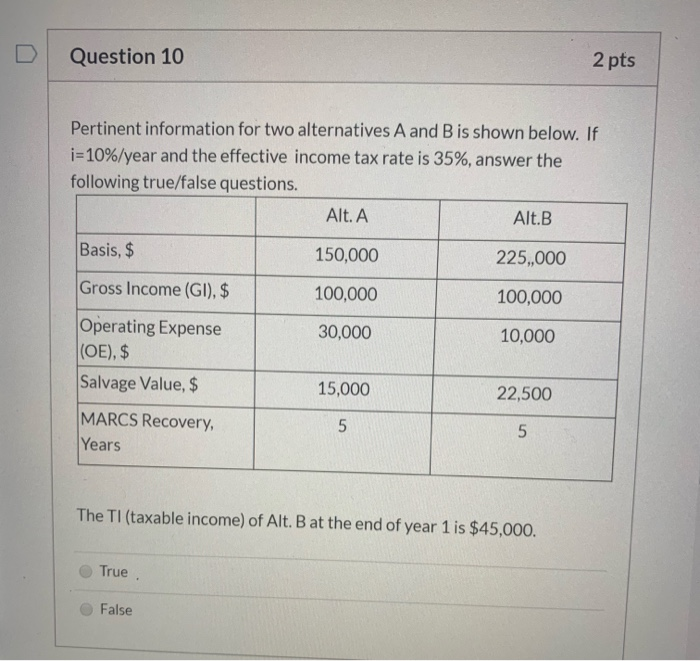

Question 9 2 pts Pertinent information for two alternatives A and B is shown below. If i=10%/year and the effective income tax rate is 35%, answer the following true/false questions. Alt. A Alt.B Basis, $ 150,000 225,,000 Gross Income (GI), $ 100,000 100,000 Operating Expense 30,000 10,000 (OE), $ Salvage Value, $ 15,000 22,500 MARCS Recovery, Years The book value of Alt. B at the end of year 4 is between $35,000-$40,000. True False Question 10 2 pts Pertinent information for two alternatives A and B is shown below. If i=10%/year and the effective income tax rate is 35%, answer the following true/false questions. Alt. A Alt.B Basis, $ 150,000 225,000 Gross Income (GI), $ 100,000 100,000 30,000 10,000 Operating Expense (OE), $ Salvage Value, $ 15,000 22,500 MARCS Recovery, Years The TI (taxable income) of Alt. B at the end of year 1 is $45,000. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts