Question: Question 9 (2.5 points) A local retailer is required to collect a 6% sales tax for the state's department of revenue and remit in the

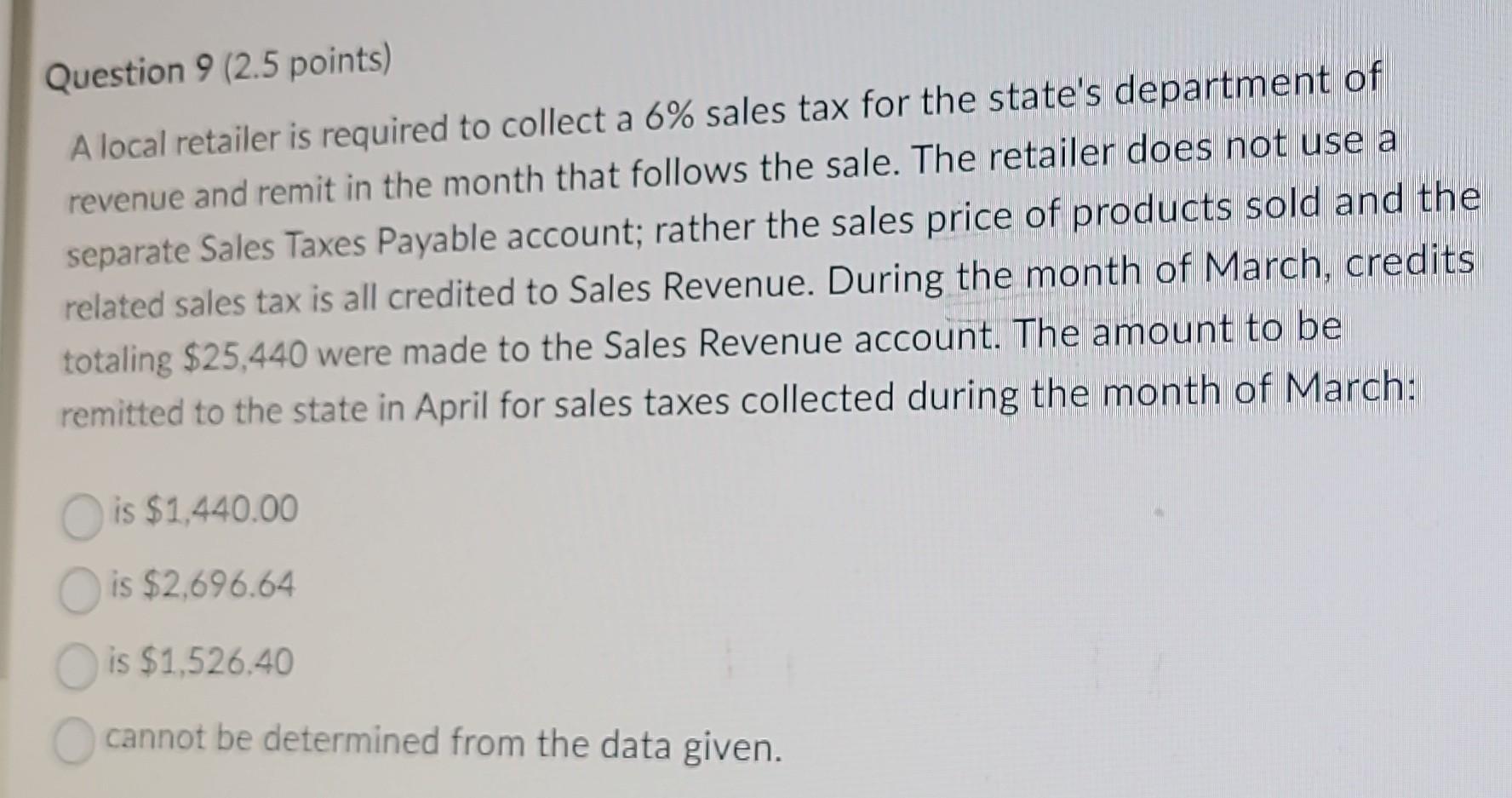

Question 9 (2.5 points) A local retailer is required to collect a 6% sales tax for the state's department of revenue and remit in the month that follows the sale. The retailer does not use a separate Sales Taxes Payable account; rather the sales price of products sold and the related sales tax is all credited to Sales Revenue. During the month of March, credits totaling $25,440 were made to the Sales Revenue account. The amount to be remitted to the state in April for sales taxes collected during the month of March: is $1,440.00 is $2,696.64 is $1,526,40 cannot be determined from the data given

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock