Question: Question 9 (3 marks) Nungesse Co. has issued bonds that have 9 coupon rate, payable semi-annually. The bonds mature in 8 years, have a face

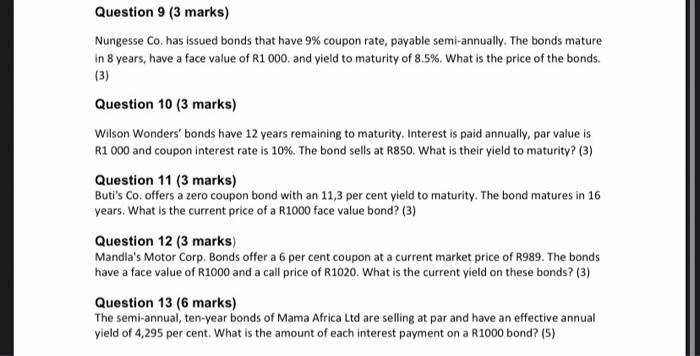

Question 9 (3 marks) Nungesse Co. has issued bonds that have \9 coupon rate, payable semi-annually. The bonds mature in 8 years, have a face value of R1 000. and yield to maturity of \8.5. What is the price of the bonds. (3) Question 10 (3 marks) Wilson Wonders' bonds have 12 years remaining to maturity. Interest is paid annually, par value is R1 000 and coupon interest rate is \10. The bond sells at R850. What is their yield to maturity? (3) Question 11 (3 marks) Buti's Co. offers a zero coupon bond with an 11,3 per cent yield to maturity. The bond matures in 16 years. What is the current price of a R1000 face value bond? (3) Question 12 (3 marks) Mandla's Motor Corp. Bonds offer a 6 per cent coupon at a current market price of R989. The bonds have a face value of R1000 and a call price of R1020. What is the current yield on these bonds? (3) Question 13 (6 marks) The semi-annual, ten-year bonds of Mama Africa Ltd are selling at par and have an effective annual yield of 4,295 per cent. What is the amount of each interest payment on a R1000 bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts