Question: QUESTION 9 3 points Sa Ben teaches golf lessons at a country club under a business called Ben's Pure Swings (BPS) He operates this business

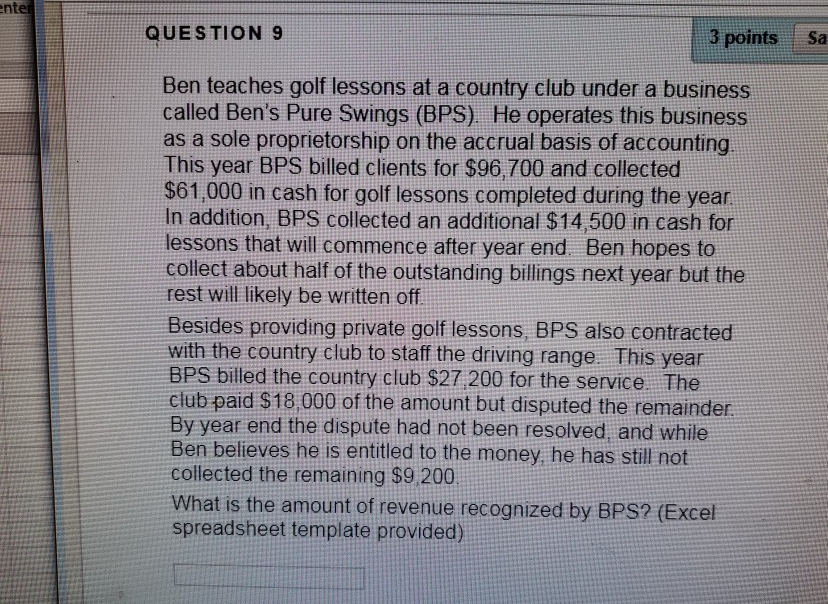

QUESTION 9 3 points Sa Ben teaches golf lessons at a country club under a business called Ben's Pure Swings (BPS) He operates this business as a sole proprietorship on the accrual basis of accounting This year BPS billed clients for $96,700 and collected $61,000 in cash for golf lessons completed during the year In addition, BPS collected an additional $14,500 in cash for lessons that will commence after year end Ben hopes to collect about half of the outstanding bilings next year but the rest will likely be written off Besides providing private golf lessons, BPS also contracted with the country club to staff the driving range. This year BPS billed the country club $27 200 for the service The club paid $18,000 of the amount but disputed the remainder By year end the dispute had not been resolved and while Ben believes he is entitled to the money he has still not collected the remaining $9 200 What is the amount of revenue recognized by BPS? (Excel spreadsheet template provided)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts