Question: Question 9 (3 points) Saved When a general partner is unable to pay a capital deficiency: The partner must take out a loan to cover

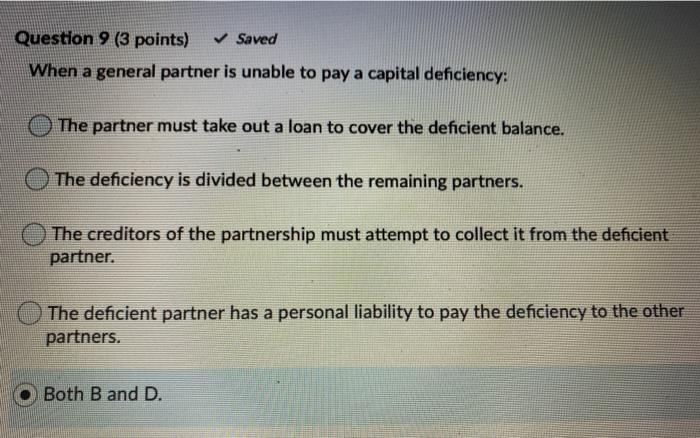

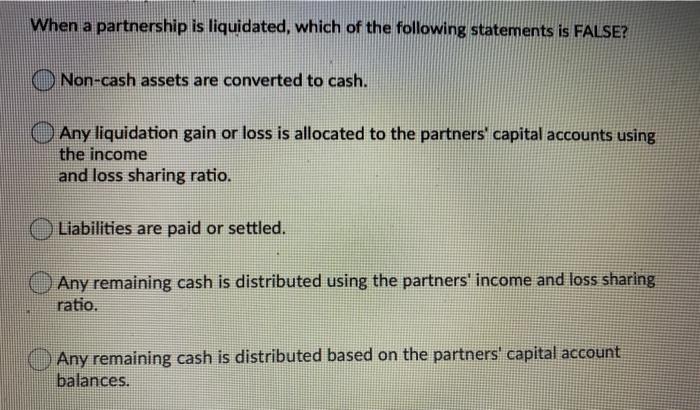

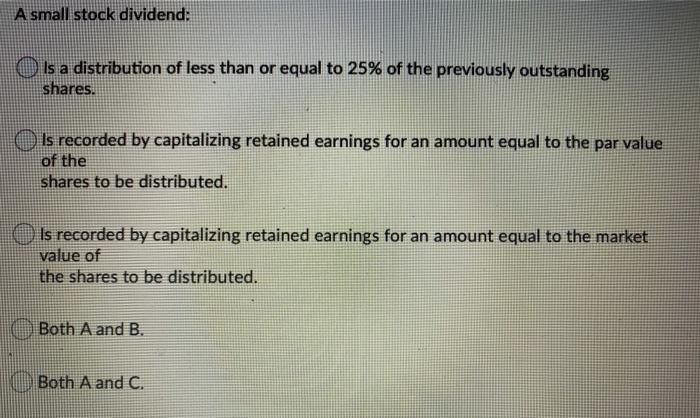

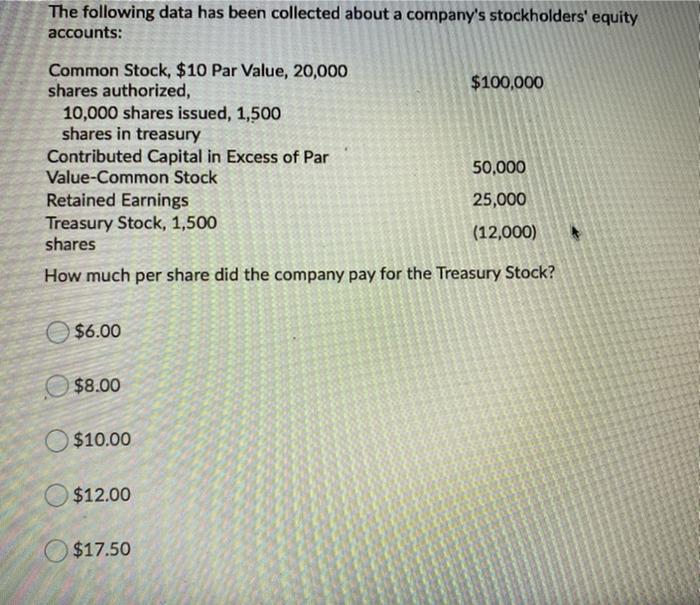

Question 9 (3 points) Saved When a general partner is unable to pay a capital deficiency: The partner must take out a loan to cover the deficient balance. The deficiency is divided between the remaining partners. The creditors of the partnership must attempt to collect it from the deficient partner. The deficient partner has a personal liability to pay the deficiency to the other partners. Both B and D. When a partnership is liquidated, which of the following statements is FALSE? Non-cash assets are converted to cash. Any liquidation gain or loss is allocated to the partners' capital accounts using the income and loss sharing ratio. Liabilities are paid or settled. Any remaining cash is distributed using the partners' income and loss sharing ratio. Any remaining cash is distributed based on the partners' capital account balances. A small stock dividend: Is a distribution of less than or equal to 25% of the previously outstanding shares. Is recorded by capitalizing retained earnings for an amount equal to the par value of the shares to be distributed. Is recorded by capitalizing retained earnings for an amount equal to the market value of the shares to be distributed. Both A and B. Both A and C. The following data has been collected about a company's stockholders' equity accounts: Common Stock, $10 Par Value, 20,000 shares authorized, $100,000 10,000 shares issued, 1,500 shares in treasury Contributed Capital in Excess of Par Value-Common Stock 50,000 Retained Earnings 25,000 Treasury Stock, 1,500 (12,000) shares How much per share did the company pay for the Treasury Stock? $6.00 $8.00 $10.00 $12.00 $17.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts