Question: QUESTION 9: 30 MARKS | Leichardt Ltd owns and operates an oil well in outback Australia. On Jan 1, 2012 Leichardt Ltd purchased a new

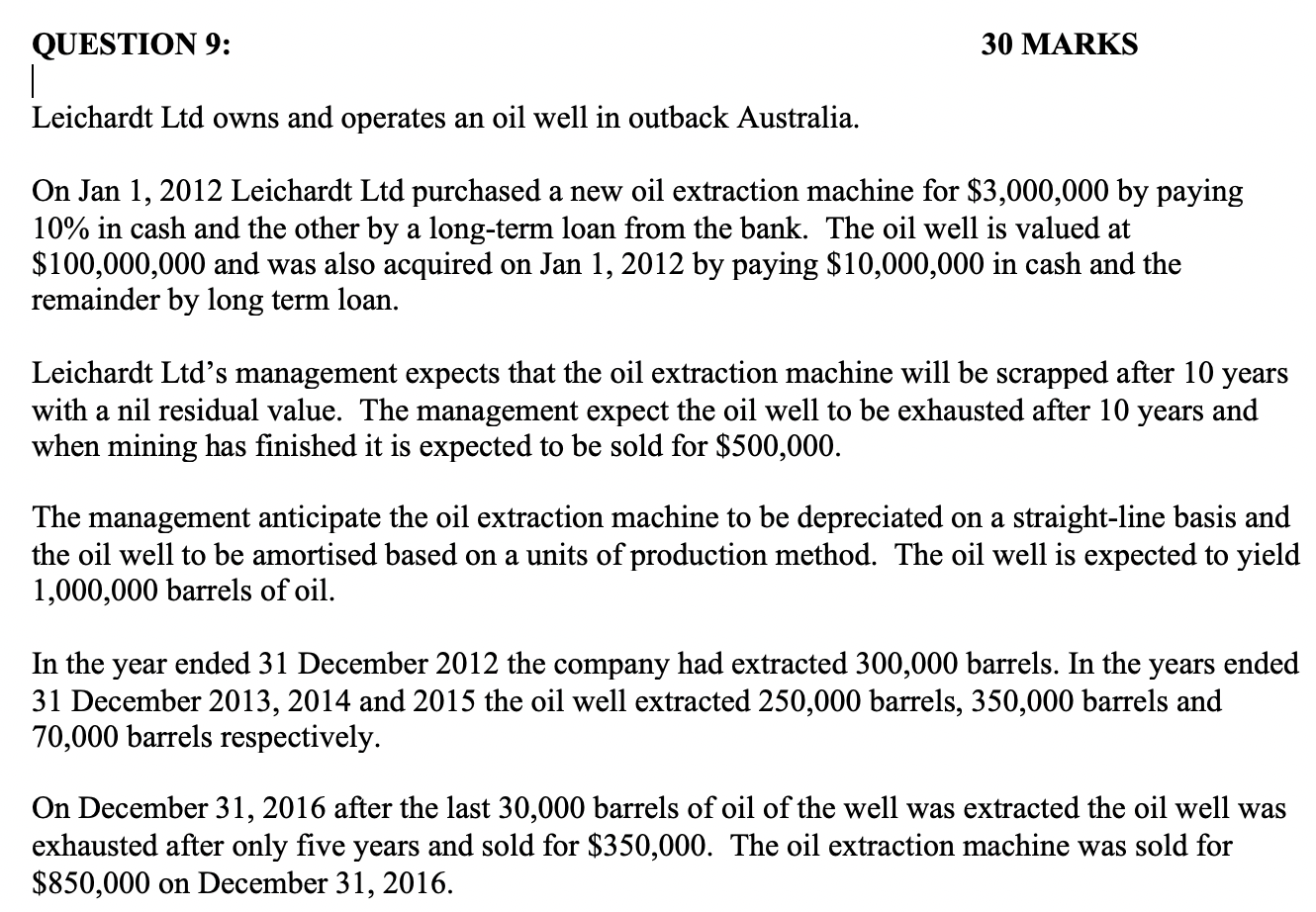

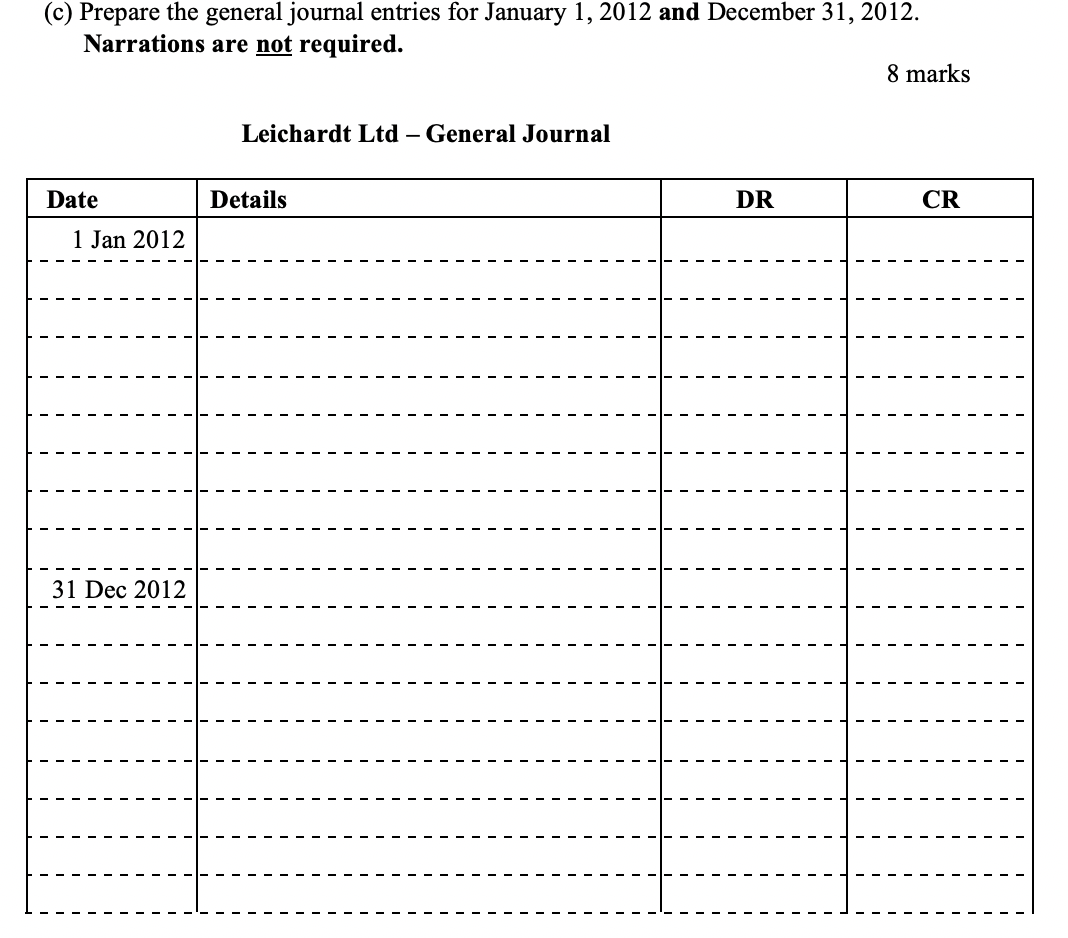

QUESTION 9: 30 MARKS | Leichardt Ltd owns and operates an oil well in outback Australia. On Jan 1, 2012 Leichardt Ltd purchased a new oil extraction machine for $3,000,000 by paying 10% in cash and the other by a long-term loan from the bank. The oil well is valued at $100,000,000 and was also acquired on Jan 1, 2012 by paying $10,000,000 in cash and the remainder by long term loan. Leichardt Ltd's management expects that the oil extraction machine will be scrapped after 10 years with a nil residual value. The management expect the oil well to be exhausted after 10 years and when mining has finished it is expected to be sold for $500,000. The management anticipate the oil extraction machine to be depreciated on a straight-line basis and the oil well to be amortised based on a units of production method. The oil well is expected to yield 1,000,000 barrels of oil. In the year ended 31 December 2012 the company had extracted 300,000 barrels. In the years ended 31 December 2013, 2014 and 2015 the oil well extracted 250,000 barrels, 350,000 barrels and 70,000 barrels respectively. On December 31, 2016 after the last 30,000 barrels of oil of the well was extracted the oil well was exhausted after only five years and sold for $350,000. The oil extraction machine was sold for $850,000 on December 31, 2016. (c) Prepare the general journal entries for January 1, 2012 and December 31, 2012. Narrations are not required. 8 marks Leichardt Ltd - General Journal Date Details DR CR 1 Jan 2012 31 Dec 2012 (e) Record the relevant journal entries for December 31, 2016. Narrations are required. 10 marks + Leichardt Ltd - General Journal DR Date Details CR 31 Dec 2016

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts