Question: Question #9 - 4 marks - 12 minutes On March 1, 2020, QKQ Company issues a bond with a face value of $1,500,000 The bond

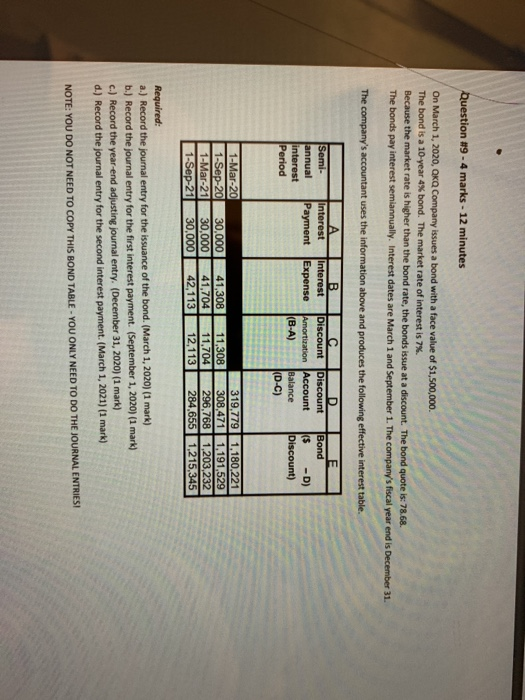

Question #9 - 4 marks - 12 minutes On March 1, 2020, QKQ Company issues a bond with a face value of $1,500,000 The bond is a 10-year 4% bond. The market rate of interest is 7%. Because the market rate is higher than the bond rate, the bonds issue at a discount. The bond quote is: 78.68 The bonds pay interest semiannually. Interest dates are March 1 and September 1. The company's fiscal year end is December 31 The company's accountant uses the information above and produces the following effective interest table. Semi- annual interest Period Interest Payment B Interest Expense Discount Discount Amortization Account (B-A) Balance (D-C) E Bond is -D) Discount) 1-Mar-20 1-Sep-20 1-Mar-21 1-Sep-211 30,000 30,000 30,000 41,308 41,704 42,113 11,308 11,704 12,113 319,779 1,180,221 308,471 1,191,529 296,768 1,203,232 284,655 1,215,345 Required: a.) Record the journal entry for the issuance of the bond. (March 1, 2020) (1 mark) b.) Record the journal entry for the first interest payment. (September 1, 2020) (1 mark) c.) Record the year-end adjusting journal entry. (December 31, 2020) (1 mark) d.) Record the journal entry for the second interest payment. (March 1, 2021) (1 mark) NOTE: YOU DO NOT NEED TO COPY THIS BOND TABLE - YOU ONLY NEED TO DO THE JOURNAL ENTRIES

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts