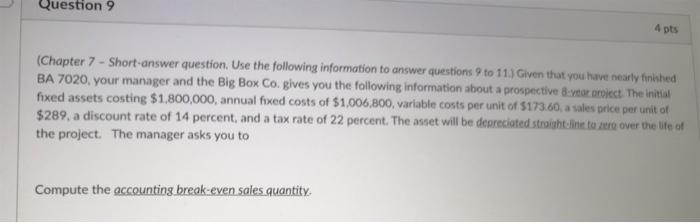

Question: Question 9 4 pts (Chapter 7 - Short-answer question. Use the following information to answer questions 9 to 11.) Given that you have nearly finished

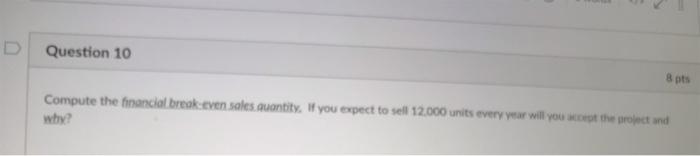

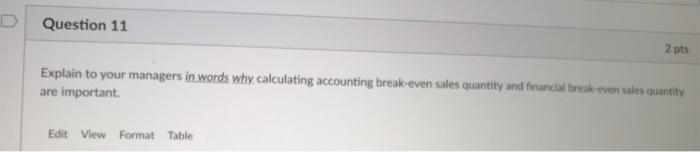

Question 9 4 pts (Chapter 7 - Short-answer question. Use the following information to answer questions 9 to 11.) Given that you have nearly finished BA 7020, your manager and the Big Box Co. gives you the following information about a prospectiveBytor lect. The initial fixed assets costing $1,800,000, annual fixed costs of $1.006,800, variable costs per unit of $173.60, a sales price per unit of $289, a discount rate of 14 percent, and a tax rate of 22 percent. The asset will be depreciated straight line to zer over the life of the project. The manager asks you to Compute the accounting break-even sales quantity, Question 10 8 pts Compute the financial break even soles quantity. If you expect to sell 12.000 units every year will you be the project and why? Question 11 2 pts Explain to your managers in words why calculating accounting break-even sales quantity and financial break even sales quantity are important Edit View Format Table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts