Question: Question 9 4 pts Suppose you are shareholder in an S-corporation. The corporation earned $10.00 per share this past quarter and plans to pay out

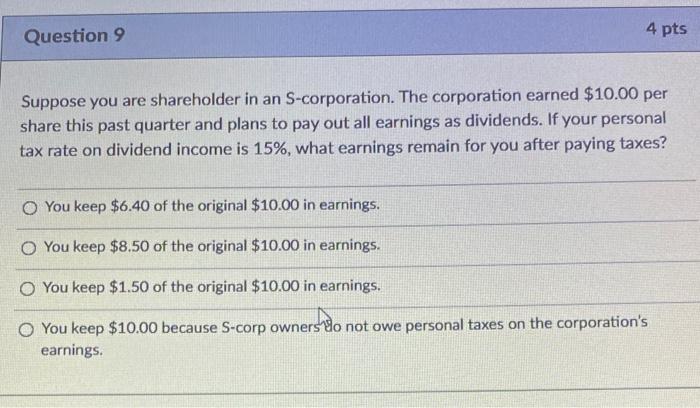

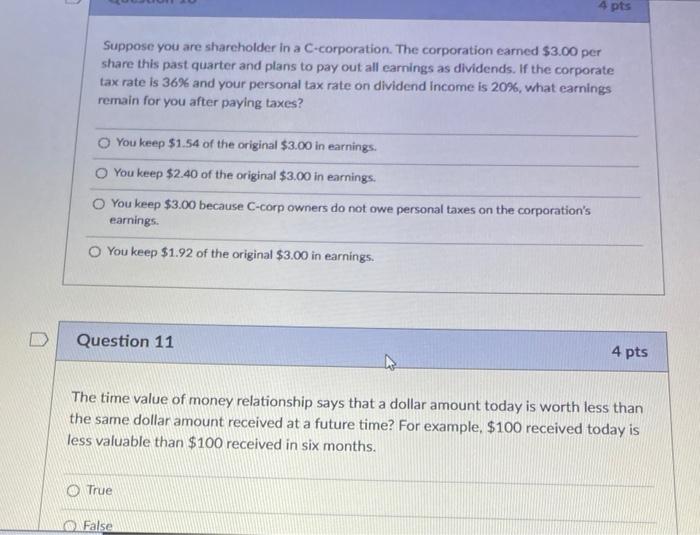

Question 9 4 pts Suppose you are shareholder in an S-corporation. The corporation earned $10.00 per share this past quarter and plans to pay out all earnings as dividends. If your personal tax rate on dividend income is 15%, what earnings remain for you after paying taxes? O You keep $6.40 of the original $10.00 in earnings. You keep $8.50 of the original $10.00 in earnings. You keep $1.50 of the original $10.00 in earnings. You keep $10.00 because S-corp owners do not owe personal taxes on the corporation's earnings. 4 pts Suppose you are shareholder in a C-corporation. The corporation earned $3.00 per share this past quarter and plans to pay out all earnings as dividends. If the corporate tax rate is 36% and your personal tax rate on dividend Income is 20%, what earnings remain for you after paying taxes? You keep $1.54 of the original $3.00 in earnings. You keep $2.40 of the original $3.00 in earnings. You keep $3.00 because C-corp owners do not owe personal taxes on the corporation's earnings. You keep $1.92 of the original $3.00 in earnings. Question 11 4 pts The time value of money relationship says that a dollar amount today is worth less than the same dollar amount received at a future time? For example, $100 received today is less valuable than $100 received in six months. O True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts