Question: Question 9 (5 points) Saved Which strategy is the best strategy if you expect that the underlying asset price decreases with a low volatility. long

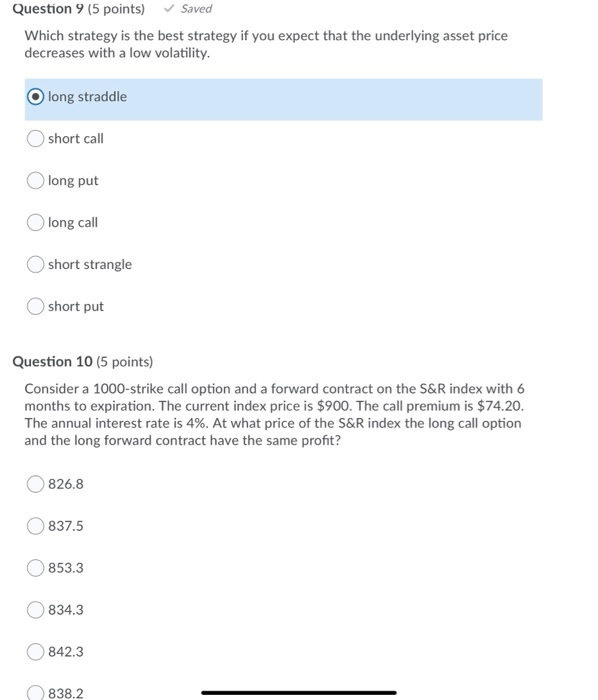

Question 9 (5 points) Saved Which strategy is the best strategy if you expect that the underlying asset price decreases with a low volatility. long straddle short call long put Olong call short strangle short put Question 10 (5 points) Consider a 1000-strike call option and a forward contract on the S&R index with 6 months to expiration. The current index price is $900. The call premium is $74.20. The annual interest rate is 4%. At what price of the S&R index the long call option and the long forward contract have the same profit? 826.8 837.5 853.3 834.3 842.3 838.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts