Question: Question 9 a. b. Please provide a recommendation to a company which consider issuing convertible debt or straight debt. Under what circumstances the choice of

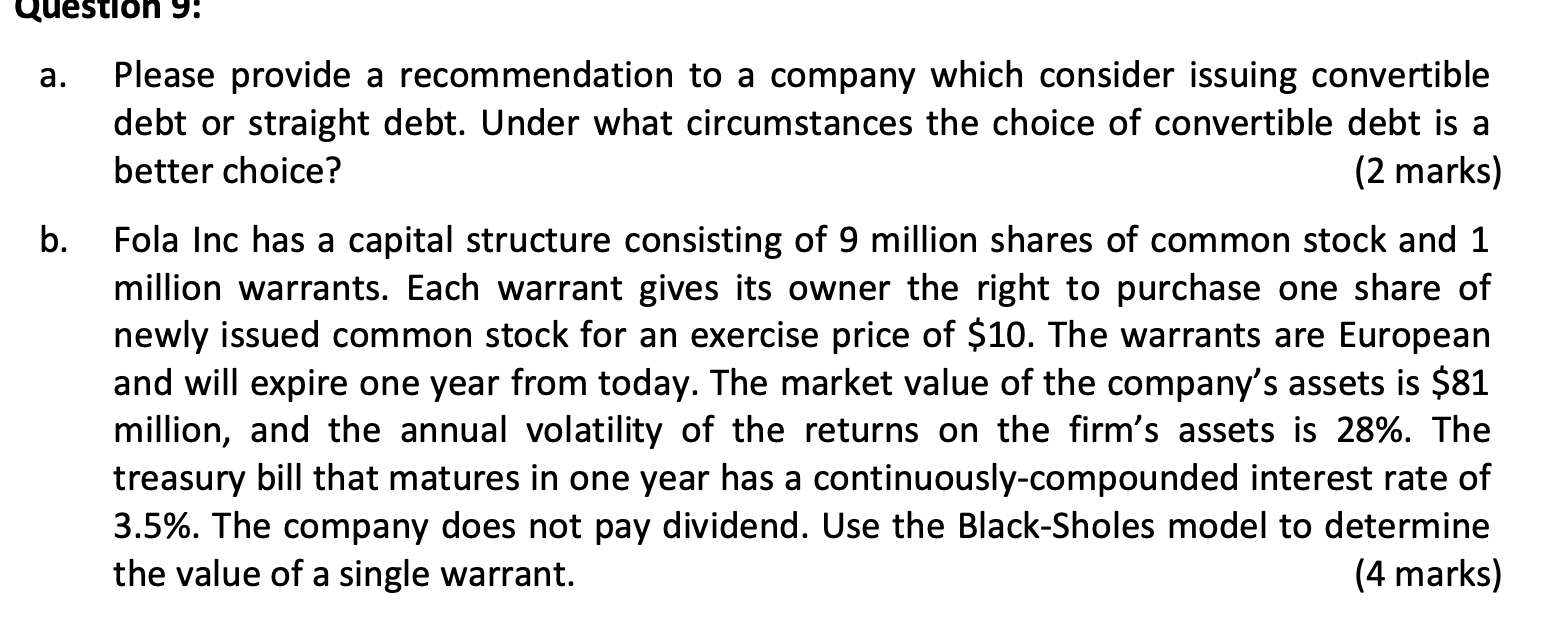

Question 9 a. b. Please provide a recommendation to a company which consider issuing convertible debt or straight debt. Under what circumstances the choice of convertible debt is a better choice? (2 marks) Fola Inc has a capital structure consisting of 9 million shares of common stock and 1 million warrants. Each warrant gives its owner the right to purchase one share of newly issued common stock for an exercise price of $10. The warrants are European and will expire one year from today. The market value of the company's assets is $81 million, and the annual volatility of the returns on the firm's assets is 28%. The treasury bill that matures in one year has a continuously-compounded interest rate of 3.5%. The company does not pay dividend. Use the Black-Sholes model to determine the value of a single warrant. (4 marks) Question 9 a. b. Please provide a recommendation to a company which consider issuing convertible debt or straight debt. Under what circumstances the choice of convertible debt is a better choice? (2 marks) Fola Inc has a capital structure consisting of 9 million shares of common stock and 1 million warrants. Each warrant gives its owner the right to purchase one share of newly issued common stock for an exercise price of $10. The warrants are European and will expire one year from today. The market value of the company's assets is $81 million, and the annual volatility of the returns on the firm's assets is 28%. The treasury bill that matures in one year has a continuously-compounded interest rate of 3.5%. The company does not pay dividend. Use the Black-Sholes model to determine the value of a single warrant. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts