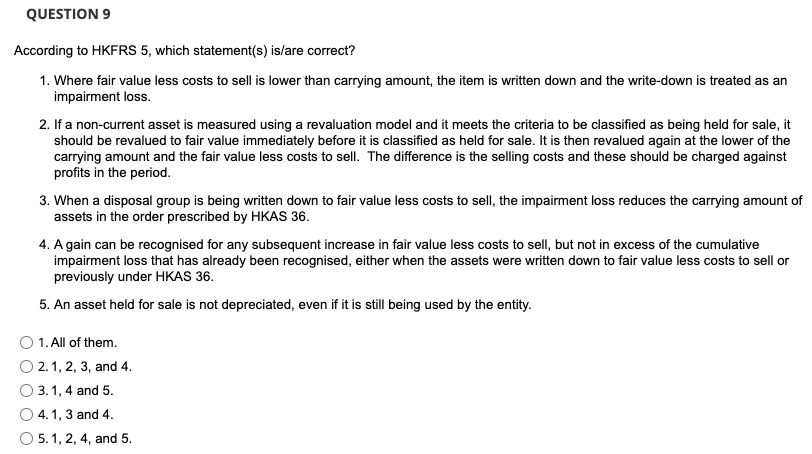

Question: QUESTION 9 According to HKFRS 5 , which statement ( s ) is / are correct? Where fair value less costs to sell is lower

QUESTION

According to HKFRS which statements isare correct?

Where fair value less costs to sell is lower than carrying amount, the item is written down and the writedown is treated as an

impairment loss.

If a noncurrent asset is measured using a revaluation model and it meets the criteria to be classified as being held for sale, it

should be revalued to fair value immediately before it is classified as held for sale. It is then revalued again at the lower of the

carrying amount and the fair value less costs to sell. The difference is the selling costs and these should be charged against

profits in the period.

When a disposal group is being written down to fair value less costs to sell, the impairment loss reduces the carrying amount of

assets in the order prescribed by HKAS

A gain can be recognised for any subsequent increase in fair value less costs to sell, but not in excess of the cumulative

impairment loss that has already been recognised, either when the assets were written down to fair value less costs to sell or

previously under HKAS

An asset held for sale is not depreciated, even if it is still being used by the entity.

All of them.

and

and

and

and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock