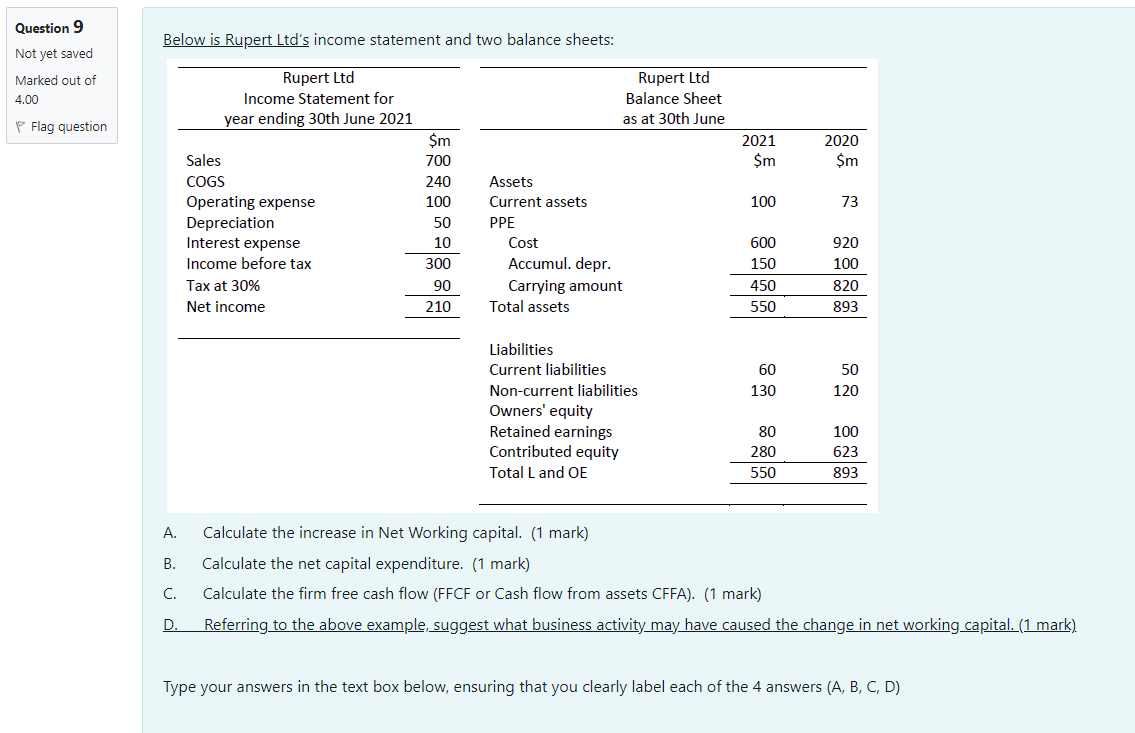

Question: Question 9 Below is Rupert Ltd's income statement and two balance sheets: Not yet saved Marked out of 4.00 Rupert Ltd Income Statement for year

Question 9 Below is Rupert Ltd's income statement and two balance sheets: Not yet saved Marked out of 4.00 Rupert Ltd Income Statement for year ending 30th June 2021 Rupert Ltd Balance Sheet as at 30th June P Flag question 2021 $m 2020 $m 100 73 Sales COGS Operating expense Depreciation Interest expense Income before tax Tax at 30% Net income Sm 700 240 100 50 10 300 90 210 || Assets Current assets PPE Cost Accumul. depr. Carrying amount Total assets 600 150 450 550 920 100 820 893 60 130 50 120 Liabilities Current liabilities Non-current liabilities Owners' equity Retained earnings Contributed equity Total Land OE 80 280 550 100 623 893 A. B. Calculate the increase in Net Working capital. (1 mark) Calculate the net capital expenditure. (1 mark) Calculate the firm free cash flow (FFCF or Cash flow from assets CFFA). (1 mark) Referring to the above example, suggest what business activity may have caused the change in net working capital. (1 mark) C. D. Type your answers in the text box below, ensuring that you clearly label each of the 4 answers (A, B, C, D)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts