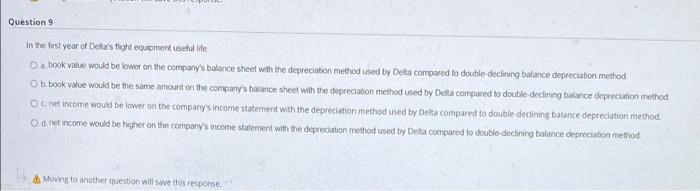

Question: Question 9 In the first year of Delta's tight equipment useful life a trook value would be lower on the company's balance sheet with the

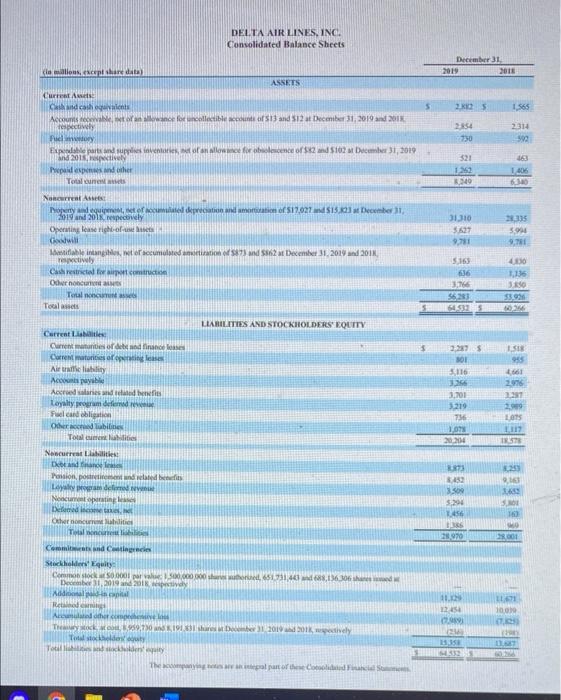

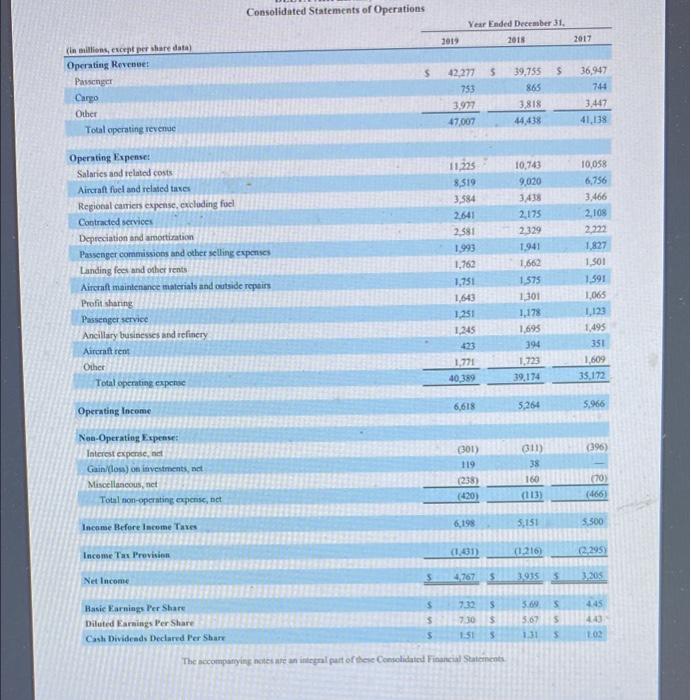

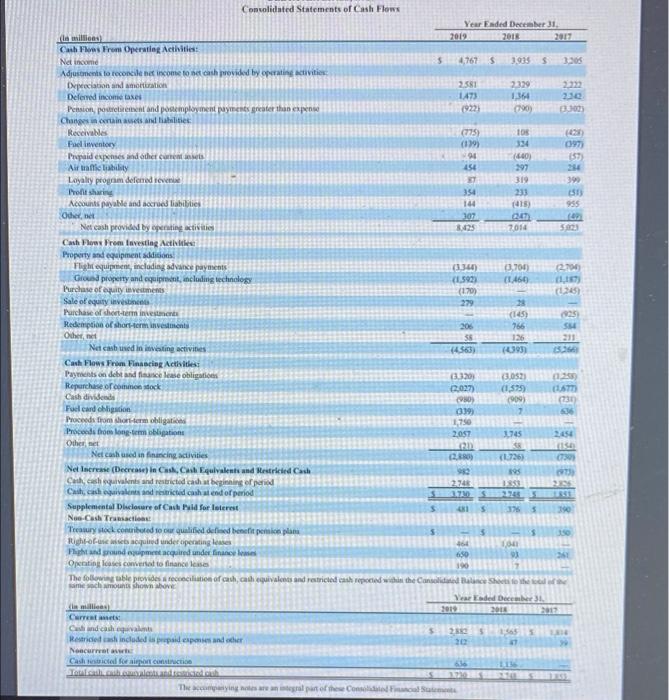

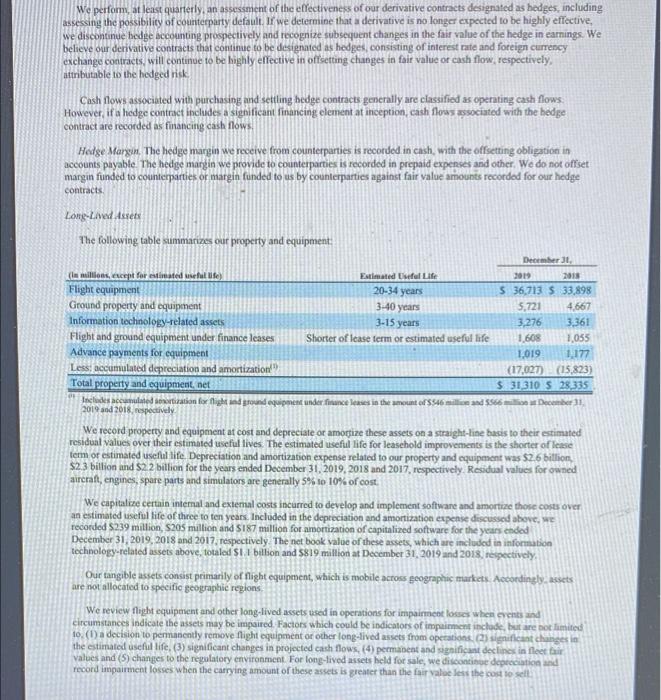

Question 9 In the first year of Delta's tight equipment useful life a trook value would be lower on the company's balance sheet with the depreciation method used by Delta compared to double-decining balance depreciation method b. book value would be the same amount on the company's balance sheet with the depreciation method used by Delta compared to double declining balance depreciation method oc net income would be lower on the company's income statement with the depreciation method used by Delta compared to double declining balance depreciation method. O . net income would be higher on the company's income statement with the depreciation method used by Delta compared to double-decining balance depreciation method Moving to another question will save this response. DELTA AIRLINES, INC. Consolidated Balance Sheets December 31 2019 2018 5 2.15 1.565 Klacious centre data ASSETS Current A Coints Account Netoface for uncollectible account of 13 and 12 at December 31, 2019 and 2012 respectively Filmy Expendable parts and supplies Avente, allowme for bence of 52 and 5102 December 31, 2019 and 2015 Prepaid puder Total 2854 2314 521 16 1405 6160 349 31310 31527 9,711 335 3,994 9,1 NORGE AS Nom det er som predmetation of $17.927 515.03 December 2019 2018 respectively Operating serio Cell ilable inngis, of accumse mutation 33 and 362 December 31, 2014 in 2011 Testy Crestrict couco Odhur non Total de Toale 5.163 636 3.766 562 54535 400 1.136 3.50 53.926 LABILITIES AND STOCKHOLDERS' EQUITY Current Current ordinace Crematories in Airtrate listy Acope Acceeded Loyalty program defende Fobligation Othered abilities wienie 2275 1.SI NOI 945 116 2016 3,701 237 3:219 756109 09 11 2014 1STE 30 3.500 5294 1456 TO 20970 3001 Necura Libilities Debrand alsin, pod is Ledelem Necunosting Dede Other cities Totalci Common and Cage Stockholders Equity Commons 50.00 50.00 58.136.306 De 31, 2018 Add Re Actor 49.00 191 2010 201 diely Total des Toy The part of the Cold 100 11. 12 09 TU HIS Consolidated Statements of Operations Year Ended December 31 2018 2019 2017 5 $ (in Millions, except per share data) Operating Revenge Passenger Cargo Other Total operating revenue 42.277 753 39,755 865 3,818 44,438 36,947 744 3.447 41,138 3,977 47007 Operating Expense: Salaries and related costs Aircraft fuel and related taxes Regional carriers expense, excluding fuel Contracted services Depreciation and amortization Passenger commissions and other selling expenses Landing fees and other rents Aircraft maintenance materials and outside repairs Profit sharing Passenger service Ancillary businesses and refinery Aircraft rent Other Total operating expeh 11.225 8.519 3,384 2641 2.581 1.993 1,762 1,751 1,643 1.251 1.245 423 1.771 40,389 10,743 9,020 3418 2.175 2329 1.941 1.662 1.575 1,301 1,178 1.695 394 1,723 39,174 10,058 6,756 3,466 2,108 2.222 1.827 1,500 1.591 1.065 1,123 1,495 351 1,609 35.172 6,618 5.264 5.966 Operating Income 011) (396) Non-Operation Expenset Interest expense, net Gain (los) on investments, net Miscellaneous, net Total non-operating expense, net 301) 119 (238) (420) 38 160 (113) (70) (466) Income Before Income Taxes 6.198 5300 5,151 Income Tax Provision (1.216) 0295 4767 $ Net Income 3915 5 3205 S 445 Basic Earnings Per Share S Diluted Earnings Per Share 7.30 $ Cash Dividends Declared Per Share 1:51 The accompanying notes are an integral part of the Consolidated Financial Statements 30 5.02 131 5 5 S 103 06 Consolidated Statements of Cash Flows Year Ended December 31 (la millo) 2019 2018 Cash Flows From Operating Acthitles Net income 47675 39355 3.305 Adjustments to reconcile et income to be ashovided by operating activities Depreciation and mortation 2.5812329 22 Deferred income se 147) 1,364 2.30 Pension pourcent and postemployment payments greater than expense 100 0:00 Changes in certaines and Babilities Receivables (775) 108 Fuel inventory (139) 334 097 Prepaid expenses and other content 90 (440 Air traffic liability 156 197 Loyalty program defend teven 319 390 Tholilstaries| 354 231 Accounts payable and some liabilities 144 (415) 955 Othernet 307 200 Net cash provided by ting activities 7014 Cash Play From Investing Acties Property and equipment additions huipen, including advance payments (140 0.700 2.700 Goud property and equipment, including technology 1.5923 (1460 11,1 Purchase of quity investments (1.700 0.265 Sale of equity investice 279 Purchase of short-term investments (145) Redemption of short-term investments 206 766 SH Othernet 38 126 Net bed in investing activities (4563) 5366 Cash Flows From Financing Activities Payments on debt and fasce le obligations BU 30523 Repurchase of common stock 0.027 (1.575 1ST Cash dividende (909) Fuel card obligation 0.39 7 56 Proceeds from the term obligation 1,750 Proceeds from longtem obligations 1745 Other set LP Nel caso used in financing activities (726) 000 Net Increase (Decrease in Cushub Equivalent and Restricted Cash Cath, cash valents and restricted cachat beginning of pred 2743 123 Chichewivalents and restricted cash at end of period Supplemental Declature of Child for leterest 5 390 Neo-Cash Transaction Teasury stock contributed to our qualified defined benefit person plan 5 5 Right-of-squired under operating less 104 Flight and ground meet acquired under financeme 650 93 361 Operating loses converted to finance less 190 The following ble provides reconciliation of cash, cath equivalents and restricted cash reported within the Consolidated Balance Sheets samechos shown bove Verde December 31 Klini 2019 Current Ciindcatherine 20 Restricted included is prepaid expenses and other 20 Noncurrat Cash site for allah The campings are an integral part of the Construct 2057 We perfor, at least quarterly, an assessment of the effectiveness of our derivative contracts designated as hedges, including assessing the possibility of counterparty default. If we determine that a derivative is no longer expected to be highly effective, we discontinue bedge decounting prospectively and recognize subsequent changes in the fair value of the hedge in earnings. We believe our derivative contracts that continue to be designated as hedges, consisting of interest rate and foreign currency exchange contracts, will continue to be highly effective in offsetting changes in falt value of cash flow, respectively, attributable to the hedged risk Cash flows associated with purchasing and settling hedge contracts generally are classified as operating cash flows However, if a hedge contract includes a significant financing element at inception, cash flows associated with the hedge contract are recorded as financing cash flows Hedge Margin. The hedge margin we receive from counterparties is recorded in cash, with the offsetting obligation in accounts payable. The hedge margin we provide to counterparties is recorded in prepaid expenses and other. We do not offset margin funded to counterparties or margin funded to us by counterparties against fair value amounts recorded for our hedge contracts Long Lived Assets The following table summarizes our property and equipment: December la milions, except for estimated fullfe) Estimated Useful Life 2019 2018 Flight equipment 20-34 years 5 36,713 $ 33,898 Ground property and equipment 5,721 4,667 Information technology-related assets 3,276 3.361 Flight and ground equipment under finance leases Shorter of lease term or estimated useful life 1,608 1,055 Advance payments for equipment 1,019 1.177 Less: accumulated depreciation and amortization (17.027) (15,823 Total property and equipment, net $ 31 310 S 28,335 Includes acculated artition for light and round equipment under franceses in the amount of $5465566 December 2019 and 2018, respectively 3-40 years 3-15 years We record property and equipment at cost and depreciate or amortize these assets on a straight-line basis to their estimated residual values over their estimated useful lives. The estimated useful life for leasehold improvements is the shorter of lease term or estimated useful life. Depreciation and amortization expense related to our property and equipment was $2.6 billion $2.3 billion and $2.2 billion for the years ended December 31, 2019, 2018 and 2017, respectively. Residual values for owned aircraft, engines, spare parts and simulators are generally 5% to 10% of cost. We capitale certain internal and extemal costs incurred to develop and implement software and amortize those costs over an estimated useful life of three to ten years. Included in the depreciation and amortization expense discussed above, we recorded $239 million, S205 million and 5187 million for amortization of capitalized software for the years ended December 31, 2019,2018 and 2017, respectively. The net book value of these assets, which are included in information technology-related assets above, totaled Sil billion and 5819 million at December 31, 2019 and 2018, respectively, Our tangible assets consist primarily of flight equipment, which is mobile across geographic markets. Accordingly, assets are not allocated to specific geographic regions We review thight equipment and other long-lived assets used in operations for impairment losses when events and circumstances indicate the assets may be impaired. Factors which could be indicators of impairment include, but are not limited to (1) a decision to permanently remove flight equipment or other long-lived assets from operations (2) significant changes in the estimated useful life. (3) significant changes in projected cash flows, (4) permanent and significant del fleet values and (5) changes to the regulatory environment. For long-lived assets held for sale, we discontinue depreciation and record impairment losses when the carrying amount of these assets is greater than the fair value less the cost to sell Question 9 In the first year of Delta's tight equipment useful life a trook value would be lower on the company's balance sheet with the depreciation method used by Delta compared to double-decining balance depreciation method b. book value would be the same amount on the company's balance sheet with the depreciation method used by Delta compared to double declining balance depreciation method oc net income would be lower on the company's income statement with the depreciation method used by Delta compared to double declining balance depreciation method. O . net income would be higher on the company's income statement with the depreciation method used by Delta compared to double-decining balance depreciation method Moving to another question will save this response. DELTA AIRLINES, INC. Consolidated Balance Sheets December 31 2019 2018 5 2.15 1.565 Klacious centre data ASSETS Current A Coints Account Netoface for uncollectible account of 13 and 12 at December 31, 2019 and 2012 respectively Filmy Expendable parts and supplies Avente, allowme for bence of 52 and 5102 December 31, 2019 and 2015 Prepaid puder Total 2854 2314 521 16 1405 6160 349 31310 31527 9,711 335 3,994 9,1 NORGE AS Nom det er som predmetation of $17.927 515.03 December 2019 2018 respectively Operating serio Cell ilable inngis, of accumse mutation 33 and 362 December 31, 2014 in 2011 Testy Crestrict couco Odhur non Total de Toale 5.163 636 3.766 562 54535 400 1.136 3.50 53.926 LABILITIES AND STOCKHOLDERS' EQUITY Current Current ordinace Crematories in Airtrate listy Acope Acceeded Loyalty program defende Fobligation Othered abilities wienie 2275 1.SI NOI 945 116 2016 3,701 237 3:219 756109 09 11 2014 1STE 30 3.500 5294 1456 TO 20970 3001 Necura Libilities Debrand alsin, pod is Ledelem Necunosting Dede Other cities Totalci Common and Cage Stockholders Equity Commons 50.00 50.00 58.136.306 De 31, 2018 Add Re Actor 49.00 191 2010 201 diely Total des Toy The part of the Cold 100 11. 12 09 TU HIS Consolidated Statements of Operations Year Ended December 31 2018 2019 2017 5 $ (in Millions, except per share data) Operating Revenge Passenger Cargo Other Total operating revenue 42.277 753 39,755 865 3,818 44,438 36,947 744 3.447 41,138 3,977 47007 Operating Expense: Salaries and related costs Aircraft fuel and related taxes Regional carriers expense, excluding fuel Contracted services Depreciation and amortization Passenger commissions and other selling expenses Landing fees and other rents Aircraft maintenance materials and outside repairs Profit sharing Passenger service Ancillary businesses and refinery Aircraft rent Other Total operating expeh 11.225 8.519 3,384 2641 2.581 1.993 1,762 1,751 1,643 1.251 1.245 423 1.771 40,389 10,743 9,020 3418 2.175 2329 1.941 1.662 1.575 1,301 1,178 1.695 394 1,723 39,174 10,058 6,756 3,466 2,108 2.222 1.827 1,500 1.591 1.065 1,123 1,495 351 1,609 35.172 6,618 5.264 5.966 Operating Income 011) (396) Non-Operation Expenset Interest expense, net Gain (los) on investments, net Miscellaneous, net Total non-operating expense, net 301) 119 (238) (420) 38 160 (113) (70) (466) Income Before Income Taxes 6.198 5300 5,151 Income Tax Provision (1.216) 0295 4767 $ Net Income 3915 5 3205 S 445 Basic Earnings Per Share S Diluted Earnings Per Share 7.30 $ Cash Dividends Declared Per Share 1:51 The accompanying notes are an integral part of the Consolidated Financial Statements 30 5.02 131 5 5 S 103 06 Consolidated Statements of Cash Flows Year Ended December 31 (la millo) 2019 2018 Cash Flows From Operating Acthitles Net income 47675 39355 3.305 Adjustments to reconcile et income to be ashovided by operating activities Depreciation and mortation 2.5812329 22 Deferred income se 147) 1,364 2.30 Pension pourcent and postemployment payments greater than expense 100 0:00 Changes in certaines and Babilities Receivables (775) 108 Fuel inventory (139) 334 097 Prepaid expenses and other content 90 (440 Air traffic liability 156 197 Loyalty program defend teven 319 390 Tholilstaries| 354 231 Accounts payable and some liabilities 144 (415) 955 Othernet 307 200 Net cash provided by ting activities 7014 Cash Play From Investing Acties Property and equipment additions huipen, including advance payments (140 0.700 2.700 Goud property and equipment, including technology 1.5923 (1460 11,1 Purchase of quity investments (1.700 0.265 Sale of equity investice 279 Purchase of short-term investments (145) Redemption of short-term investments 206 766 SH Othernet 38 126 Net bed in investing activities (4563) 5366 Cash Flows From Financing Activities Payments on debt and fasce le obligations BU 30523 Repurchase of common stock 0.027 (1.575 1ST Cash dividende (909) Fuel card obligation 0.39 7 56 Proceeds from the term obligation 1,750 Proceeds from longtem obligations 1745 Other set LP Nel caso used in financing activities (726) 000 Net Increase (Decrease in Cushub Equivalent and Restricted Cash Cath, cash valents and restricted cachat beginning of pred 2743 123 Chichewivalents and restricted cash at end of period Supplemental Declature of Child for leterest 5 390 Neo-Cash Transaction Teasury stock contributed to our qualified defined benefit person plan 5 5 Right-of-squired under operating less 104 Flight and ground meet acquired under financeme 650 93 361 Operating loses converted to finance less 190 The following ble provides reconciliation of cash, cath equivalents and restricted cash reported within the Consolidated Balance Sheets samechos shown bove Verde December 31 Klini 2019 Current Ciindcatherine 20 Restricted included is prepaid expenses and other 20 Noncurrat Cash site for allah The campings are an integral part of the Construct 2057 We perfor, at least quarterly, an assessment of the effectiveness of our derivative contracts designated as hedges, including assessing the possibility of counterparty default. If we determine that a derivative is no longer expected to be highly effective, we discontinue bedge decounting prospectively and recognize subsequent changes in the fair value of the hedge in earnings. We believe our derivative contracts that continue to be designated as hedges, consisting of interest rate and foreign currency exchange contracts, will continue to be highly effective in offsetting changes in falt value of cash flow, respectively, attributable to the hedged risk Cash flows associated with purchasing and settling hedge contracts generally are classified as operating cash flows However, if a hedge contract includes a significant financing element at inception, cash flows associated with the hedge contract are recorded as financing cash flows Hedge Margin. The hedge margin we receive from counterparties is recorded in cash, with the offsetting obligation in accounts payable. The hedge margin we provide to counterparties is recorded in prepaid expenses and other. We do not offset margin funded to counterparties or margin funded to us by counterparties against fair value amounts recorded for our hedge contracts Long Lived Assets The following table summarizes our property and equipment: December la milions, except for estimated fullfe) Estimated Useful Life 2019 2018 Flight equipment 20-34 years 5 36,713 $ 33,898 Ground property and equipment 5,721 4,667 Information technology-related assets 3,276 3.361 Flight and ground equipment under finance leases Shorter of lease term or estimated useful life 1,608 1,055 Advance payments for equipment 1,019 1.177 Less: accumulated depreciation and amortization (17.027) (15,823 Total property and equipment, net $ 31 310 S 28,335 Includes acculated artition for light and round equipment under franceses in the amount of $5465566 December 2019 and 2018, respectively 3-40 years 3-15 years We record property and equipment at cost and depreciate or amortize these assets on a straight-line basis to their estimated residual values over their estimated useful lives. The estimated useful life for leasehold improvements is the shorter of lease term or estimated useful life. Depreciation and amortization expense related to our property and equipment was $2.6 billion $2.3 billion and $2.2 billion for the years ended December 31, 2019, 2018 and 2017, respectively. Residual values for owned aircraft, engines, spare parts and simulators are generally 5% to 10% of cost. We capitale certain internal and extemal costs incurred to develop and implement software and amortize those costs over an estimated useful life of three to ten years. Included in the depreciation and amortization expense discussed above, we recorded $239 million, S205 million and 5187 million for amortization of capitalized software for the years ended December 31, 2019,2018 and 2017, respectively. The net book value of these assets, which are included in information technology-related assets above, totaled Sil billion and 5819 million at December 31, 2019 and 2018, respectively, Our tangible assets consist primarily of flight equipment, which is mobile across geographic markets. Accordingly, assets are not allocated to specific geographic regions We review thight equipment and other long-lived assets used in operations for impairment losses when events and circumstances indicate the assets may be impaired. Factors which could be indicators of impairment include, but are not limited to (1) a decision to permanently remove flight equipment or other long-lived assets from operations (2) significant changes in the estimated useful life. (3) significant changes in projected cash flows, (4) permanent and significant del fleet values and (5) changes to the regulatory environment. For long-lived assets held for sale, we discontinue depreciation and record impairment losses when the carrying amount of these assets is greater than the fair value less the cost to sell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts