Question: Question 9. PART 1 - 13 QUESTION. DO ALL PARTS. For General Motors and Ford Motor Company, Compare these two companies using the following finacial

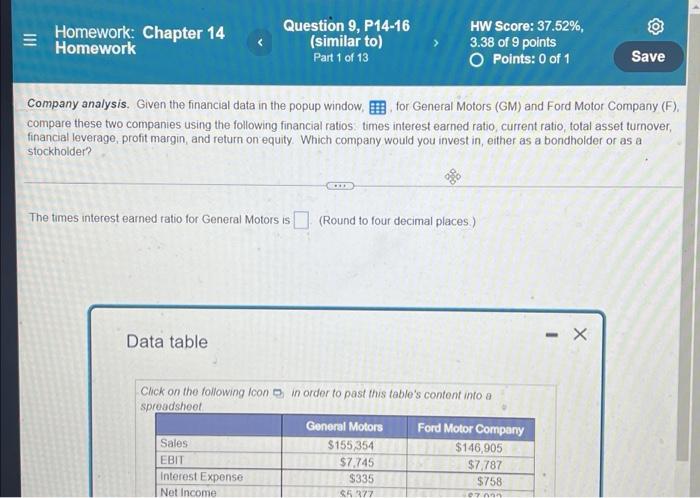

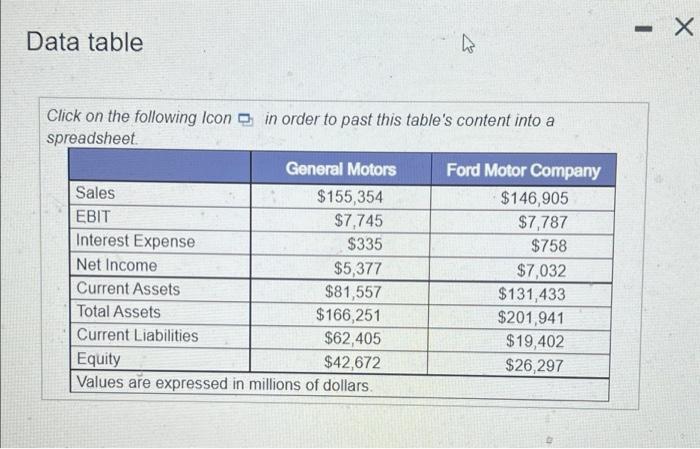

Homework: Chapter 14 Homework Question 9, P14-16 (similar to) Part 1 of 13 HW Score: 37.52%, 3.38 of 9 points O Points: 0 of 1 Save Company analysis. Given the financial data in the popup window, for General Motors (GM) and Ford Motor Company (F), compare these two companies using the following financial ratios times interest earned ratio current ratio, total asset turnover, financial leverage, profit margin, and return on equity. Which company would you invest in, either as a bondholder or as a stockholder? The times interest earned ratio for General Motors is (Round to four decimal places) Data table - X Click on the following icon in order to post this table's content into a spreadsheet General Motors Ford Motor Company Sales $155,354 $146,905 EBIT $7,745 $7,787 Interest Expense $335 $758 Net Income 65377 ey Company analysis. Given the financial data in the popup window, Elor General Motors (GM) and Ford Motor Company (F). compare these two companies using the following financial ratios: times interest earned ratio, current ratio, total asset turnover financial leverage, profit margin, and return on equity Which company would you invest in either as a bondholder or as a stockholder The times interest earned ratio for General Motors is (Round to four decimal places) Data table - X Click on the following Icon in order to past this table's content into a spreadsheet General Motors Ford Motor Company Sales $155,354 $146,905 Data table a Click on the following Icon in order to past this table's content into a spreadsheet General Motors Ford Motor Company Sales $155,354 $146,905 EBIT $7,745 $7,787 Interest Expense $335 $758 Net Income $5,377 $7,032 Current Assets $81,557 $131,433 Total Assets $ 166,251 $201.941 Current Liabilities $62,405 $19,402 Equity $42,672 $26,297 Values are expressed in millions of dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts