Question: Question 9, Problem 6-20 (algorithmic) Homework: Lab 03 > HW Score: 40%, 6 of 15 points O Points: 0 of 1 Save Part 1 of

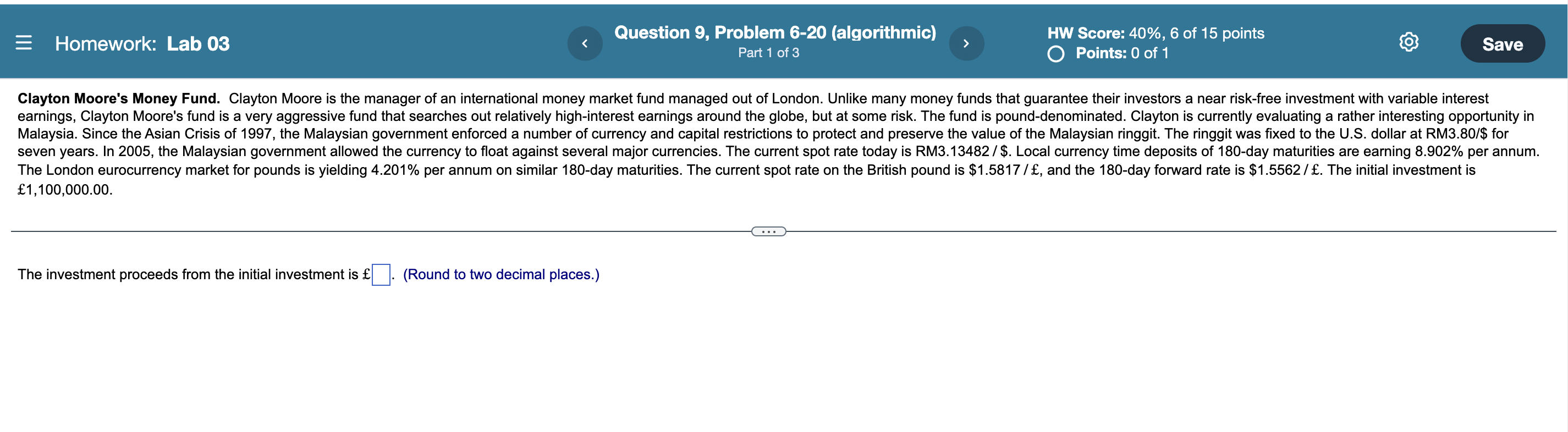

Question 9, Problem 6-20 (algorithmic) Homework: Lab 03 > HW Score: 40%, 6 of 15 points O Points: 0 of 1 Save Part 1 of 3 Clayton Moore's Money Fund. Clayton Moore is the manager of an international money market fund managed out of London. Unlike many money funds that guarantee their investors a near risk-free investment with variable interest earnings, Clayton Moore's fund is a very aggressive fund that searches out relatively high-interest earnings around the globe, but at some risk. The fund is pound-denominated. Clayton is currently evaluating a rather interesting opportunity in Malaysia. Since the Asian Crisis of 1997, the Malaysian government enforced a number of currency and capital restrictions to protect and preserve the value of the Malaysian ringgit. The ringgit was fixed to the U.S. dollar at RM3.80/$ for seven years. In 2005, the Malaysian government allowed the currency to float against several major currencies. The current spot rate today is RM3.13482/$. Local currency time deposits of 180-day maturities are earning 8.902% per annum. The London eurocurrency market for pounds is yielding 4.201% per annum on similar 180-day maturities. The current spot rate on the British pound is $1.5817/, and the 180-day forward rate is $1.5562/ . The initial investment is 1,100,000.00 The investment proceeds from the initial investment is - (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts