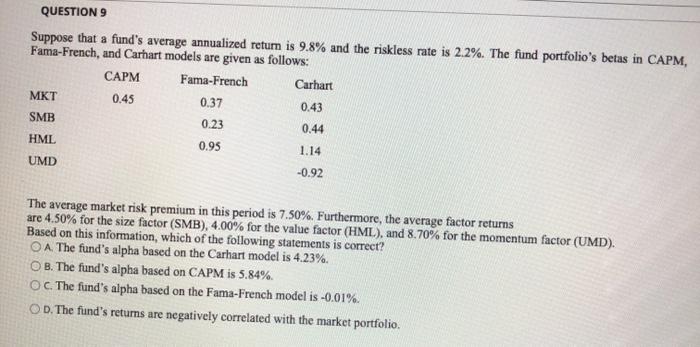

Question: QUESTION 9 Suppose that a fund's average annualized return is 9.8% and the riskless rate is 2.2%. The fund portfolio's betas in CAPM, Fama-French, and

QUESTION 9 Suppose that a fund's average annualized return is 9.8% and the riskless rate is 2.2%. The fund portfolio's betas in CAPM, Fama-French, and Carhart models are given as follows: CAPM Fama-French Carhart MKT 0.45 0.37 0.43 SMB 0.23 0.44 HML 0.95 1.14 UMD -0.92 The average market risk premium in this period is 7.50%. Furthermore, the average factor returns are 4.50% for the size factor (SMB), 4.00% for the value factor (HML), and 8.70% for the momentum factor (UMD). Based on this information, which of the following statements is correct? O A The fund's alpha based on the Carhart model is 4.23%. OB. The fund's alpha based on CAPM is 5.84%. OC. The fund's alpha based on the Fama-French model is -0.01%. OD. The fund's returns are negatively correlated with the market portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts