Question: QUESTION 9 Tom got a 30 year fully amortizing FRM for $500,000 at 8%, with constant monthly payments. After 3 years of payments rates

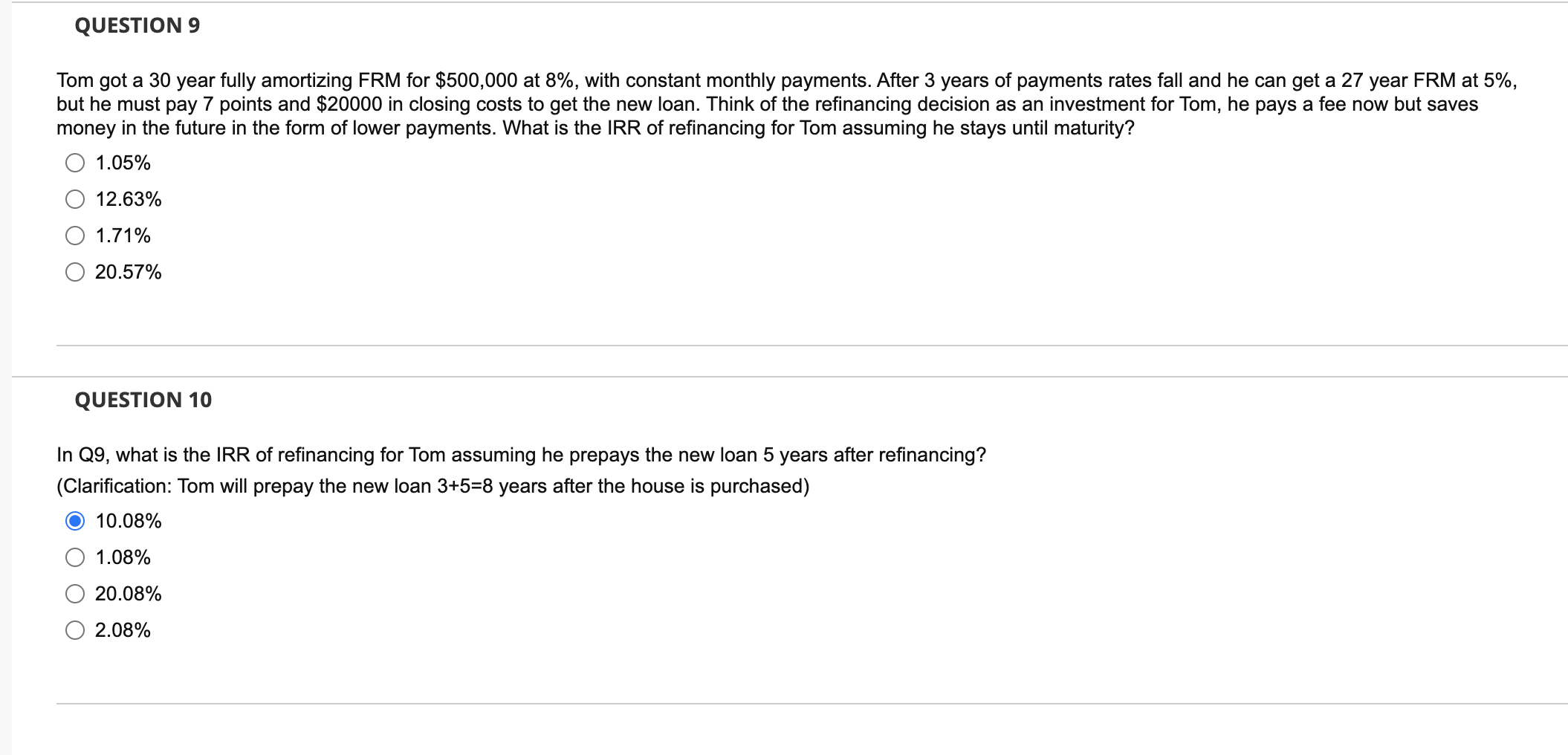

QUESTION 9 Tom got a 30 year fully amortizing FRM for $500,000 at 8%, with constant monthly payments. After 3 years of payments rates fall and he can get a 27 year FRM at 5%, but he must pay 7 points and $20000 in closing costs to get the new loan. Think of the refinancing decision as an investment for Tom, he pays a fee now but saves money in the future in the form of lower payments. What is the IRR of refinancing for Tom assuming he stays until maturity? 1.05% 12.63% 1.71% 20.57% QUESTION 10 In Q9, what is the IRR of refinancing for Tom assuming he prepays the new loan 5 years after refinancing? (Clarification: Tom will prepay the new loan 3+5=8 years after the house is purchased) 10.08% 1.08% 20.08% 2.08%

Step by Step Solution

There are 3 Steps involved in it

To solve these problems well calculate the Internal Rate of Return IRR for the refinancing scenarios described Question 9 1 Calculate Toms Original Lo... View full answer

Get step-by-step solutions from verified subject matter experts