Question: QUESTION 9 Using the information found in the financial statements for the month ended May 31, fill in the Deferred Revenue ledger account below

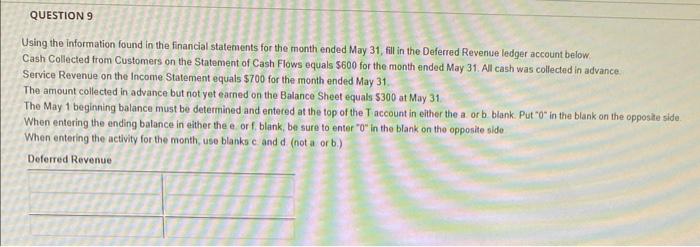

QUESTION 9 Using the information found in the financial statements for the month ended May 31, fill in the Deferred Revenue ledger account below Cash Collected from Customers on the Statement of Cash Flows equals $600 for the month ended May 31. All cash was collected in advance. Service Revenue on the Income Statement equals $700 for the month ended May 31. The amount collected in advance but not yet earned on the Balance Sheet equals $300 at May 31 The May 1 beginning balance must be determined and entered at the top of the T account in either the a. or b. blank. Put "0" in the blank on the opposite side. When entering the ending balance in either the e. or f. blank, be sure to enter "0" in the blank on the opposite side When entering the activity for the month, use blanks c and d (not a or b.) Deferred Revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts