Question: QUESTION 9 Which statement is FALSE related to payroll liabilities? O Federal and State Income taxes are withheld from an employee's gross salary and therefore,

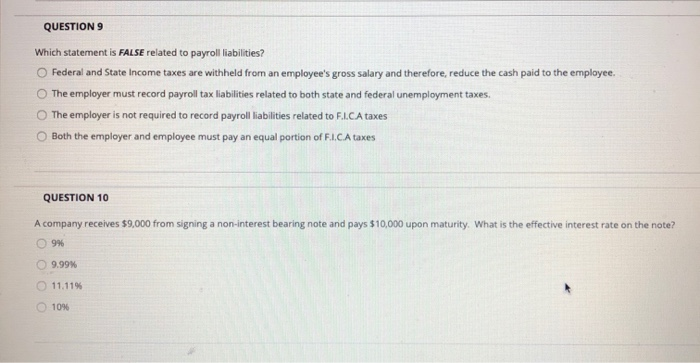

QUESTION 9 Which statement is FALSE related to payroll liabilities? O Federal and State Income taxes are withheld from an employee's gross salary and therefore, reduce the cash paid to the employee. The employer must record payroll tax liabilities related to both state and federal unemployment taxes. The employer is not required to record payroll liabilities related to F.I.CA taxes O Both the employer and employee must pay an equal portion of F.I.C.A taxes QUESTION 10 A company receives $9,000 from signing a non-interest bearing note and pays $10,000 upon maturity. What is the effective interest rate on the note? 9% 9.99% 11.11% 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts