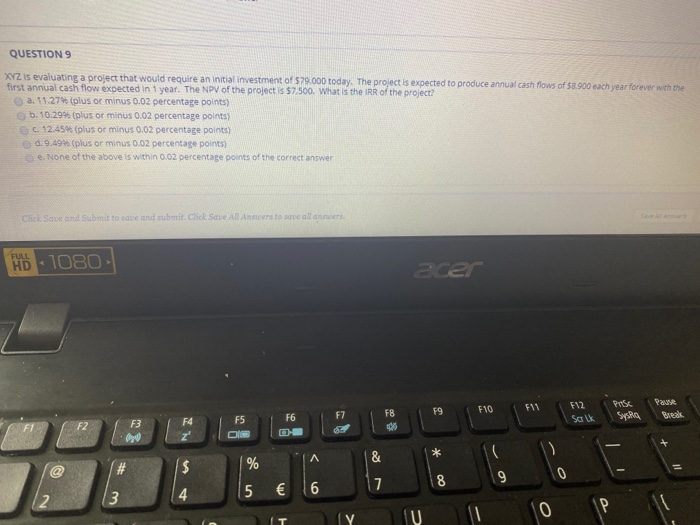

Question: QUESTION 9 XYZ is evaluating a project that would require an initial investment of 579.000 today. The project is expected to produce annual cash flows

QUESTION 9 XYZ is evaluating a project that would require an initial investment of 579.000 today. The project is expected to produce annual cash flows of $8.900 each year forever with the first annual cash flow expected in 1 year. The NPV of the project is $7.500. What is the IRR of the project? a. 11.2796 plus or minus 0.02 percentage points) b. 10.299 plus or minus 0.02 percentage points) 12.45 (plus or minus 0.02 percentage points) d. 9.49(plus or minus 0.02 percentage points) . None of the above is within 0.02 percentage points of the correct answer Click Save and submit to save and subit. Chick Save All Amers to steal ers HD 1080 YUN O P

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts