Question: QUESTION 9 Your team is tasked with evaluating a new offshore drilling project. At first, your team assumed the project will have 0 debt and

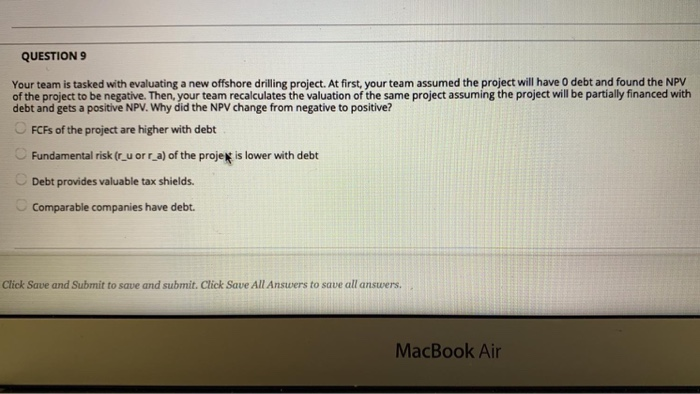

QUESTION 9 Your team is tasked with evaluating a new offshore drilling project. At first, your team assumed the project will have 0 debt and found the NPV of the project to be negative. Then, your team recalculates the valuation of the same project assuming the project will be partially financed with debt and gets a positive NPV. Why did the NPV change from negative to positive? FCFs of the project are higher with debt Fundamental risk (r_u or r_a) of the projek is lower with debt Debt provides valuable tax shields. Comparable companies have debt. Click Save and Submit to save and submit. Click Save All Answers to save all answers. MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts