Question: QUESTION 9.1 (14 marks) Easter Corp. bought a machine on January 3, 2018 for $275,000. It had a $15,000 estimated residual value and a ten-year

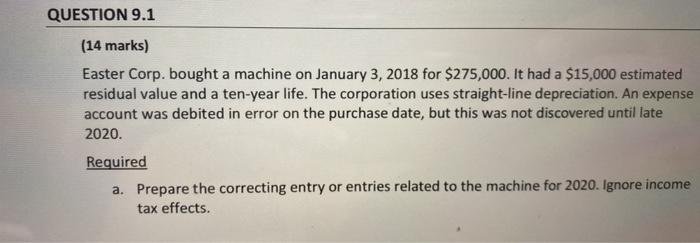

QUESTION 9.1 (14 marks) Easter Corp. bought a machine on January 3, 2018 for $275,000. It had a $15,000 estimated residual value and a ten-year life. The corporation uses straight-line depreciation. An expense account was debited in error on the purchase date, but this was not discovered until late 2020. Required a. Prepare the correcting entry or entries related to the machine for 2020. Ignore income tax effects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts