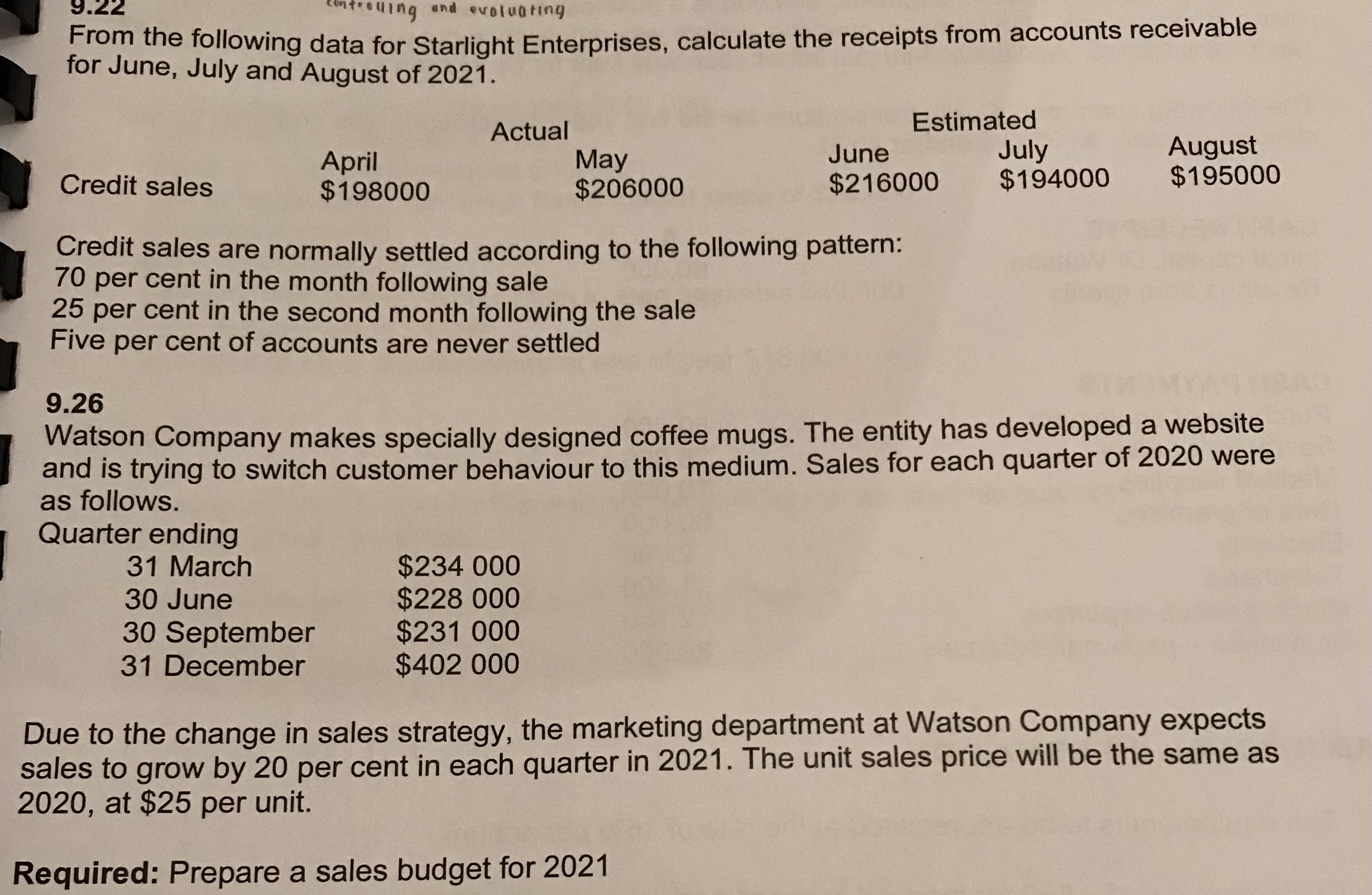

Question: Question: 9.22 troling and evaluating From the following data for Starlight Enterprises, calculate the receipts from accounts receivable for June, July and August of 2021.

Question:

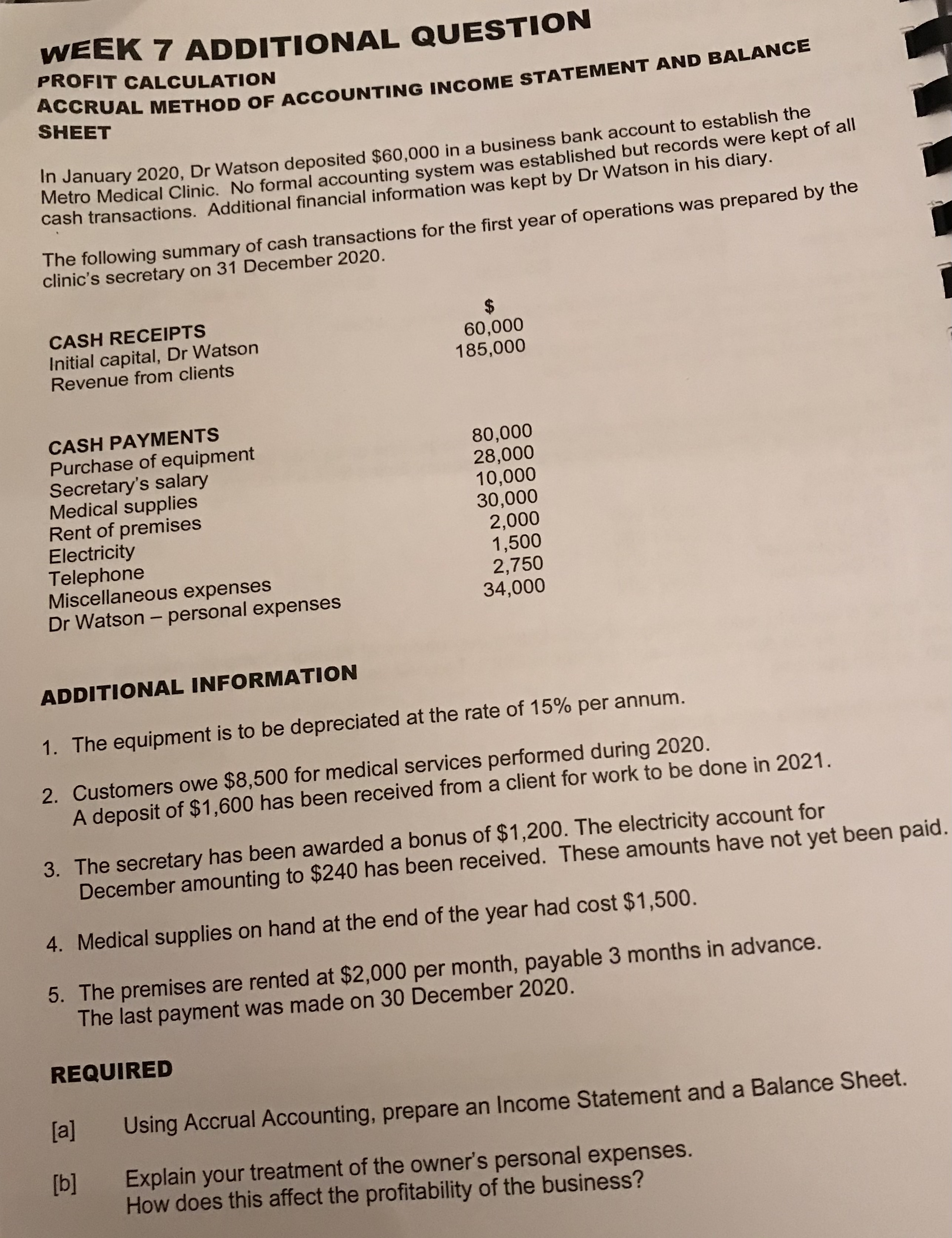

9.22 troling and evaluating From the following data for Starlight Enterprises, calculate the receipts from accounts receivable for June, July and August of 2021. Actual Estimated April May June July August Credit sales $198000 $206000 $216000 $194000 $195000 Credit sales are normally settled according to the following pattern: 70 per cent in the month following sale 25 per cent in the second month following the sale Five per cent of accounts are never settled 9.26 Watson Company makes specially designed coffee mugs. The entity has developed a website and is trying to switch customer behaviour to this medium. Sales for each quarter of 2020 were as follows. Quarter ending 31 March $234 000 30 June $228 000 30 September $231 000 31 December $402 000 Due to the change in sales strategy, the marketing department at Watson Company expects sales to grow by 20 per cent in each quarter in 2021. The unit sales price will be the same as 2020, at $25 per unit. Required: Prepare a sales budget for 2021WEEK 7 ADDITIONAL QUESTION PROFIT CALCULATION ACCRUAL METHOD OF ACCOUNTING INCOME STATEMENT AND BALANCE SHEET In January 2020, Dr Watson deposited $60,000 in a business bank account to establish the Metro Medical Clinic. No formal accounting system was established but records were kept of all cash transactions. Additional financial information was kept by Dr Watson in his diary. The following summary of cash transactions for the first year of operations was prepared by the clinic's secretary on 31 December 2020. CASH RECEIPTS $ Initial capital, Dr Watson 60,000 Revenue from clients 185,000 CASH PAYMENTS Purchase of equipment 80,000 Secretary's salary 28,000 Medical supplies 10,000 Rent of premises 30,000 Electricity 2,000 Telephone 1,500 Miscellaneous expenses 2,750 Dr Watson - personal expenses 34,000 ADDITIONAL INFORMATION 1. The equipment is to be depreciated at the rate of 15% per annum. 2. Customers owe $8,500 for medical services performed during 2020. A deposit of $1,600 has been received from a client for work to be done in 2021. 3. The secretary has been awarded a bonus of $1,200. The electricity account for December amounting to $240 has been received. These amounts have not yet been paid 4. Medical supplies on hand at the end of the year had cost $1,500. 5. The premises are rented at $2,000 per month, payable 3 months in advance. The last payment was made on 30 December 2020. REQUIRED [a] Using Accrual Accounting, prepare an Income Statement and a Balance Sheet. [b] Explain your treatment of the owner's personal expenses. How does this affect the profitability of the business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts