Question: Question 9.5 (Total: 22 marks; 4 marks for req. 1; 9 marks for req. 2.-3 per error: 9 marks for req. 3; -3 marks per

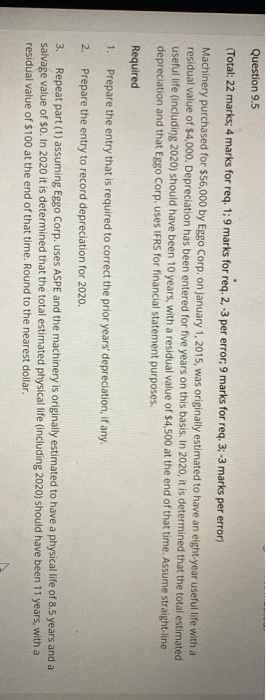

Question 9.5 (Total: 22 marks; 4 marks for req. 1; 9 marks for req. 2.-3 per error: 9 marks for req. 3; -3 marks per error) Machinery purchased for $56,000 by Eggo Corp. on January 1, 2015, was originally estimated to have an eight-year useful life with a residual value of $4,000. Depreciation has been entered for five years on this basis. In 2020, it is determined that the total estimated useful life (including 2020) should have been 10 years, with a residual value of $4,500 at the end of that time. Assume straight-line depreciation and that Eggo Corp. uses IFRS for financial statement purposes. Required 1. Prepare the entry that is required to correct the prior years' depreciation, if any. Prepare the entry to record depreciation for 2020. 3. Repeat part (1) assuming Eggo Corp. uses ASPE and the machinery is originally estimated to have a physical life of 8.5 years and a salvage value of $0. In 2020 it is determined that the total estimated physical life (including 2020) should have been 11 years with a residual value of $100 at the end of that time. Round to the nearest dollar. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts