Question: Question A a) Explain how you can replicate the cash flows coming from a 3-year FRN that pays semi-annual coupons of LIBOR + 4.5% by

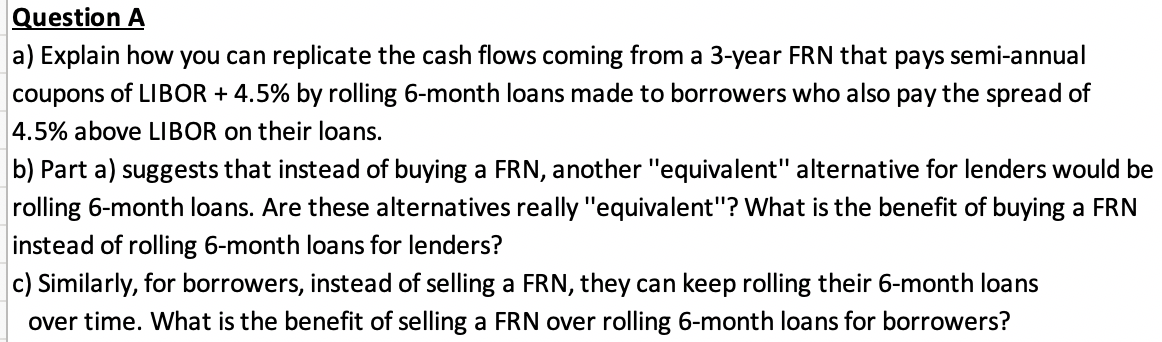

Question A a) Explain how you can replicate the cash flows coming from a 3-year FRN that pays semi-annual coupons of LIBOR + 4.5% by rolling 6-month loans made to borrowers who also pay the spread of 4.5% above LIBOR on their loans. b) Part a) suggests that instead of buying a FRN, another "equivalent" alternative for lenders would be rolling 6-month loans. Are these alternatives really "equivalent"? What is the benefit of buying a FRN instead of rolling 6-month loans for lenders? c) Similarly, for borrowers, instead of selling a FRN, they can keep rolling their 6-month loans over time. What is the benefit of selling a FRN over rolling 6-month loans for borrowers? Question A a) Explain how you can replicate the cash flows coming from a 3-year FRN that pays semi-annual coupons of LIBOR + 4.5% by rolling 6-month loans made to borrowers who also pay the spread of 4.5% above LIBOR on their loans. b) Part a) suggests that instead of buying a FRN, another "equivalent" alternative for lenders would be rolling 6-month loans. Are these alternatives really "equivalent"? What is the benefit of buying a FRN instead of rolling 6-month loans for lenders? c) Similarly, for borrowers, instead of selling a FRN, they can keep rolling their 6-month loans over time. What is the benefit of selling a FRN over rolling 6-month loans for borrowers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts