Question: Question A, B, C, and D. As a new intern for the local branch office of a national brokerage firm, you are excited to get

Question A, B, C, and D.

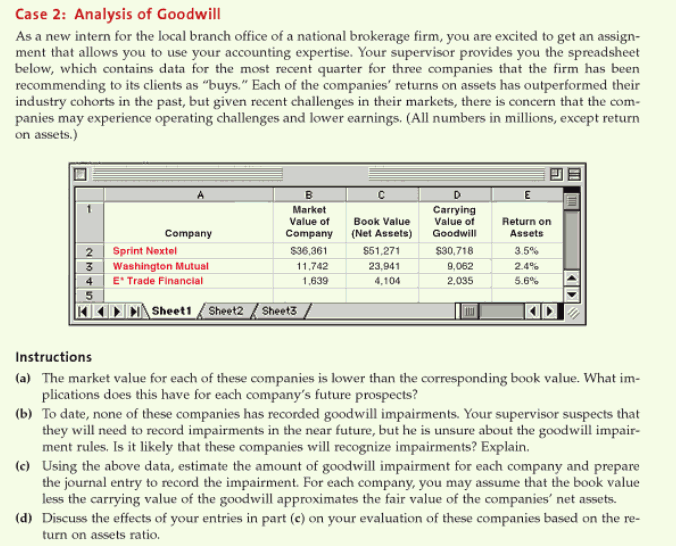

As a new intern for the local branch office of a national brokerage firm, you are excited to get an assignment that allows you to use your accounting expertise. Your supervisor provides you the spreadsheet below, which contains data for the most recent quarter for three companies that the firm has been recommending to its clients as "buys." Each of the companies' returns on assets has outperformed their industry cohorts in the past, but given recent challenges in their markets, there is concern that the companies may experience operating challenges and lower earnings. (All numbers in millions, except return on assets.) The market value for each of these companies is lower than the corresponding book value. What implications does this have for each company's future prospects? To date, none of these companies has recorded goodwill impairments. Your supervisor suspects that they will need to record impairments in the near future, but he is unsure about the goodwill impairment rules. Is it likely that these companies will recognize impairments? Explain. Using the above data, estimate the amount of goodwill impairment for each company and prepare the journal entry to record the impairment For each company, you may assume that the book value less the carrying value of the goodwill approximates the fair value of the companies' net assets. (d) Discuss the effects of your entries in part (c) on your evaluation of these companies based on the return on assets ratio. As a new intern for the local branch office of a national brokerage firm, you are excited to get an assignment that allows you to use your accounting expertise. Your supervisor provides you the spreadsheet below, which contains data for the most recent quarter for three companies that the firm has been recommending to its clients as "buys." Each of the companies' returns on assets has outperformed their industry cohorts in the past, but given recent challenges in their markets, there is concern that the companies may experience operating challenges and lower earnings. (All numbers in millions, except return on assets.) The market value for each of these companies is lower than the corresponding book value. What implications does this have for each company's future prospects? To date, none of these companies has recorded goodwill impairments. Your supervisor suspects that they will need to record impairments in the near future, but he is unsure about the goodwill impairment rules. Is it likely that these companies will recognize impairments? Explain. Using the above data, estimate the amount of goodwill impairment for each company and prepare the journal entry to record the impairment For each company, you may assume that the book value less the carrying value of the goodwill approximates the fair value of the companies' net assets. (d) Discuss the effects of your entries in part (c) on your evaluation of these companies based on the return on assets ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts