Question: Question A B C D E please Question 14 a) Grande Co has earnings per share of 2. It has 11 million shares outstanding and

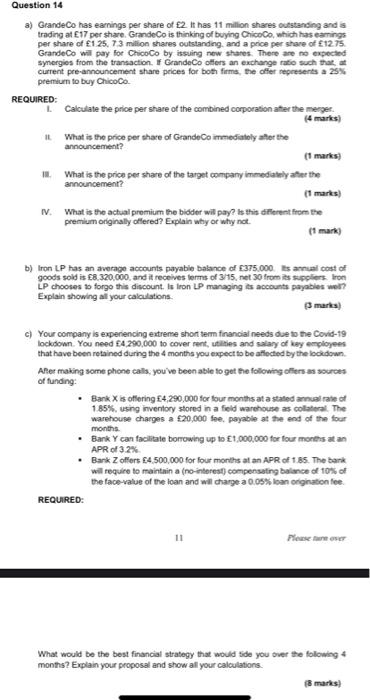

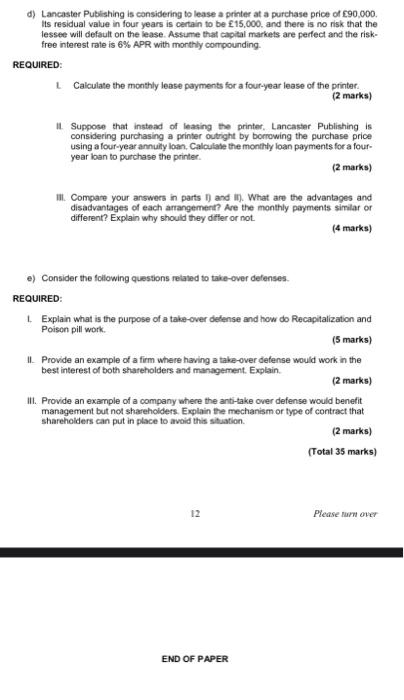

Question 14 a) Grande Co has earnings per share of 2. It has 11 million shares outstanding and is trading at E17 per share. Grande Co is thinking of buying ChicoCo, which has earings per share of 125.73 milion shares outstanding and a price per share of 12.75 GrandeCo will pay for ChicoCo by issuing new shares. There are expected Synergies from the transaction. If GrandeCo offers an exchange ratio such that a current pre-announcement share prices for both firms, the offer represents a 25% premium to buy Chico Co. REQUIRED: Calculate the price per share of the combined corporation after the merger What is the price per share of GrandeCommediately after the announcement? (1 marks) What is the price per share of the target company immediately after the announcement? (1 marks) 1. What is the actual premium the bidder will pay? Is this different from the premium originally offered? Explain why or why not (1 mark) b) Iron LP has an average accounts payable balance of 375,000 sanal cost of goods sold is 8.320.000, and it receives terms of 3/15.net 30 from its suppliers Iron LP chooses to forgo this discount. Is Iron LP managing its accounts payabies wel? Explain showing all your calculations C) Your company is experiencing extreme short term financial needs due to the Covid-19 lockdown. You need 4.290,000 to cover rent, utilities and salary of key employees that have been retained during the 4 months you expect to be affected by the lookdown After making some phone calls, you've been able to get the following offers a sources of funding: Bank X is offering 4,290,000 for four months at a stated annual rate of 185%, using inventory stored in a field warehouse as collateral. The warehouse charges a 20,000 foe, payable at the end of the four months Bank Y can facilitate borrowing up to 1,000,000 for four months at an APR of 3.2% Bark Zoffers 4500,000 for four months at an APR of 185. The bank will require to maintain a (no interest compensating balance of 10% of the face value of the loan and will change a 0.05% loan origination fee. REQUIRED: 11 Per What would be the best financial strategy that would side you over the folowing months? Explain your proposal and show all your calculations. & marks) d) Lancaster Publishing is considering to lease a printer at a purchase price of 90,000 Its residual value in four years is certain to be 15.000. and there is no risk that the lessee will default on the lease. Assume that capital markets are perfect and the risk- free interest rate is 6% APR with monthly compounding REQUIRED Calculate the monthly lease payments for a four-year lease of the printer (2 marks) I Suppose that instead of feasing the printer, Lancaster Publishing is considering purchasing a printer outright by borrowing the purchase price using a four-year annuity loan. Calculate the monthly loan payments for a four- year loan to purchase the printer (2 marks) . Compare your answers in parts 1) and 1). What are the advantages and disadvantages of each arrangement? Are the monthly payments similar or different? Explain why should they difter or not. (4 marks) ) Consider the following questions related to take-over defenses REQUIRED Explain what is the purpose of a take-over defense and how do Recapitalization and Poison pill work. (5 marks) Provide an example of a firm where having a take-over defense would work in the best interest of both shareholders and management. Explain (2 marks) it. Provide an example of a company where the anti-take over defense would benefit management but not shareholders. Explain the mechanism or type of contract that Shareholders can put in place to avoid this situation. (2 marks) (Total 35 marks) 12 Please turn over END OF PAPER

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts