Question: QUESTION: A decrease in earned capital for a non-owner transaction must accompany a decrease in cash when using cash basis accounting. o True o False

QUESTION:

A decrease in earned capital for a non-owner transaction must accompany a decrease in cash when using cash basis accounting.

o True

o False

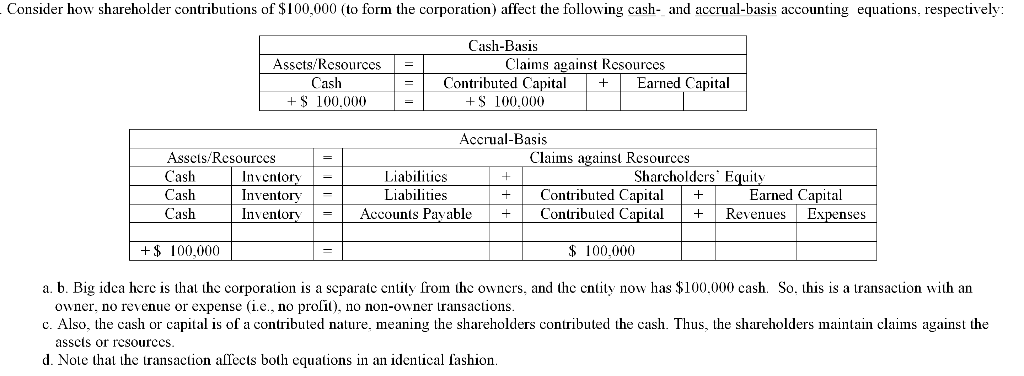

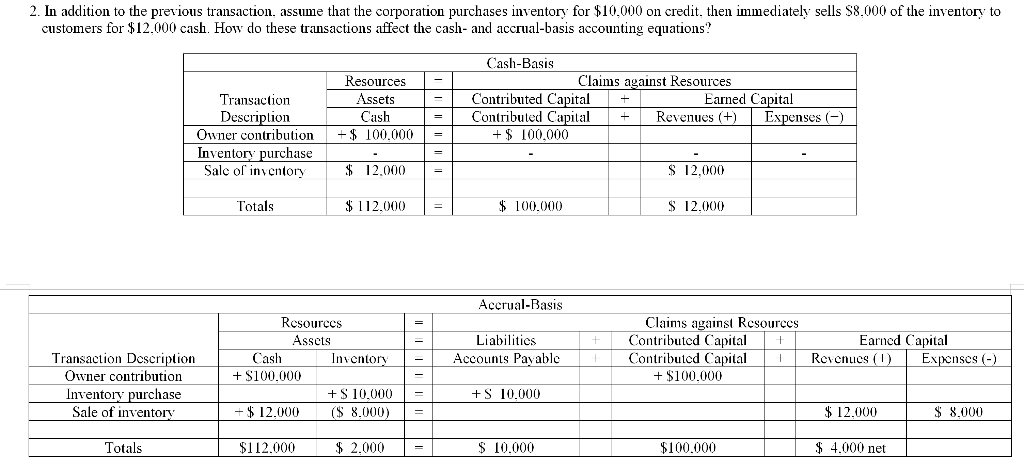

Consider how shareholder contributions of $100,000 (to form the corporation) affect the following cash- and accrual-basis accounting equations, respectively: Assets/Resources Cash +$ 100.000 Cash-Basis Claims against Resources Contributed Capital Earned Capital +S 100.000 + Assets/Resources Cash Inventory Cash Inventory Cash Inventory Accrual-Basis Claims against Resources Liabilities Sharcholders' Equity Liabilities Contributed Capital + Earned Capital Accounts Payable Contributed Capital + Revenues Expenses + + + +$ 100.000 $ 100.000 a. b. Big idea here is that the corporation is a separate entity from the owners, and the entity now has $100.000 cash. So, this is a transaction with an owner, no revenue or expense (i.e., no proil), 10 non-owner transactions. c. Also, the cash or capital is of a contributed nature, meaning the shareholders contributed the cash. Thus, the shareholders maintain claims against the asscis or resources. d. Note that the transaction allects both equations in an identical fashion. 2. In addition to the previous transaction, assume that the corporation purchases inventory for $10,000 on credit, then immediately sells $8.000 of the inventory to customers for $12.000 cash. How do these transactions affect the cash- and accrual-basis accounting equations? Transaction Description Owner contribution Inventory purchase Sale of inventory + Cash-Basis Claims against Resources Contributed Capital Earned Capital Contributed Capital + Revenues (+) Expenses (-) +$ 100.000 Resources Assets Cash +$ 100.000 $ 12.000 = $ 12.000 Totals $112.000 $ 100.000 $ 12.000 Accrual-Basis + Liabilities Accounts Payable Earned Capital Revenues (1) Expenses (-) Transaction Description Owner contribution Inventory purchase Sale of inventory Resources Assets Cash Inventory + $100.000 + S 10.000 $ 12.000 ($ 8.000) Claims against Resources Contributed Capital + Contributed Capital 1 + $100.000 +S 10.000 = $ 12.000 $ 8.000 Totals $112.000 $ 2.000 $ 10.000 $100.000 $ 4.000 net

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts