Question: Question: A financial team has been properly selected and charged to proceed with its analysis of EEV's financial statements. In the course of its evaluation,

Question:

A financial team has been properly selected and charged to proceed with its analysis of EEV's financial statements. In the course of its evaluation, it will be assessing the firm's operating performance, benchmarking its competitors, and looking at the industry using financial ratios as its source of measurement.

The income statement measures the firm's profitability over a period of time: 1 month, 1 quarter, or 1 year. The statement focuses on the operations of the firm and explains what was produced and sold. In essence, it summarizes revenues generated and the results.

Tony understands that managing profitability involves overseeing 3 interrelated factors: volume, cost, and price. He has given you the job of conducting an in-depth analysis of EEV's operating performance. You will analyze the following factors:

Sales volume, cost, and price of each specific product

Each product's contribution to sales in terms of profit

The relationship between sales and supportive employment

Tony has made it clear that he expects you to initiate a constructive discussion by describing your findings both in narrative form and through an organized numeric presentation.

Click here to view the EEV income statement, and then complete the following in your paper:

Review the sales volume, cost, and price of each specific product.

Review each product's contribution to sales in terms of profit.

Describe the relationship between sales and supportive employment.

Provide an Excel spreadsheet that depicts your findings along with your analysis.

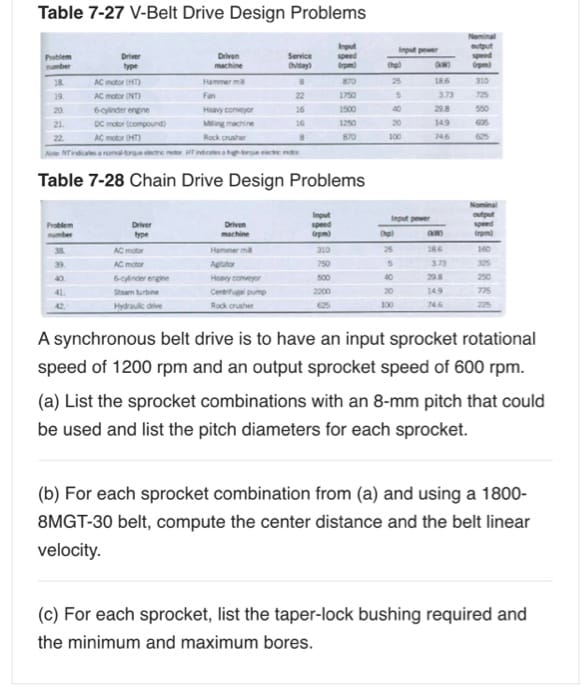

Electronic Equipment Venture Income StatementThousands 2008 2009 2010 (Fsct) Net Sales 98800 108000 113500 Cost of good sold Total cost of good sold 68500 80250 85425 Gross Profit 30300 27750 28075 % 31% 26% 25%Expenses General & Administrative 3500 5300 5700 Marketing 7500 8500 9000Operating Expense 9900 10610 11120 Total Expenses 20900 24410 25820Income Before Taxes 9400 3340 2255 Taxes 3760 1336 902 Net Income 5640 2004 1353HeadcountDirect2080 2400 2500Indirect 320 350 400 Total Headcount 2400 2750 2900Products 2008 2009 2010 Fcst Sales Margin % Sales Margin % Sales Margin % Electronic EquipmentTelevision 4000 1000 25% 3500 900 26% 5000 1045 21%Computers 5000 2400 48%5200 2300 44% 7600 3300 43%Medical 2300 1500 65% 3500 2000 57% 4000 1800 45%Automotive 15000 3200 21% 16000 2800 18% 15400 3000 19% Electronic Equipment Total 26300 8100 31% 28200 8000 28% 32000 9145 29%Electronic Equipment PartsTelevision 12000 3200 27% 13000 3050 23% 12000 2230 19%Computers 44500 13000 29% 50000 10500 21% 48000 10500 22%Medical 6000 3500 58% 7000 3700 53% 7500 3700 49%Automotive 10000 2500 25% 9800 2500 26% 14000 2500 18% Electronic Equipment Parts Total 72500 22200 31% 79800 19750 25% 81500 18930 23%Total 98800 30300 31% 108000 27750 26% 113500 28075 25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts