Question: - question A requied 300 words please. - question B calculater. Task 2 - Discuss the following concept in detail and find out the value

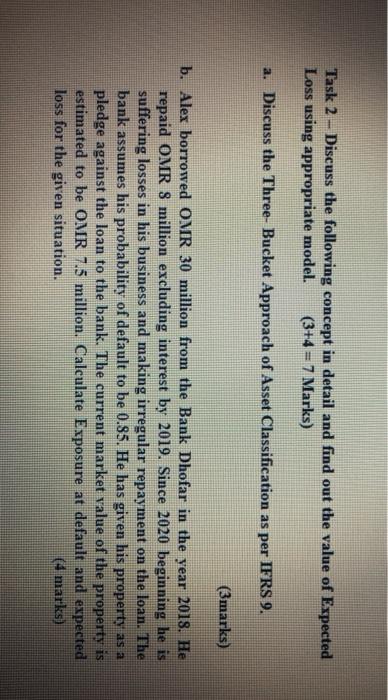

Task 2 - Discuss the following concept in detail and find out the value of Expected Loss using appropriate model. (3+4= 7 Marks) a. Discuss the Three- Bucket Approach of Asset Classification as per IFRS 9. (3marks) b. Alex borrowed OMR 30 million from the Bank Dhofar in the year 2018. He repaid OMR 8 million excluding interest by 2019. Since 2020 beginning he is suffering losses in his business and making irregular repayment on the loan. The bank assumes his probability of default to be 0.85. He has given his property as a pledge against the loan to the bank. The current market value of the property is estimated to be OMR 7.5 million. Calculate Exposure at default and expected loss for the given situation. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts