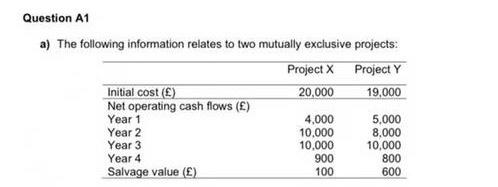

Question: Question A1 a) The following information relates to two mutually exclusive projects: Project X Project Y Initial cost (E) 20.000 19,000 Net operating cash flows

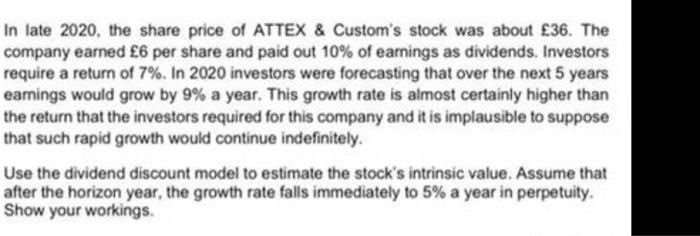

Question A1 a) The following information relates to two mutually exclusive projects: Project X Project Y Initial cost (E) 20.000 19,000 Net operating cash flows () Year 1 4,000 5,000 Year 2 10,000 8,000 Year 3 10.000 10,000 Year 4 900 800 Salvage value () 100 600 In late 2020, the share price of ATTEX & Custom's stock was about 36. The company earned 6 per share and paid out 10% of earnings as dividends. Investors require a return of 7%. In 2020 investors were forecasting that over the next 5 years earnings would grow by 9% a year. This growth rate is almost certainly higher than the return that the investors required for this company and it is implausible to suppose that such rapid growth would continue indefinitely. Use the dividend discount model to estimate the stock's intrinsic value. Assume that after the horizon year, the growth rate falls immediately to 5% a year in perpetuity. Show your workings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts