Question: Question : According the above case, What are the key factors that differentiate the different mobile payment systems? Which factors do consumers care most about?

Question : According the above case, What are the key factors that differentiate the different mobile payment systems? Which factors do consumers care most about? Which factors do merchants care most about?

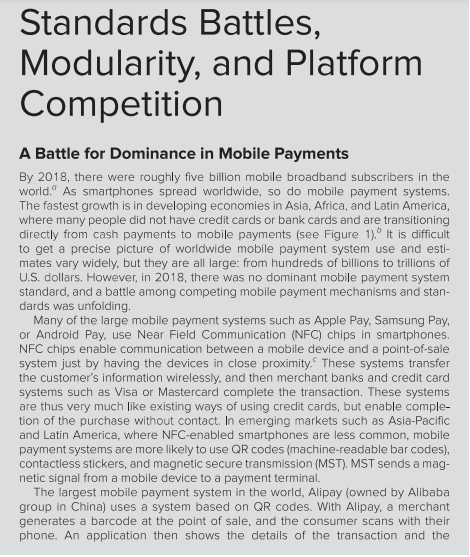

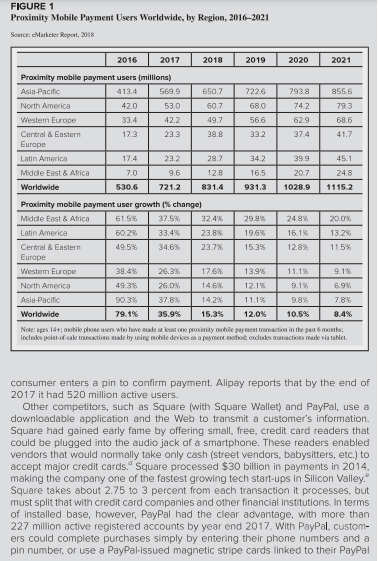

Standards Battles, Modularity, and Platform Competition A Battle for Dominance in Mobile Payments By 2018 , there were roughly five billion mobile broadband subscribers in the world, a As smartphones spread worldwide, so do mobile payment systems. The fastest growth is in developing economies in Asia, Africa, and Latin America, where many people did not have credit cards or bank cards and are transitioning directly from cash payments to mobile payments (see Figure 1). b It is difficult to get a precise picture of worldwide mobile payment system use and estimates vary widely, but they are all large: from hundreds of billions to trillions of U.S. dollars. However, in 2018, there was no dominant mobile payment system standard, and a battle among competing mobile payment mechanisms and standards was unfolding. Many of the large mobile payment systems such as Apple Pay, Samsung Pay, or Android Pay, use Near Fleld Communication (NFC) chips in smartphones. NFC chips enable communication between a mobile device and a point-of-sale system just by having the devices in close proximity. c These systems transfer the customer's information wirelessly, and then merchant banks and credit card systems such as Visa or Mastercard complete the transaction. These systems are thus very much like existing ways of using credit cards, but enable completion of the purchase without contact. In emerging markets such as Asia-Pacific and Latin America, where NFC-enabled smartphones are less common, mobile payment systems are more likely to use QR codes (machine-readable bar codes), contactless stickers, and magnetic secure transmission (MST). MST sends a magnetic signal from a mobile device to a payment terminal. The largest mobile payment system in the world, Alipay (owned by Alibaba group in China) uses a system based on QR codes. With Alipay, a merchant generates a barcode at the point of sale, and the consumer scans with their phone. An application then shows the details of the transaction and the FIGURE 1 Proximity Mobile Payment Users Worldwide, by Region, 2016-2021 consumer enters a pin to confirm payment. Alipay reports that by the end of 2017 it had 520 million active users. Other competitors, such as Square (with Square Wallet) and PayPal, use a downloadable application and the Web to transmit a customer's information. Square had gained early fame by offering small, free, credit card readers that could be plugged into the audio jack of a smartphone. These readers enabled vendors that would nomally take only cash (street vendors, babysitters, etc.) to accept major credit cards. Square processed $30 billion in payments in 2014. making the company one of the fastest growing tech start-ups in Silicon Valley. Square takes about 2.75 to 3 percent from each transaction it processes, but must split that with credit card companies and other financial institutions. In terms of installed base, however, PayPal had the clear advantage, with more than 227 million active registered accounts by year end 2017. With PayPal, customers could complete purchases simply by entering their phone numbers and a pin number, or use a PayPal-issued magnetic stripe cards linked to their PayPal accounts. Users could opt to link their PayPal accounts to their credit cards, or directly to their bank accounts. PayPal also owned a service called Venmo that enabled peer-to-peer exchanges with a Facebook-like interface that was growing in popularity as a way to exchange money without carrying cash. Venmo charged a 3 percent fee if the transaction used a major credit card, but was free if the consumer used it with a major bank card or debit card. In other parts of the world, intriguing alternatives for mobile banking are gaining traction quickly. In India and Africa, for example, there are enormous populations of "unbanked" or "underbanked" people (individuals who do not have bank accounts or make limited use of banking services). In these regions, the proportion of people with mobile phones vastly exceeds the proportion of people with credit cards. According to a GSMA report, for example, in sub-Saharan Africa, the number of mobile money accounts surpassed the number of bank account 5 in 2015, and in 2016 more than 40 percent of the adult population of Kenya, Tanzania, Ghana, and Paraguay actively used mobile payment systems.' The World Bank estimates that roughly two billion people worldwide do not have access to financial services, and 31 percent of adults have no bank account (Figure 2). This is a serious obstacle to overcoming poverty-access to banking is a very important resource for people to save money and utilize credit. Fortunately, the rise of mobile payment systems could have enormously beneficial social and economic consequences by helping the unbanked become banked. FIGURE 2 Percent of Adults with a Bank Account Sounce: Cidotel Findex atabowe. In parts of Africa, where the proportion of people who are unbanked is very large, a system called M-Pesa ["M" for mobile and "pesa," which is kiswahili for money) enables any individual with a passport or national ID card to deposit money into his or her phone account, and transfer money to other users using Short Message Service (SMS). 9 By 2017 , there were roughly 30 million M-Pesa users in 10 countries. The system had grown to offer a range of services including international transfers, loans, and health provision. It processed about six billion transactions in 2016 , hitting a peak rate of 529 per second." As noted above, some of the mobile systems did not require involvement of the major credit card companies. PayPal, and its peer-to-peer system Venmo, for instance, did not require credit cards, nor does Alipay. A mobile payment system that cuts out the credit card companies could potentially save (or capture) billions of dollars in transaction fees. Credit card companies and merchants thus both had high incentives to influence the outcome of this battle. For consumers, the key dimensions that influenced adoption were convenience (e.g., would the customer have to type in a code at the point of purchase? Was it easily accessible on a device the individual already owned?), risk of fraud (e.g., was the individual's identity and financial information at risk?), and ubiquity (e.g., could the system be used everywhere? Did it enable peer-topeer transactions?). For merchants, the primary concerns were fraud and cost (e.g., what were the fixed costs and transaction fees of using the system?). Apple Pay had a significant convenience advantage in that a customer could pay with their fingerprint.' QR code-based systems, by contrast, required the customer to open the application on their phone and get a QR code that would need to be scanned at the checkout or to type in a pin. By early 2018, it was clear that mobile payments represented a game-changing opportunity that could accelerate e-commerce, smartphone adoption, and the global reach of financial services. However, lack of compatibility between many of the mobile payment systems and uncertainty over what type of mobile payment system would become dominant still posed significant obstacles to consumer and merchant adoption, particularly in countries where most consumers already had credit cards. Discussion Questions 2. What are the key factors that differentiate the different mobile payment systems? Which factors do consumers care most about? Which factors do merchants care most aboutStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts