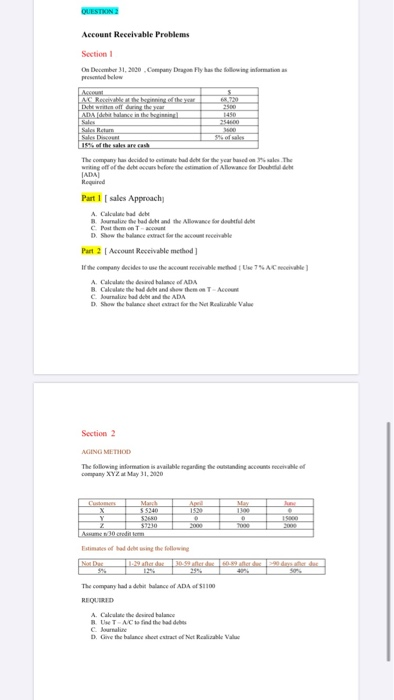

Question: QUESTION Account Receivable Problems Section 1 Os December 1, 2000. Company Despre Fly has the following informatica AC Resetting the 68.729 Dawn of the 3500

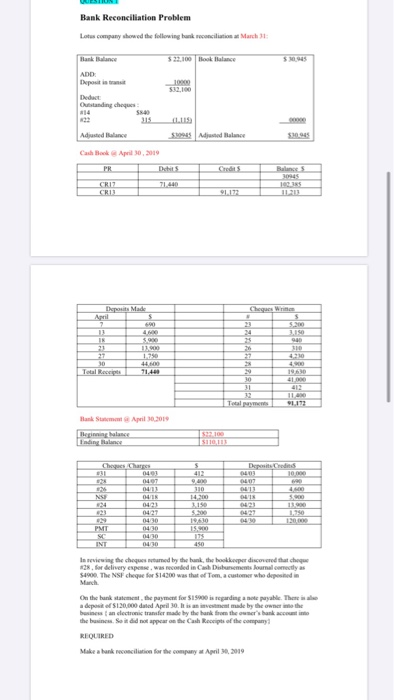

QUESTION Account Receivable Problems Section 1 Os December 1, 2000. Company Despre Fly has the following informatica AC Resetting the 68.729 Dawn of the 3500 ADA di Malance in the 1450 Sales we Sales Discount 19% of the sales are rash The company decided to estimate addicte Sarthe year bed on the waiting for the date cours before the time of Allowance Delle PADA Part 1 sales Approach A. Callebate jurnalist tad tand the Allowance fordi det Post them on Taccount D. Show the balance extract for the cost revelable Part 2 Account Receivable method] If the company decides to use the account receivable method Use 7 AC receivable) A. Calculate the desired balance of ADA B. Calculate the bed and the them on T- Accu Journaline had debe and the ADA Show the balance sheet tract for the death Value Section 2 AGING METHOD The following information is available regarding the standing recebeef company XYZ May 1, 2020 MA May 100 . ISO 57230 Assume 30 credit Estimates of lading the following 25% 40 50 The company had a debit balance of ADA 1100 REQUIRED A. Calculate the desired BUXT-AC to find the bad debes Cumaline D. Give the balance sheet extracto Not Realizable Value Bank Reconciliation Problem Lotus company showed the following bank reconciliation at March 31: 522,100 Book Balance ADD Depois www $100 LLUS Adjusted lance 2005 Adjusted Balance Cash Back April 30,209 PR Dehits Credits Balance CRIE Deposits Made Cheques Written Am 90 24 25 S900 . 13 IN 12 21 27 30 Teles 53 1140 900 10 4310 4400 71.40 1960 30 Total Hank Sma April 2019 Cheques that 0401 DOT 09 10 ME 930 14200 11 013 0918 500 0427 0427 04/30 1930 PMT INT In reviewing the cheques tumed by the bank, the bookkeeper discovered that chaque 128. for delivery expense was recorded in Cash Dutements al correctly as 51900. The NSF cheque far 14300 was that of Tom, a customer who deposited in On the bank statement the payment for S15900 is regarding and payable. There deposit of 120.000 dated Apeil 30. listom made by the owner in the business an electronic transfer made by the bank from the owner's bank account inte the business. So it did not appear on the Cash Receipt of the company REQUIRED Make a bank reconciliation for the company at April 2019 QUESTION Account Receivable Problems Section 1 Os December 1, 2000. Company Despre Fly has the following informatica AC Resetting the 68.729 Dawn of the 3500 ADA di Malance in the 1450 Sales we Sales Discount 19% of the sales are rash The company decided to estimate addicte Sarthe year bed on the waiting for the date cours before the time of Allowance Delle PADA Part 1 sales Approach A. Callebate jurnalist tad tand the Allowance fordi det Post them on Taccount D. Show the balance extract for the cost revelable Part 2 Account Receivable method] If the company decides to use the account receivable method Use 7 AC receivable) A. Calculate the desired balance of ADA B. Calculate the bed and the them on T- Accu Journaline had debe and the ADA Show the balance sheet tract for the death Value Section 2 AGING METHOD The following information is available regarding the standing recebeef company XYZ May 1, 2020 MA May 100 . ISO 57230 Assume 30 credit Estimates of lading the following 25% 40 50 The company had a debit balance of ADA 1100 REQUIRED A. Calculate the desired BUXT-AC to find the bad debes Cumaline D. Give the balance sheet extracto Not Realizable Value Bank Reconciliation Problem Lotus company showed the following bank reconciliation at March 31: 522,100 Book Balance ADD Depois www $100 LLUS Adjusted lance 2005 Adjusted Balance Cash Back April 30,209 PR Dehits Credits Balance CRIE Deposits Made Cheques Written Am 90 24 25 S900 . 13 IN 12 21 27 30 Teles 53 1140 900 10 4310 4400 71.40 1960 30 Total Hank Sma April 2019 Cheques that 0401 DOT 09 10 ME 930 14200 11 013 0918 500 0427 0427 04/30 1930 PMT INT In reviewing the cheques tumed by the bank, the bookkeeper discovered that chaque 128. for delivery expense was recorded in Cash Dutements al correctly as 51900. The NSF cheque far 14300 was that of Tom, a customer who deposited in On the bank statement the payment for S15900 is regarding and payable. There deposit of 120.000 dated Apeil 30. listom made by the owner in the business an electronic transfer made by the bank from the owner's bank account inte the business. So it did not appear on the Cash Receipt of the company REQUIRED Make a bank reconciliation for the company at April 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts