Question: Question Al4-A18 are based on the information below On May 15, 2019 at 10a.m. a stock traded at $80 per share (St). At that early

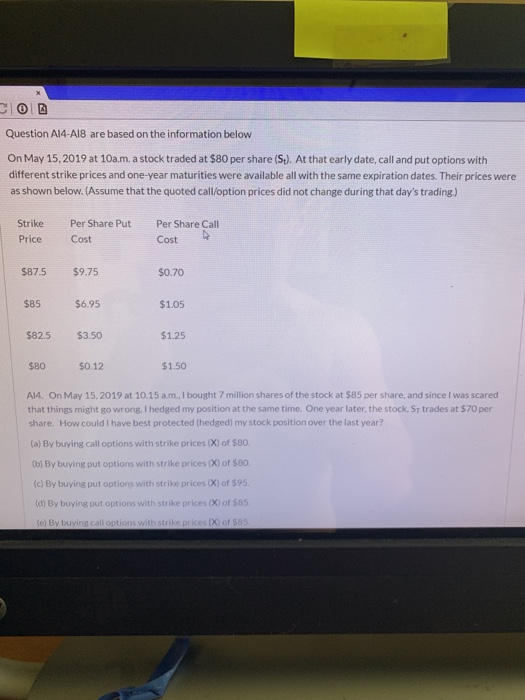

Question Al4-A18 are based on the information below On May 15, 2019 at 10a.m. a stock traded at $80 per share (St). At that early date, call and put options with different strike prices and one-year maturities were available all with the same expiration dates. Their prices were as shown below. (Assume that the quoted call/option prices did not change during that day's trading.) Strike Price Per Share Put Cost Per Share Call Cost $87.5 $9.75 $0.70 $85 $6.95 $1.05 $82,5 $3.50 $1.25 $80 $0.12 $1.50 A14. On May 15, 2019 at 10.15 am, I bought 7 million shares of the stock at $85 per share, and since I was scared that things might go wrong. I hedged my position at the same time. One year later, the stock. Sy trades at 570 per share. How could I have best protected hedged) my stock position over the last year? (a) By buying call options with strike prices XI of 580 By buying put options with strike prices XI of 580. By buying put options with strike prices x) of 595 (d) By buying put options with strike prices (X) of 585 e) By buying call options with strike prices (X) of $85

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts