Question: Question and answer both are provided. KINDLY HELP TO UNDERSTANDwhich value is used where, pleae explain in detaila I am not in a hurry .

Question and answer both are provided. KINDLY HELP TO UNDERSTANDwhich value is used where, pleae explain in detaila

I am not in a hurry .

please present it in a very good understandable way

#Showing which value is obained from where, and used in which place#

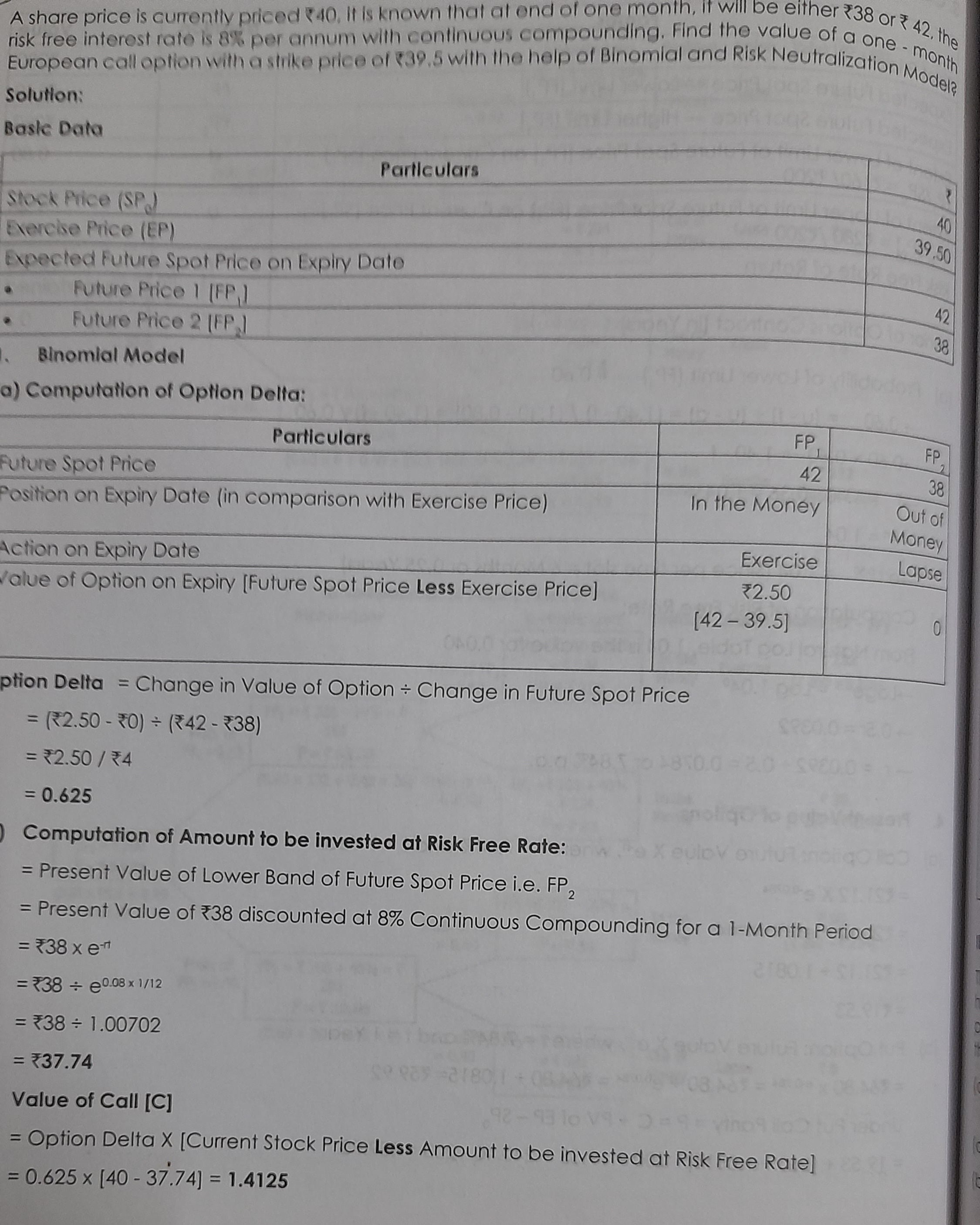

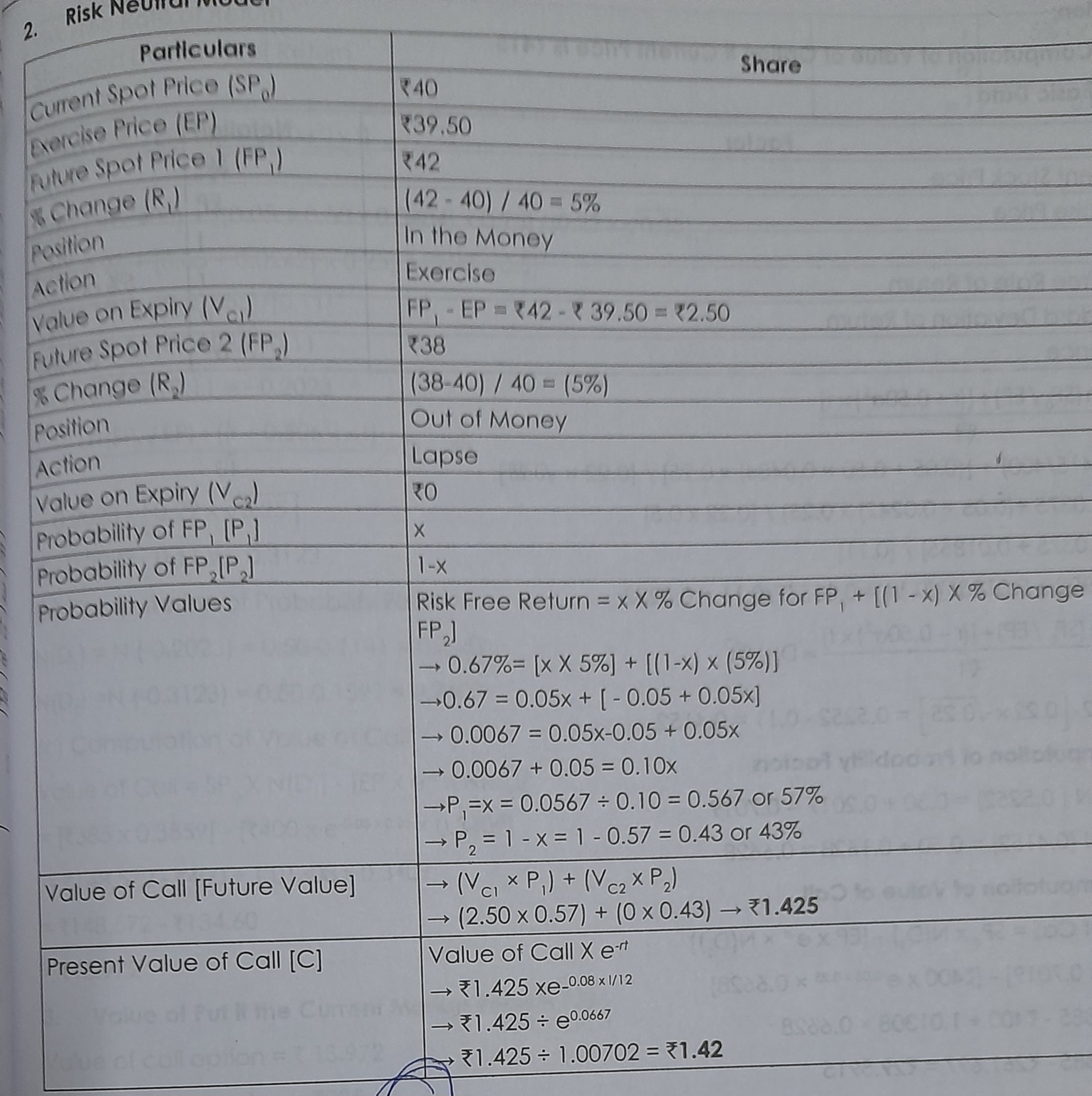

A share price is currently priced 40 , It is known that al end of one month, if will be either 38 or 42 , the risk free interest rate is 8% per annum with continuous compounding. Find the value of a one - month European call option with a strike price of 39.5 with the help of Binomial and Risk Neutralization Model? Solution: Basle Data prionverra=ChangeinValueofOptionChangeinFutureSpotPrice=(2.500)(4238)=2.50/4=0.625 Computation of Amount to be invested at Risk Free Rate: = Present Value of Lower Band of Future Spot Price i.e. FP2 = Present Value of 38 discounted at 8% Continuous Compounding for a 1-Month Period =38e =38e0.081/12=381.00702 =37.74 Value of Call [C] = Option Delta X [Current Stock Price Less Amount to be invested at Risk Free Rate] =0.625[4037.74]=1.4125 2. A share price is currently priced 40 , It is known that al end of one month, if will be either 38 or 42 , the risk free interest rate is 8% per annum with continuous compounding. Find the value of a one - month European call option with a strike price of 39.5 with the help of Binomial and Risk Neutralization Model? Solution: Basle Data prionverra=ChangeinValueofOptionChangeinFutureSpotPrice=(2.500)(4238)=2.50/4=0.625 Computation of Amount to be invested at Risk Free Rate: = Present Value of Lower Band of Future Spot Price i.e. FP2 = Present Value of 38 discounted at 8% Continuous Compounding for a 1-Month Period =38e =38e0.081/12=381.00702 =37.74 Value of Call [C] = Option Delta X [Current Stock Price Less Amount to be invested at Risk Free Rate] =0.625[4037.74]=1.4125 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts