Question: question and answer sheet solve it from part 5 the shafai capital expenditure budget because the first part it is already done thanks. Chapter 27

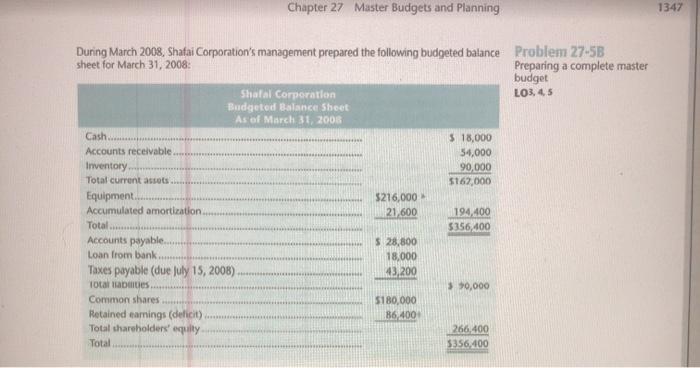

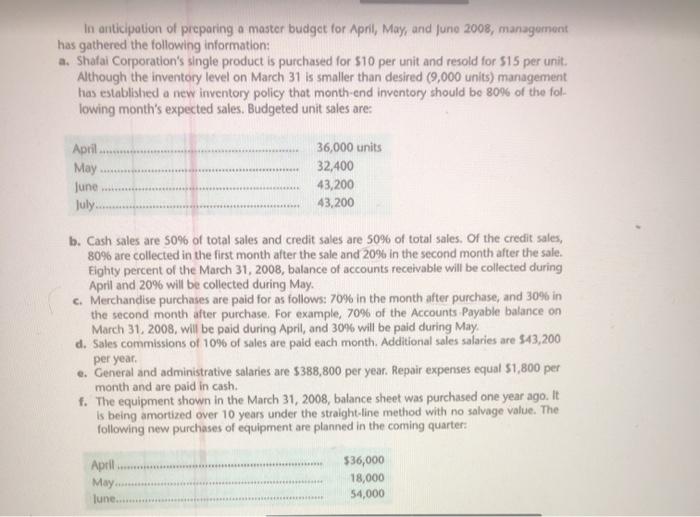

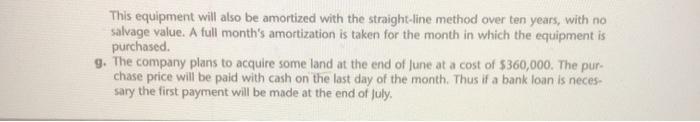

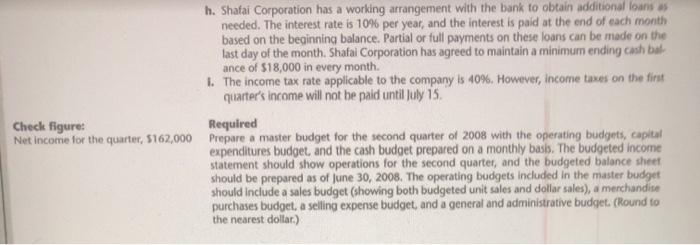

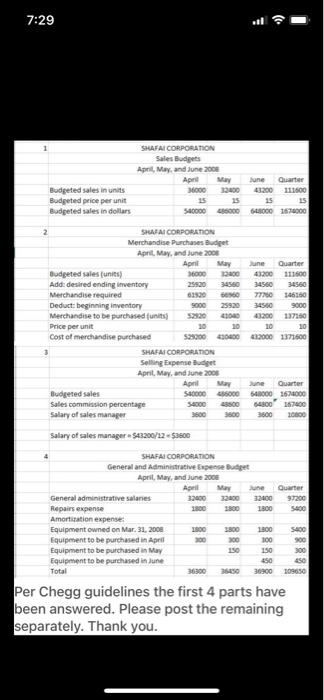

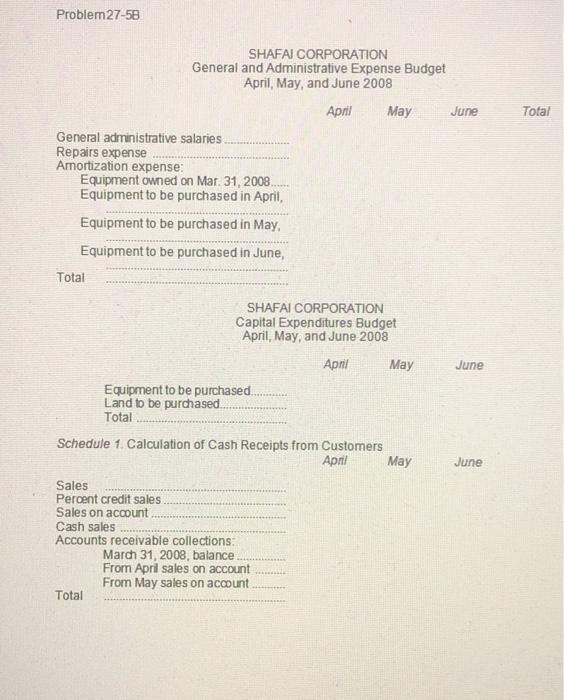

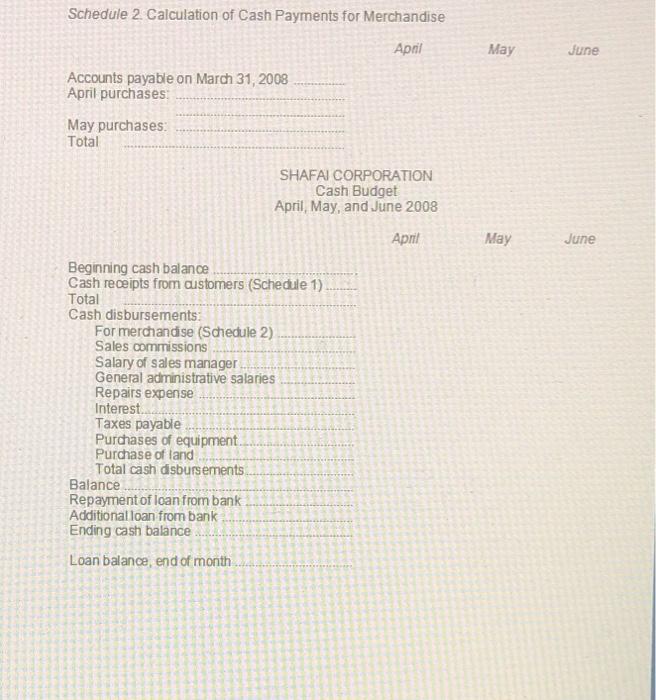

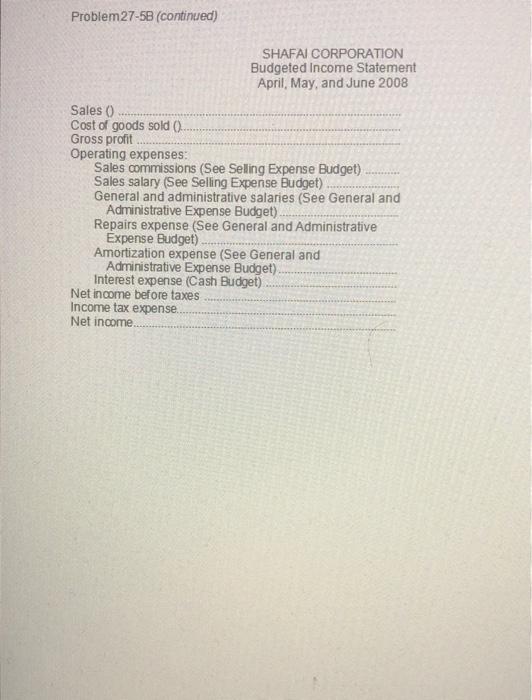

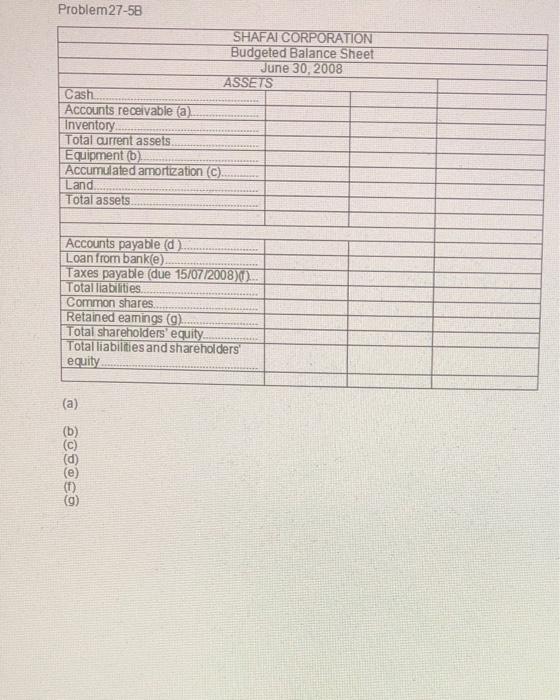

Chapter 27 Master Budgets and Planning 1347 During March 2008, Shatai Corporation's management prepared the following budgeted balance Problem 27-5B sheet for March 31, 2008: Preparing a complete master budget Shalal Corporation LO3,45 Budgeted Balance Sheet As of March 31, 2005 Cash $ 18,000 Accounts receivable 54,000 Inventory 90,000 Total current assets... 5162,000 Equipment $216,000 Accumulated amortization 21,600 194,400 Total 5356,400 Accounts payable 5 28,800 Loan from bank 18,000 Taxes payable (due July 15, 2008) 143,200 Total tauties 370,000 Common shares 5180.000 Retained earnings (deficit) 86,400 Total shareholders' equilty 266,400 Total 5356,400 In anticipation of preparing a master budget for April, May, and June 2008, management has gathered the following information: a. Shafal Corporation's single product is purchased for $10 per unit and resold for 515 per unit. Although the inventory level on March 31 is smaller than desired (9,000 units) management has established a new inventory policy that month-end inventory should be 80% of the fol lowing month's expected sales, Budgeted unit sales are: April May June July 36,000 units 32.400 43,200 43,200 b. Cash sales are 50% of total sales and credit sales are 50% of total sales. Of the credit sales, 80% are collected in the first month after the sale and 20% in the second month after the sale. Fighty percent of the March 31, 2008, balance of accounts receivable will be collected during April and 20% will be collected during May. c. Merchandise purchases are paid for as follows: 70% in the month after purchase, and 30% in the second month after purchase. For example, 70% of the Accounts Payable balance on March 31, 2008, will be paid during April, and 30% will be paid during May d. Sales commissions of 10% of sales are paid each month. Additional sales salaries are 543,200 per year. e. General and administrative salaries are $388,800 per year. Repair expenses equal $1,800 per month and are paid in cash. f. The equipment shown in the March 31, 2008, balance sheet was purchased one year ago. It is being amortized over 10 years under the straight line method with no salvage value. The following new purchases of equipment are planned in the coming quarter: April May lune, $36,000 18,000 54,000 This equipment will also be amortized with the straight-line method over ten years, with no salvage value. A full month's amortization is taken for the month in which the equipment is purchased. 9. The company plans to acquire some land at the end of June at a cost of $360,000. The pur chase price will be paid with cash on the last day of the month. Thus if a bank loan is neces- sary the first payment will be made at the end of July h. Shafai Corporation has a working arrangement with the bank to obtain additional loans needed. The interest rate is 10% per year, and the interest is paid at the end of each month based on the beginning balance. Partial or full payments on these loans can be made on the last day of the month. Shafal Corporation has agreed to maintain a minimum ending cash bal. ance of $18,000 in every month. 1. The income tax rate applicable to the company is 40%. However, income taxes on the first quarter's income will not be paid until July 15, Check figure: Required Net Income for the quarter, 5162,000 Prepare a master budget for the second quarter of 2008 with the operating budgets, capital expenditures budget, and the cash budget prepared on a monthly basis. The budgeted income statement should show operations for the second quarter, and the budgeted balance sheet should be prepared as of June 30, 2008. The operating budgets included in the master budget should include a sales budget (showing both budgeted unit sales and dollar sales), a merchandise purchases budget, a selling expense budget, and a general and administrative budget. (Round to the nearest dollar.) 7:29 SHAFAI CORPORATION Sales Budgets April, May, and June 2008 April May June Quarter MO 43200 111600 15 540000 40000 5000 670000 Budgeted sales in units Budgeted price per unit Budgeted sales in dollars 2 SAI CORPORATION Merchandise Purchases Budget April May June 2008 April June Quarter Budgeted sales (units) 36000 111600 Add: desired ending inventory 25920 34560 34560 34560 Merchandise required 7720 306100 Deduct: beginning inventory 9000 25920 9000 Merchandise to be purchased units 430 43200 13700 Price per unit 10 Cost of merchandise purchased 30400432000 1375600 SHAFAI CORPORATION Selling Expense Budget April, May and June 2008 And May une Quarter Budgeted sales 540000 456000 540000 1670000 Sales commission percentage 54000 43500 4800167400 Salary of sales manager 3800 3600 20000 Salary of sales manager $43200/22-5300 4 SHAFAI CORPORATION General and Administrative pense April, May, and June 2008 May Quarter General administrative salanes 32000 200 32400 97200 Repairs expense 1800 Amortization expenses Equipment owned on Mar 31, 2008 1800 5400 Equipment to be purchased in April 100 900 Equipment to be purchased an May 150 150 300 Equipment to be purchased in June 150 Total 36300 250 30900309650 he Per Chegg guidelines the first 4 parts have been answered. Please post the remaining separately. Thank you. Problem 27-58 Total SHAFAI CORPORATION General and Administrative Expense Budget April May, and June 2008 April May June General administrative salaries Repairs expense Amortization expense: Equipment owned on Mar 31, 2008 Equipment to be purchased in April, Equipment to be purchased in May, Equipment to be purchased in June, Total SHAFAI CORPORATION Capital Expenditures Budget April, May, and June 2008 June April May Equipment to be purchased Land to be purchased Total Schedule 1. Calculation of Cash Receipts from Customers April May June Sales Percent credit sales Sales on account Cash sales Accounts receivable collections March 31, 2008, balance From April sales on account From May sales on account Total Schedule 2. Calculation of Cash Payments for Merchandise April May June Accounts payable on March 31, 2008 April purchases May purchases Total SHAFAI CORPORATION Cash Budget April, May, and June 2008 April May June Beginning cash balance Cash receipts from customers (Schedule 1) Total Cash disbursements: For merchandise (Schedule 2) Sales commissions Salary of sales manager General administrative salaries Repairs expense Interest. Taxes payable Purchases of equipment Purchase of land Total cash disbursements Balance Repayment of loan from bank Additional loan from bank Ending cash balance Loan balance, end of month Problem 27-5B (continued) SHAFAI CORPORATION Budgeted Income Statement April, May, and June 2008 Sales 0 Cost of goods sold 0 Gross profit Operating expenses Sales commissions (See Selling Expense Budget) Sales salary (See Selling Expense Budget) General and administrative salaries (See General and Administrative Expense Budget) Repairs expense (See General and Administrative Expense Budget) Amortization expense (See General and Administrative Expense Budget) Interest expense (Cash Budget) Net income before taxes Income tax expense Net income Problem 27-5B SHAFAI CORPORATION Budgeted Balance Sheet June 30, 2008 ASSETS Cash Accounts receivable a) Inventory Total current assets Equipment (D) Accumulated amortization (C). Land Total assets Accounts payable (d). Loan from banke) Taxes payable (due 15/07/2008)()... Total liabilities Common shares Retained eamings 9) Total shareholders' equity Total liabilities and shareholders equity @30@@@ @ Chapter 27 Master Budgets and Planning 1347 During March 2008, Shatai Corporation's management prepared the following budgeted balance Problem 27-5B sheet for March 31, 2008: Preparing a complete master budget Shalal Corporation LO3,45 Budgeted Balance Sheet As of March 31, 2005 Cash $ 18,000 Accounts receivable 54,000 Inventory 90,000 Total current assets... 5162,000 Equipment $216,000 Accumulated amortization 21,600 194,400 Total 5356,400 Accounts payable 5 28,800 Loan from bank 18,000 Taxes payable (due July 15, 2008) 143,200 Total tauties 370,000 Common shares 5180.000 Retained earnings (deficit) 86,400 Total shareholders' equilty 266,400 Total 5356,400 In anticipation of preparing a master budget for April, May, and June 2008, management has gathered the following information: a. Shafal Corporation's single product is purchased for $10 per unit and resold for 515 per unit. Although the inventory level on March 31 is smaller than desired (9,000 units) management has established a new inventory policy that month-end inventory should be 80% of the fol lowing month's expected sales, Budgeted unit sales are: April May June July 36,000 units 32.400 43,200 43,200 b. Cash sales are 50% of total sales and credit sales are 50% of total sales. Of the credit sales, 80% are collected in the first month after the sale and 20% in the second month after the sale. Fighty percent of the March 31, 2008, balance of accounts receivable will be collected during April and 20% will be collected during May. c. Merchandise purchases are paid for as follows: 70% in the month after purchase, and 30% in the second month after purchase. For example, 70% of the Accounts Payable balance on March 31, 2008, will be paid during April, and 30% will be paid during May d. Sales commissions of 10% of sales are paid each month. Additional sales salaries are 543,200 per year. e. General and administrative salaries are $388,800 per year. Repair expenses equal $1,800 per month and are paid in cash. f. The equipment shown in the March 31, 2008, balance sheet was purchased one year ago. It is being amortized over 10 years under the straight line method with no salvage value. The following new purchases of equipment are planned in the coming quarter: April May lune, $36,000 18,000 54,000 This equipment will also be amortized with the straight-line method over ten years, with no salvage value. A full month's amortization is taken for the month in which the equipment is purchased. 9. The company plans to acquire some land at the end of June at a cost of $360,000. The pur chase price will be paid with cash on the last day of the month. Thus if a bank loan is neces- sary the first payment will be made at the end of July h. Shafai Corporation has a working arrangement with the bank to obtain additional loans needed. The interest rate is 10% per year, and the interest is paid at the end of each month based on the beginning balance. Partial or full payments on these loans can be made on the last day of the month. Shafal Corporation has agreed to maintain a minimum ending cash bal. ance of $18,000 in every month. 1. The income tax rate applicable to the company is 40%. However, income taxes on the first quarter's income will not be paid until July 15, Check figure: Required Net Income for the quarter, 5162,000 Prepare a master budget for the second quarter of 2008 with the operating budgets, capital expenditures budget, and the cash budget prepared on a monthly basis. The budgeted income statement should show operations for the second quarter, and the budgeted balance sheet should be prepared as of June 30, 2008. The operating budgets included in the master budget should include a sales budget (showing both budgeted unit sales and dollar sales), a merchandise purchases budget, a selling expense budget, and a general and administrative budget. (Round to the nearest dollar.) 7:29 SHAFAI CORPORATION Sales Budgets April, May, and June 2008 April May June Quarter MO 43200 111600 15 540000 40000 5000 670000 Budgeted sales in units Budgeted price per unit Budgeted sales in dollars 2 SAI CORPORATION Merchandise Purchases Budget April May June 2008 April June Quarter Budgeted sales (units) 36000 111600 Add: desired ending inventory 25920 34560 34560 34560 Merchandise required 7720 306100 Deduct: beginning inventory 9000 25920 9000 Merchandise to be purchased units 430 43200 13700 Price per unit 10 Cost of merchandise purchased 30400432000 1375600 SHAFAI CORPORATION Selling Expense Budget April, May and June 2008 And May une Quarter Budgeted sales 540000 456000 540000 1670000 Sales commission percentage 54000 43500 4800167400 Salary of sales manager 3800 3600 20000 Salary of sales manager $43200/22-5300 4 SHAFAI CORPORATION General and Administrative pense April, May, and June 2008 May Quarter General administrative salanes 32000 200 32400 97200 Repairs expense 1800 Amortization expenses Equipment owned on Mar 31, 2008 1800 5400 Equipment to be purchased in April 100 900 Equipment to be purchased an May 150 150 300 Equipment to be purchased in June 150 Total 36300 250 30900309650 he Per Chegg guidelines the first 4 parts have been answered. Please post the remaining separately. Thank you. Problem 27-58 Total SHAFAI CORPORATION General and Administrative Expense Budget April May, and June 2008 April May June General administrative salaries Repairs expense Amortization expense: Equipment owned on Mar 31, 2008 Equipment to be purchased in April, Equipment to be purchased in May, Equipment to be purchased in June, Total SHAFAI CORPORATION Capital Expenditures Budget April, May, and June 2008 June April May Equipment to be purchased Land to be purchased Total Schedule 1. Calculation of Cash Receipts from Customers April May June Sales Percent credit sales Sales on account Cash sales Accounts receivable collections March 31, 2008, balance From April sales on account From May sales on account Total Schedule 2. Calculation of Cash Payments for Merchandise April May June Accounts payable on March 31, 2008 April purchases May purchases Total SHAFAI CORPORATION Cash Budget April, May, and June 2008 April May June Beginning cash balance Cash receipts from customers (Schedule 1) Total Cash disbursements: For merchandise (Schedule 2) Sales commissions Salary of sales manager General administrative salaries Repairs expense Interest. Taxes payable Purchases of equipment Purchase of land Total cash disbursements Balance Repayment of loan from bank Additional loan from bank Ending cash balance Loan balance, end of month Problem 27-5B (continued) SHAFAI CORPORATION Budgeted Income Statement April, May, and June 2008 Sales 0 Cost of goods sold 0 Gross profit Operating expenses Sales commissions (See Selling Expense Budget) Sales salary (See Selling Expense Budget) General and administrative salaries (See General and Administrative Expense Budget) Repairs expense (See General and Administrative Expense Budget) Amortization expense (See General and Administrative Expense Budget) Interest expense (Cash Budget) Net income before taxes Income tax expense Net income Problem 27-5B SHAFAI CORPORATION Budgeted Balance Sheet June 30, 2008 ASSETS Cash Accounts receivable a) Inventory Total current assets Equipment (D) Accumulated amortization (C). Land Total assets Accounts payable (d). Loan from banke) Taxes payable (due 15/07/2008)()... Total liabilities Common shares Retained eamings 9) Total shareholders' equity Total liabilities and shareholders equity @30@@@ @

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts