Question: Question and Data provided, no other info was given. Pecking Order Hypothesis. Ross Enterprises can raise capital from the sources in the popup window (Data

Question and Data provided, no other info was given.

Pecking Order Hypothesis.

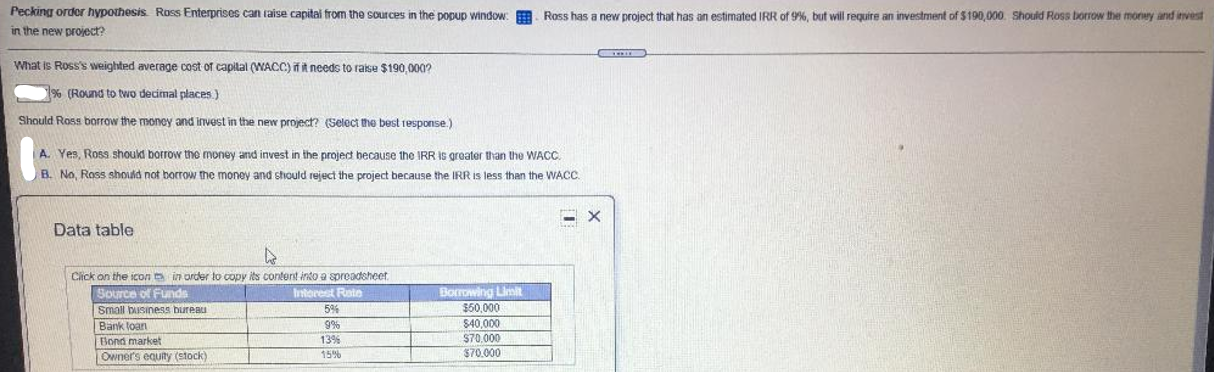

Ross Enterprises can raise capital from the sources in the popup window (Data Table).

Ross has a new project that has an estimated IRR of 9%, but will require an investment of $190,000.

Should Ross borrow the money and invest in the new project?

DATA TABLE

| Source of Funds | Interest Rate | Borrowing Limit |

| Small Business Bureau | 5% | $50,000 |

| Bank Loan | 9% | $40,000 |

| Bond Market | 13% | $70,000 |

| Owner's Equity (stock) | 15% | $70,000 |

What is Ross's weighted average cost of capital (WACC) if it needs to raise $190,000? (round to 2 decimal places)

Should Ross borrow the money and invest in the new project? Multiple Choice

a. Yes, Ross should borrow the money and invest in the project because the IRR is greater than the WACC.

b. No, Ross should not borrow the money and should reject the project because the IRR is less than the WACC.

please show all working steps with formulas or excel

Pecking order hypothesis. Ross Enterprises can raise capital from the sources in the popup Window in the new project? Ross has a new project that has an estimated IRR of 9%, but will require an investment of $190,000. Should Ross borrow the money and invest What is Ross's weighted average cost of capital (WACC) if it needs to raise $190,000? % (Round to two decimal places.) Should Ross borrow the money and invest in the new project? (Select the best response.) A. Yes, Ross should borrow the money and invest in the project because the IRR is greater than the WACC. B. No, Ross should not borrow the money and should reject the project because the IRR is less than the WACC. -X Data table Click on the icon in order to copy its content into a spreadsheet Source of Funds Interest Rate Small business bureau 594 Bank loan 9% Bond market 139 Owner's equity (stock 15% Boring Limit 350.000 $40.000 $70,000 $70.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts