Question: QUESTION Another factor that affects the demand for an asset is how quickly it can be convened into cash at low costs-its liquidity. An asset

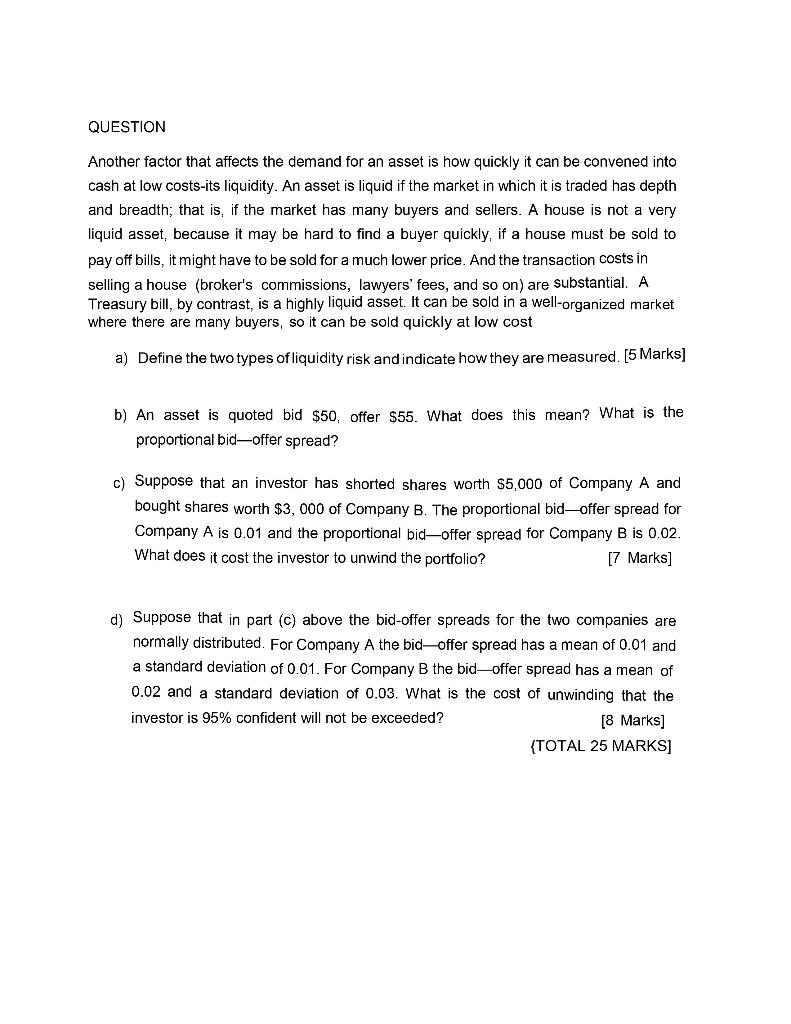

QUESTION Another factor that affects the demand for an asset is how quickly it can be convened into cash at low costs-its liquidity. An asset is liquid if the market in which it is traded has depth and breadth; that is, if the market has many buyers and sellers. A house is not a very liquid asset, because it may be hard to find a buyer quickly, if a house must be sold to pay off bills, it might have to be sold for a much lower price. And the transaction costs in selling a house (broker's commissions, lawyers' fees, and so on) are substantial. A Treasury bill, by contrast, is a highly liquid asset. It can be sold in a well-organized market where there are many buyers, so it can be sold quickly low cost a) Define the two types of liquidity risk and indicate how they are measured. [5 Marks] b) An asset is quoted bid $50, offer $55. What does this mean? What is the proportional bid-offer spread? c) Suppose that an investor has shorted shares worth $5,000 of Company A and bought shares worth $3, 000 of Company B. The proportional bid-offer spread for Company A is 0.01 and the proportional bid-offer spread for Company B is 0.02. What does it cost the investor to unwind the portfolio? [7 Marks] d) Suppose that in part (c) above the bid-offer spreads for the two companies are normally distributed. For Company A the bid-offer spread has a mean of 0.01 and a standard deviation of 0.01. For Company B the bid-offer spread has a mean of 0.02 and a standard deviation of 0.03. What is the cost of unwinding that the investor is 95% confident will not be exceeded? [8 Marks] (TOTAL 25 MARKS] QUESTION Another factor that affects the demand for an asset is how quickly it can be convened into cash at low costs-its liquidity. An asset is liquid if the market in which it is traded has depth and breadth; that is, if the market has many buyers and sellers. A house is not a very liquid asset, because it may be hard to find a buyer quickly, if a house must be sold to pay off bills, it might have to be sold for a much lower price. And the transaction costs in selling a house (broker's commissions, lawyers' fees, and so on) are substantial. A Treasury bill, by contrast, is a highly liquid asset. It can be sold in a well-organized market where there are many buyers, so it can be sold quickly low cost a) Define the two types of liquidity risk and indicate how they are measured. [5 Marks] b) An asset is quoted bid $50, offer $55. What does this mean? What is the proportional bid-offer spread? c) Suppose that an investor has shorted shares worth $5,000 of Company A and bought shares worth $3, 000 of Company B. The proportional bid-offer spread for Company A is 0.01 and the proportional bid-offer spread for Company B is 0.02. What does it cost the investor to unwind the portfolio? [7 Marks] d) Suppose that in part (c) above the bid-offer spreads for the two companies are normally distributed. For Company A the bid-offer spread has a mean of 0.01 and a standard deviation of 0.01. For Company B the bid-offer spread has a mean of 0.02 and a standard deviation of 0.03. What is the cost of unwinding that the investor is 95% confident will not be exceeded? [8 Marks] (TOTAL 25 MARKS]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts