Question: Question: Answer book template: Answer Book Template: AutoSave OFF OFF $U Financial Planning & Software Application Main assessment 2 Brief 52 2020-21(2) - Compatibility Mode

Question:

Answer book template:

Answer Book Template:

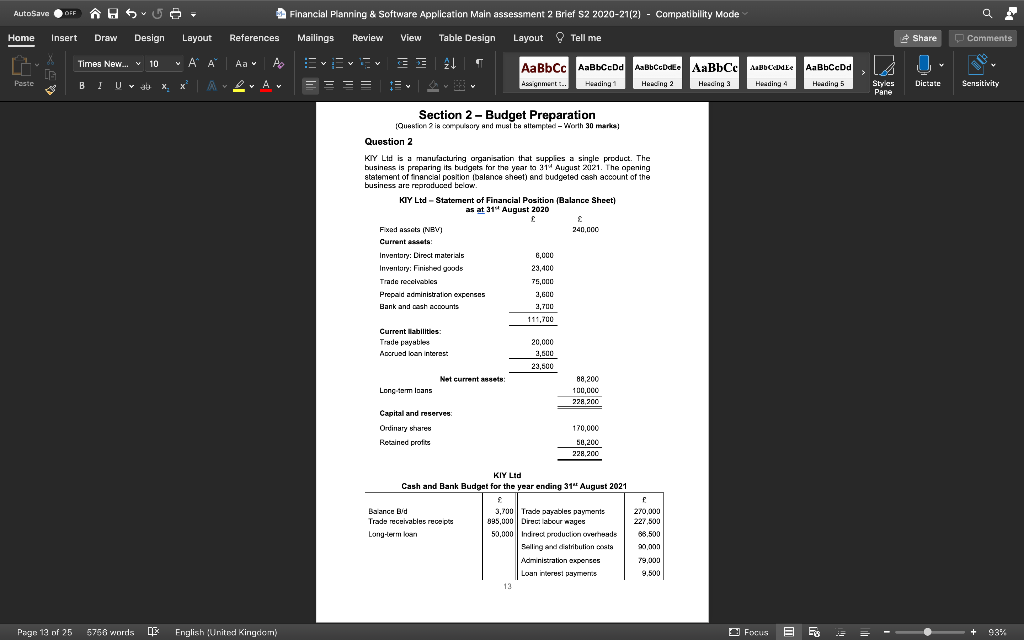

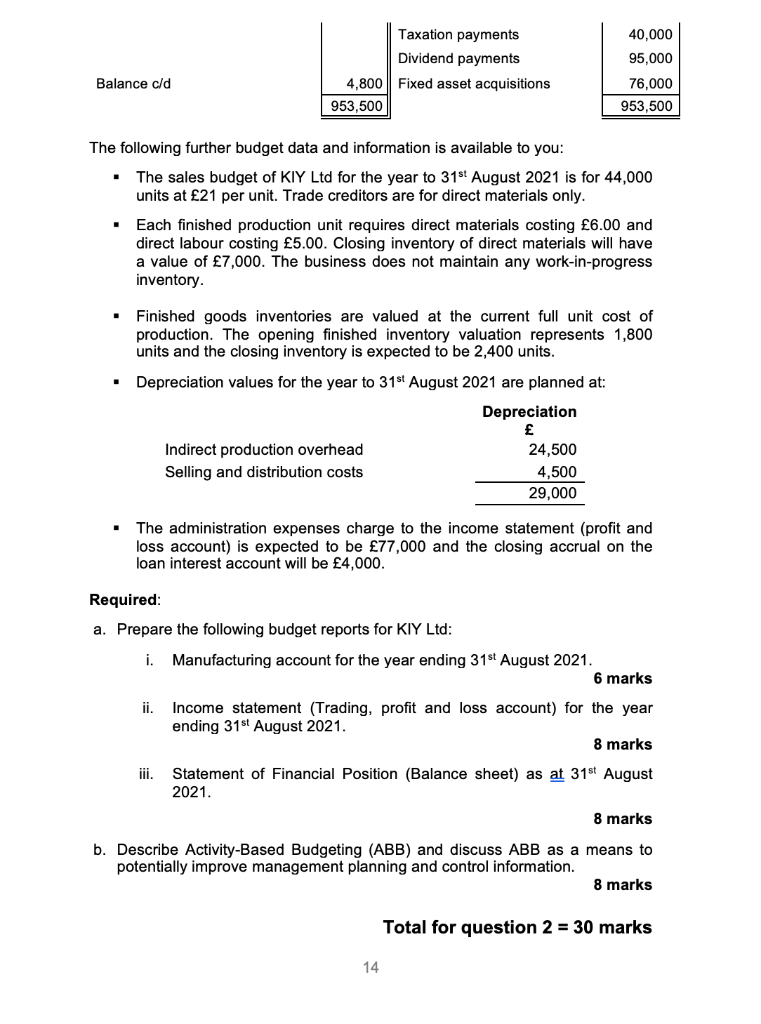

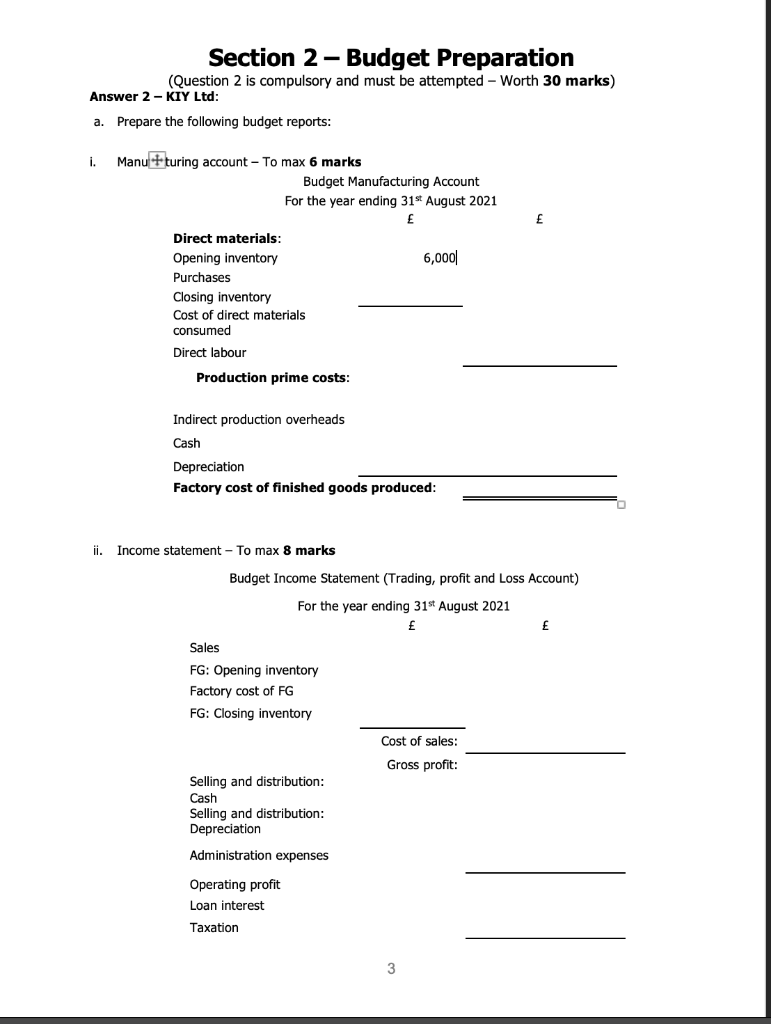

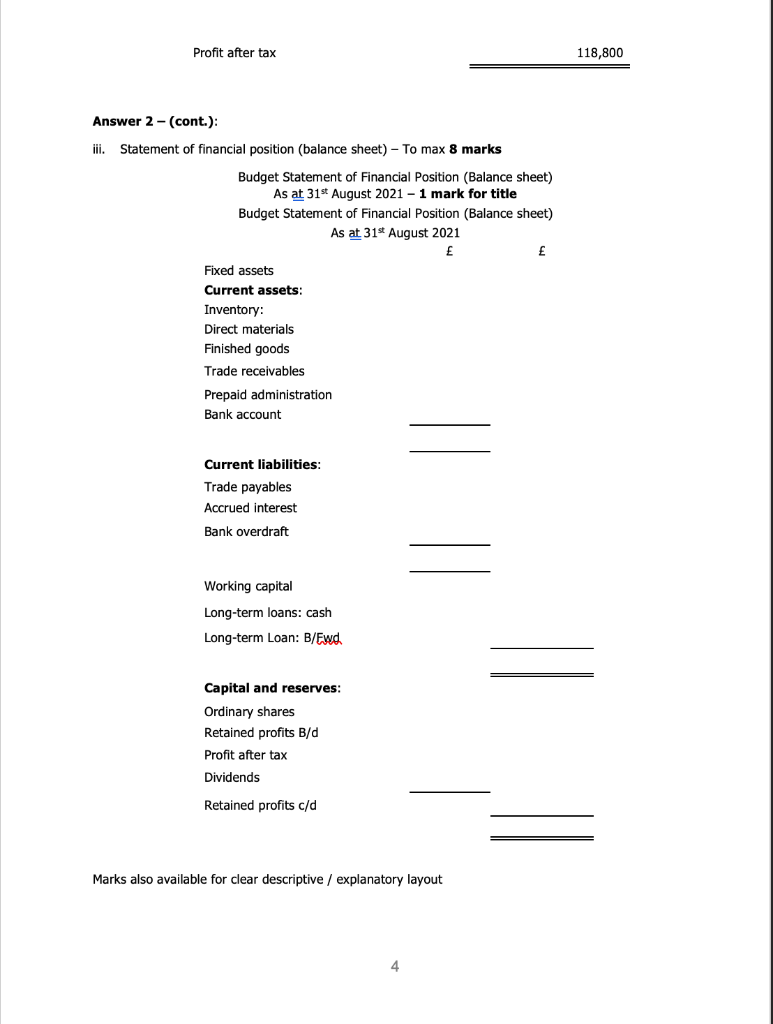

AutoSave OFF OFF $U Financial Planning & Software Application Main assessment 2 Brief 52 2020-21(2) - Compatibility Mode a Home Insert Draw Design Layout References Mailings Review View Table Design Layout Tell me Share Comments X Times New... v 10 - AI Aa As E 41 AaBbcodee AaBbcc ABBCODE AaBbccd Heading 2 2 Heading 4 Heading 5 Psic BU aux X Headina1 Heading 3 Dictate Styles Pare Sensitivity Section 2-Budget Preparation Question is expulsary and must be attempted - Worth 30 marks) Question 2 KIY Ltd is a manufacturing organisation that supplies a single product. The business is preparing its budgets for the year to 31 August 2i21. The opening statement of financial position balance sheet) and budgeted cash account of the business are reproduced below KIY Ltd - Statement of Financial Position (Balance Sheet) as at 31 August 2020 C Fixed assets (NBV) 240,000 Current assets Inventory: Direct materials 6.000 Inventory: Finished goods 23,100 Trade receivables 75,000 Prepaid administration experses 2,600 Bank and cash accounts 111,700 Current abilities Trude puyubles 20,000 Accrued loan interest 3,600 23,500 Net current assets: 88,200 Long term loans 100,000 229.200 2,700 Capital and reserves Ordinary res Retained profits 170,000 50,200 228,200 KIY Lid Cash and Bank Budget for the year ending 31" August 2021 Balance Dvd Trade receivables recept Long-termen f 270.000 227,500 38.500 20,000 3,700 Trade payables payments 895,000 Druc:abour wages 50.000 indirect production overheads Selling and distribution rate Administration expenses Loan interesi payo. 12 79,000 9.500 Page 13 of 25 6766 words LE English (United Kingdom) Focus 40,000 95,000 Taxation payments Dividend payments 4,800 Fixed asset acquisitions 953,500 Balance cld 76,000 953,500 The following further budget data and information is available to you: The sales budget of KIY Ltd for the year to 31st August 2021 is for 44,000 units at 21 per unit. Trade creditors are for direct materials only. Each finished production unit requires direct materials costing 6.00 and direct labour costing 5.00. Closing inventory of direct materials will have a value of 7,000. The business does not maintain any work-in-progress inventory. Finished goods inventories are valued at the current full unit cost of production. The opening finished inventory valuation represents 1,800 units and the closing inventory is expected to be 2,400 units. Depreciation values for the year to 31st August 2021 are planned at: Depreciation Indirect production overhead 24,500 Selling and distribution costs 4,500 29,000 The administration expenses charge to the income statement (profit and loss account) is expected to be 77,000 and the closing accrual on the loan interest account will be 4,000. Required: a. Prepare the following budget reports for KIY Ltd: i. Manufacturing account for the year ending 31st August 2021. 6 marks ii. Income statement (Trading, profit and loss account) for the year ending 31st August 2021. 8 marks iii. Statement of Financial Position (Balance sheet) as at 31st August 2021. 8 marks b. Describe Activity-Based Budgeting (ABB) and discuss ABB as a means to potentially improve management planning and control information. 8 marks Total for question 2 = 30 marks 14 Section 2-Budget Preparation (Question 2 is compulsory and must be attempted - Worth 30 marks) Answer 2- KIY Ltd: a. Prepare the following budget reports: i. Manu #turing account - To max 6 marks Budget Manufacturing Account For the year ending 31st August 2021 Direct materials: Opening inventory 6,000 Purchases Closing inventory Cost of direct materials consumed Direct labour Production prime costs: Indirect production overheads Cash Depreciation Factory cost of finished goods produced: ii. Income statement - To max 8 marks Budget Income Statement (Trading, profit and Loss Account) For the year ending 31st August 2021 E Sales FG: Opening inventory Factory cost of FG FG: Closing inventory Cost of sales: Gross profit: Selling and distribution: Cash Selling and distribution: Depreciation Administration expenses Operating profit Loan interest Taxation 3 Profit after tax 118,800 Answer 2-(cont.): ili. Statement of financial position (balance sheet) - To max 8 marks Budget Statement of Financial Position (Balance sheet) As at 31st August 2021 -1 mark for title Budget Statement of Financial Position (Balance sheet) As at 31 August 2021 Fixed assets Current assets: Inventory: Direct materials Finished goods Trade receivables Prepaid administration Bank account Current liabilities: Trade payables Accrued interest Bank overdraft Working capital Long-term loans: cash Long-term Loan: B/Ewd. Capital and reserves: Ordinary shares Retained profits B/d Profit after tax Dividends Retained profits c/d Marks also available for clear descriptive / explanatory layout 4 AutoSave OFF OFF $U Financial Planning & Software Application Main assessment 2 Brief 52 2020-21(2) - Compatibility Mode a Home Insert Draw Design Layout References Mailings Review View Table Design Layout Tell me Share Comments X Times New... v 10 - AI Aa As E 41 AaBbcodee AaBbcc ABBCODE AaBbccd Heading 2 2 Heading 4 Heading 5 Psic BU aux X Headina1 Heading 3 Dictate Styles Pare Sensitivity Section 2-Budget Preparation Question is expulsary and must be attempted - Worth 30 marks) Question 2 KIY Ltd is a manufacturing organisation that supplies a single product. The business is preparing its budgets for the year to 31 August 2i21. The opening statement of financial position balance sheet) and budgeted cash account of the business are reproduced below KIY Ltd - Statement of Financial Position (Balance Sheet) as at 31 August 2020 C Fixed assets (NBV) 240,000 Current assets Inventory: Direct materials 6.000 Inventory: Finished goods 23,100 Trade receivables 75,000 Prepaid administration experses 2,600 Bank and cash accounts 111,700 Current abilities Trude puyubles 20,000 Accrued loan interest 3,600 23,500 Net current assets: 88,200 Long term loans 100,000 229.200 2,700 Capital and reserves Ordinary res Retained profits 170,000 50,200 228,200 KIY Lid Cash and Bank Budget for the year ending 31" August 2021 Balance Dvd Trade receivables recept Long-termen f 270.000 227,500 38.500 20,000 3,700 Trade payables payments 895,000 Druc:abour wages 50.000 indirect production overheads Selling and distribution rate Administration expenses Loan interesi payo. 12 79,000 9.500 Page 13 of 25 6766 words LE English (United Kingdom) Focus 40,000 95,000 Taxation payments Dividend payments 4,800 Fixed asset acquisitions 953,500 Balance cld 76,000 953,500 The following further budget data and information is available to you: The sales budget of KIY Ltd for the year to 31st August 2021 is for 44,000 units at 21 per unit. Trade creditors are for direct materials only. Each finished production unit requires direct materials costing 6.00 and direct labour costing 5.00. Closing inventory of direct materials will have a value of 7,000. The business does not maintain any work-in-progress inventory. Finished goods inventories are valued at the current full unit cost of production. The opening finished inventory valuation represents 1,800 units and the closing inventory is expected to be 2,400 units. Depreciation values for the year to 31st August 2021 are planned at: Depreciation Indirect production overhead 24,500 Selling and distribution costs 4,500 29,000 The administration expenses charge to the income statement (profit and loss account) is expected to be 77,000 and the closing accrual on the loan interest account will be 4,000. Required: a. Prepare the following budget reports for KIY Ltd: i. Manufacturing account for the year ending 31st August 2021. 6 marks ii. Income statement (Trading, profit and loss account) for the year ending 31st August 2021. 8 marks iii. Statement of Financial Position (Balance sheet) as at 31st August 2021. 8 marks b. Describe Activity-Based Budgeting (ABB) and discuss ABB as a means to potentially improve management planning and control information. 8 marks Total for question 2 = 30 marks 14 Section 2-Budget Preparation (Question 2 is compulsory and must be attempted - Worth 30 marks) Answer 2- KIY Ltd: a. Prepare the following budget reports: i. Manu #turing account - To max 6 marks Budget Manufacturing Account For the year ending 31st August 2021 Direct materials: Opening inventory 6,000 Purchases Closing inventory Cost of direct materials consumed Direct labour Production prime costs: Indirect production overheads Cash Depreciation Factory cost of finished goods produced: ii. Income statement - To max 8 marks Budget Income Statement (Trading, profit and Loss Account) For the year ending 31st August 2021 E Sales FG: Opening inventory Factory cost of FG FG: Closing inventory Cost of sales: Gross profit: Selling and distribution: Cash Selling and distribution: Depreciation Administration expenses Operating profit Loan interest Taxation 3 Profit after tax 118,800 Answer 2-(cont.): ili. Statement of financial position (balance sheet) - To max 8 marks Budget Statement of Financial Position (Balance sheet) As at 31st August 2021 -1 mark for title Budget Statement of Financial Position (Balance sheet) As at 31 August 2021 Fixed assets Current assets: Inventory: Direct materials Finished goods Trade receivables Prepaid administration Bank account Current liabilities: Trade payables Accrued interest Bank overdraft Working capital Long-term loans: cash Long-term Loan: B/Ewd. Capital and reserves: Ordinary shares Retained profits B/d Profit after tax Dividends Retained profits c/d Marks also available for clear descriptive / explanatory layout 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts