Question: Question Answer sheet Hi, I would like to get the calculations and solution of this question. Excel format will be appreciated. I am in a

Question

Answer sheet

Hi, I would like to get the calculations and solution of this question. Excel format will be appreciated. I am in a hurry, so quick response would be really appreciated.

Thanks!

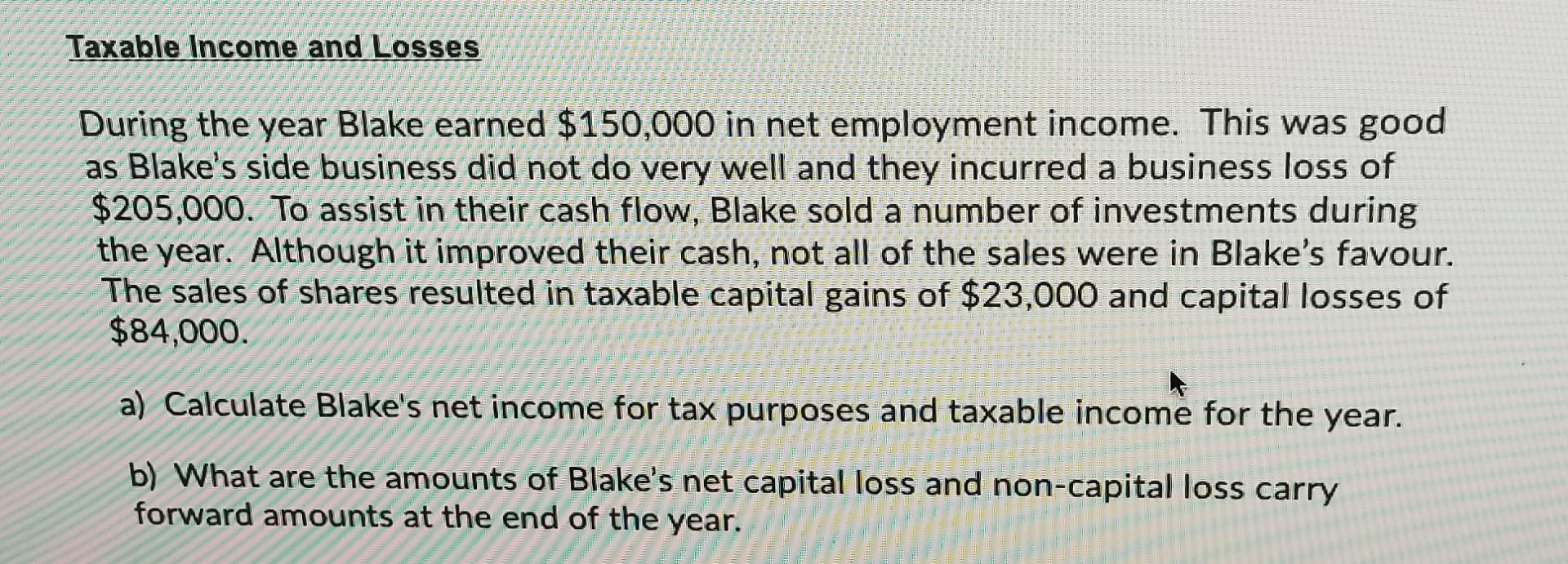

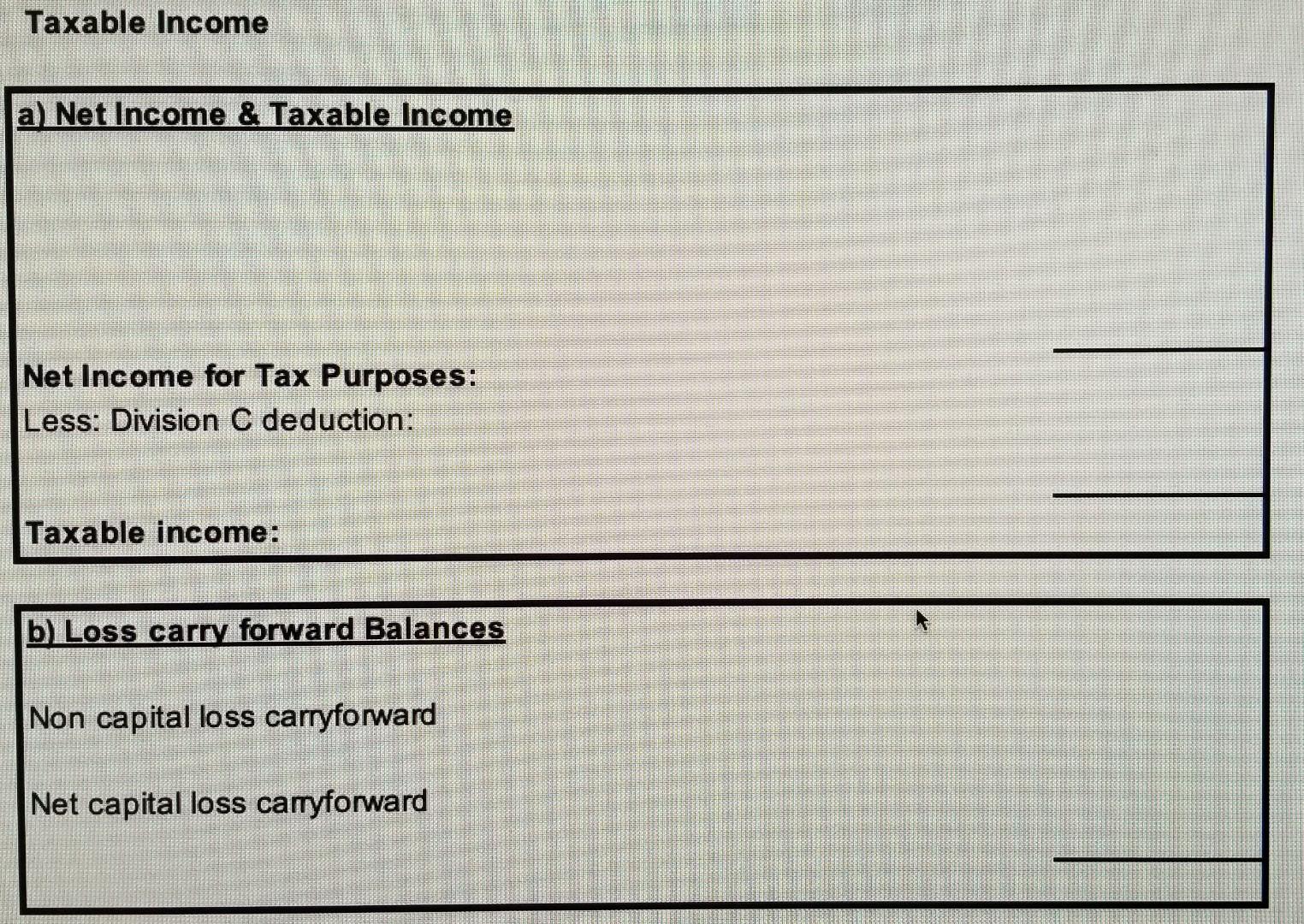

Taxable Income and Losses During the year Blake earned $150,000 in net employment income. This was good as Blake's side business did not do very well and they incurred a business loss of $205,000. To assist in their cash flow, Blake sold a number of investments during the year. Although it improved their cash, not all of the sales were in Blake's favour. The sales of shares resulted in taxable capital gains of $23,000 and capital losses of $84,000. a) Calculate Blake's net income for tax purposes and taxable income for the year. b) What are the amounts of Blake's net capital loss and non-capital loss carry forward amounts at the end of the year. Taxable Income a) Net Income & Taxable Income Net Income for Tax Purposes: Less: Division C deduction: Taxable income: b) Loss carry forward Balances Non capital loss carryforward Net capital loss carryforward

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts