Question: question are in photos. kindly answer asap QUESTION 15 Same information for questions 14 to 16: A bank holds a 5-year par value bond of

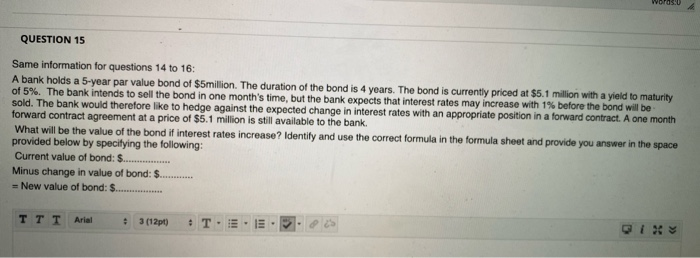

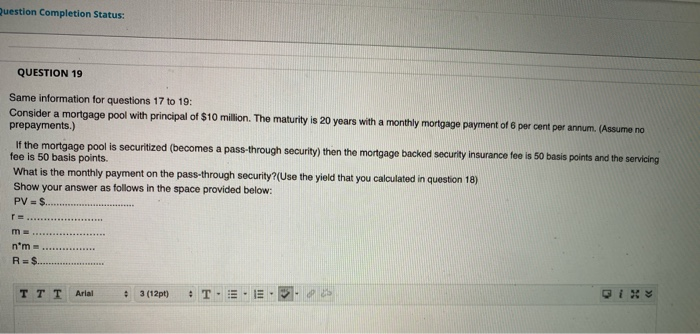

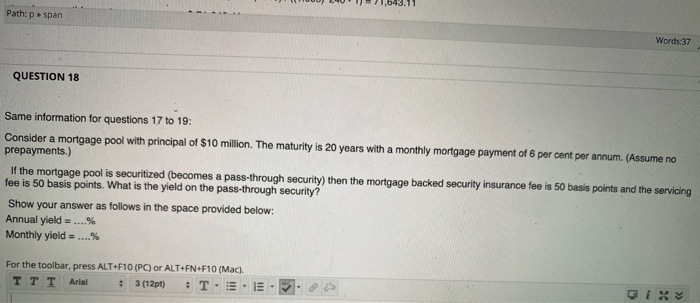

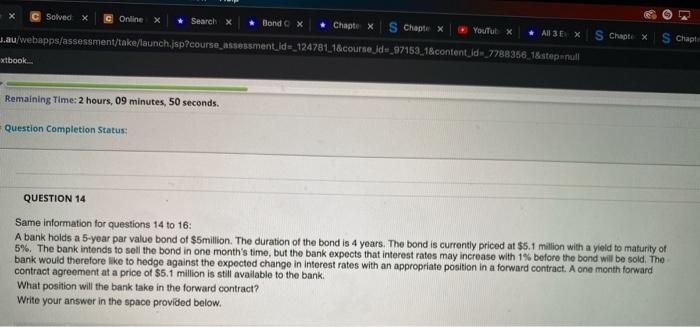

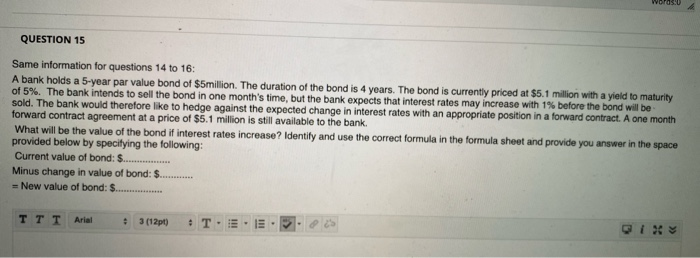

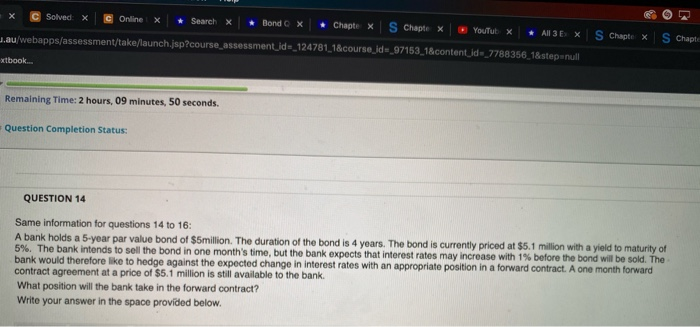

QUESTION 15 Same information for questions 14 to 16: A bank holds a 5-year par value bond of $5million. The duration of the bond is 4 years. The bond is currently priced at $5.1 million with a yield to maturity of 5%. The bank intends to sell the bond in one month's time, but the bank expects that interest rates may increase with 1% before the bond will be sold. The bank would therefore like to hedge against the expected change in interest rates with an appropriate position in a forward contract. A one month forward contract agreement at a price of $5.1 million is still available to the bank. What will be the value of the bond if interest rates increase? Identify and use the correct formula in the formula sheet and provide you answer in the space provided below by specifying the following: Current value of bond: $............ Minus change in value of bond: $... =New value of bond: $..... TTT Arial : 3 (1200 T.E.5. uestion Completion Status: QUESTION 19 Same information for questions 17 to 19: Consider a mortgage pool with principal of $10 million. The maturity is 20 years with a monthly mortgage payment of 6 per cent per annum, (Assume no prepayments.) If the mortgage pool is securitized (becomes a pass-through security) then the mortgage backed security insurance fee is 50 basis points and the servicing fee is 50 basis points. What is the monthly payment on the pass-through security? (Use the yield that you calculated in question 18) Show your answer as follows in the space provided below: PV = $..... me. n'm TT T Arial : 3 (12pt) T.E.E.>. 11.643.11 Path: pspan Words:37 QUESTION 18 Same information for questions 17 to 19: Consider a mortgage pool with principal of $10 million. The maturity is 20 years with a monthly mortgage payment of 6 per cent per annum. (Assume no prepayments.) If the mortgage pool is securitized (becomes a pass-through security) then the mortgage backed security insurance fee is 50 basis points and the servicing fee is 50 basis points. What is the yield on the pass-through security? Show your answer as follows in the space provided below: Annual yield = ....% Monthly yield = ....% For the toolbar, press ALT+F10 (PC) or ALT FN+F10 (Mac). TTT Arial 3(121) T. E.5. X C Solved: x C Online Search X . Bondex Chapte x S Chapter x Yux A3E X S Chaptex Scha Lau/webapps/assessment/take/launch.jsp?course assessment_id=_124781,1&course id=_97153.18 content_ide_7788356.18 stepenull wtbook. Remaining Time: 2 hours, 09 minutes, 50 seconds. Question Completion Status: QUESTION 14 Same information for questions 14 to 16: A bank holds a 5-year par value bond of $5million. The duration of the bond is 4 years. The bond is currently priced at $5.1 milion with a yield to maturity of 5%. The bank intends to sell the bond in one month's time, but the bank expects that interest rates may increase with 1% before the bond will be sold. The bank would therefore like to hedge against the expected change in interest rates with an appropriate position in a forward contract. A one month forward contract agreement at a price of $5.1 million is still available to the bank What position will the bank take in the forward contract? Write your answer in the space provided below. QUESTION 15 Same information for questions 14 to 16: A bank holds a 5-year par value bond of $5million. The duration of the bond is 4 years. The bond is currently priced at $5.1 million with a yield to maturity of 5%. The bank intends to sell the bond in one month's time, but the bank expects that interest rates may increase with 1% before the bond will be sold. The bank would therefore like to hedge against the expected change in interest rates with an appropriate position in a forward contract. A one month forward contract agreement at a price of $5.1 million is still available to the bank What will be the value of the bond if interest rates increase? Identify and use the correct formula in the formula sheet and provide you answer in the space provided below by specifying the following: Current value of bond: S................ Minus change in value of bond: $... = New value of bond: $.... TTT Ariel 3(1291) TEE 5. X C Solved: x C Online Search x Bordo x Chapte x S Chaptex Out x 36 S Chaptex S Cham Lau/webapps/assessment/take/launch.jsp?course assessment_id=_124781,1&course_id=_97163_1&content_id_7788356 18 stepenull wtbook. Remaining Time: 2 hours, 09 minutes, 50 seconds. Question Completion Status: QUESTION 14 Same information for questions 14 to 16: A bank holds a 5-year par value bond of $5million. The duration of the bond is 4 years. The bond is currently priced at $5.1 million with a yield to maturity of 5%. The bank intends to sell the bond in one month's time, but the bank expects that interest rates may increase with 1% before the bond will be sold. The bank would therefore like to hedge against the expected change in interest rates with an appropriate position in a forward contract. A one month forward contract agreement of a price of $5.1 million is still available to the bank What position will the bank take in the forward contract? Write your answer in the space provided below. QUESTION 15 Same information for questions 14 to 16: A bank holds a 5-year par value bond of $5million. The duration of the bond is 4 years. The bond is currently priced at $5.1 million with a yield to maturity of 5%. The bank intends to sell the bond in one month's time, but the bank expects that interest rates may increase with 1% before the bond will be sold. The bank would therefore like to hedge against the expected change in interest rates with an appropriate position in a forward contract. A one month forward contract agreement at a price of $5.1 million is still available to the bank. What will be the value of the bond if interest rates increase? Identify and use the correct formula in the formula sheet and provide you answer in the space provided below by specifying the following: Current value of bond: $............ Minus change in value of bond: $... =New value of bond: $..... TTT Arial : 3 (1200 T.E.5. uestion Completion Status: QUESTION 19 Same information for questions 17 to 19: Consider a mortgage pool with principal of $10 million. The maturity is 20 years with a monthly mortgage payment of 6 per cent per annum, (Assume no prepayments.) If the mortgage pool is securitized (becomes a pass-through security) then the mortgage backed security insurance fee is 50 basis points and the servicing fee is 50 basis points. What is the monthly payment on the pass-through security? (Use the yield that you calculated in question 18) Show your answer as follows in the space provided below: PV = $..... me. n'm TT T Arial : 3 (12pt) T.E.E.>. 11.643.11 Path: pspan Words:37 QUESTION 18 Same information for questions 17 to 19: Consider a mortgage pool with principal of $10 million. The maturity is 20 years with a monthly mortgage payment of 6 per cent per annum. (Assume no prepayments.) If the mortgage pool is securitized (becomes a pass-through security) then the mortgage backed security insurance fee is 50 basis points and the servicing fee is 50 basis points. What is the yield on the pass-through security? Show your answer as follows in the space provided below: Annual yield = ....% Monthly yield = ....% For the toolbar, press ALT+F10 (PC) or ALT FN+F10 (Mac). TTT Arial 3(121) T. E.5. X C Solved: x C Online Search X . Bondex Chapte x S Chapter x Yux A3E X S Chaptex Scha Lau/webapps/assessment/take/launch.jsp?course assessment_id=_124781,1&course id=_97153.18 content_ide_7788356.18 stepenull wtbook. Remaining Time: 2 hours, 09 minutes, 50 seconds. Question Completion Status: QUESTION 14 Same information for questions 14 to 16: A bank holds a 5-year par value bond of $5million. The duration of the bond is 4 years. The bond is currently priced at $5.1 milion with a yield to maturity of 5%. The bank intends to sell the bond in one month's time, but the bank expects that interest rates may increase with 1% before the bond will be sold. The bank would therefore like to hedge against the expected change in interest rates with an appropriate position in a forward contract. A one month forward contract agreement at a price of $5.1 million is still available to the bank What position will the bank take in the forward contract? Write your answer in the space provided below. QUESTION 15 Same information for questions 14 to 16: A bank holds a 5-year par value bond of $5million. The duration of the bond is 4 years. The bond is currently priced at $5.1 million with a yield to maturity of 5%. The bank intends to sell the bond in one month's time, but the bank expects that interest rates may increase with 1% before the bond will be sold. The bank would therefore like to hedge against the expected change in interest rates with an appropriate position in a forward contract. A one month forward contract agreement at a price of $5.1 million is still available to the bank What will be the value of the bond if interest rates increase? Identify and use the correct formula in the formula sheet and provide you answer in the space provided below by specifying the following: Current value of bond: S................ Minus change in value of bond: $... = New value of bond: $.... TTT Ariel 3(1291) TEE 5. X C Solved: x C Online Search x Bordo x Chapte x S Chaptex Out x 36 S Chaptex S Cham Lau/webapps/assessment/take/launch.jsp?course assessment_id=_124781,1&course_id=_97163_1&content_id_7788356 18 stepenull wtbook. Remaining Time: 2 hours, 09 minutes, 50 seconds. Question Completion Status: QUESTION 14 Same information for questions 14 to 16: A bank holds a 5-year par value bond of $5million. The duration of the bond is 4 years. The bond is currently priced at $5.1 million with a yield to maturity of 5%. The bank intends to sell the bond in one month's time, but the bank expects that interest rates may increase with 1% before the bond will be sold. The bank would therefore like to hedge against the expected change in interest rates with an appropriate position in a forward contract. A one month forward contract agreement of a price of $5.1 million is still available to the bank What position will the bank take in the forward contract? Write your answer in the space provided below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts