Question: Question: As a financial advisor, explain to your client Dwight how RRIFs work and demonstrate how much he will need to withdraw from his RRIF

Question:

As a financial advisor, explain to your client Dwight how RRIFs work and demonstrate how much he will need to withdraw from his RRIF this year.

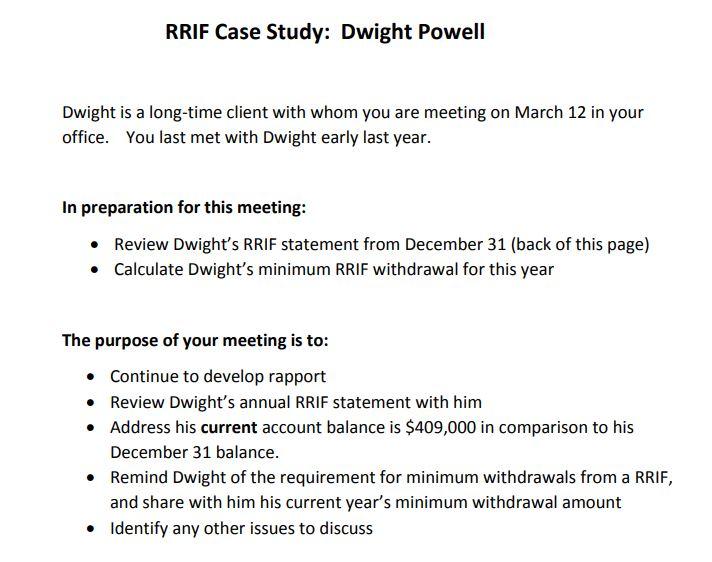

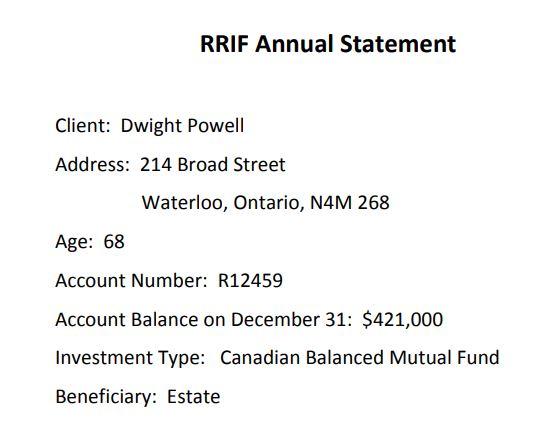

RRIF Case Study: Dwight Powell Dwight is a long-time client with whom you are meeting on March 12 in your office. You last met with Dwight early last year. In preparation for this meeting: Review Dwight's RRIF statement from December 31 (back of this page) Calculate Dwight's minimum RRIF withdrawal for this year The purpose of your meeting is to: Continue to develop rapport Review Dwight's annual RRIF statement with him Address his current account balance is $409,000 in comparison to his December 31 balance. Remind Dwight of the requirement for minimum withdrawals from a RRIF, and share with him his current year's minimum withdrawal amount Identify any other issues to discuss RRIF Annual Statement Client: Dwight Powell Address: 214 Broad Street Waterloo, Ontario, N4M 268 Age: 68 Account Number: R12459 Account Balance on December 31: $421,000 Investment Type: Canadian Balanced Mutual Fund Beneficiary: Estate RRIF Case Study: Dwight Powell Dwight is a long-time client with whom you are meeting on March 12 in your office. You last met with Dwight early last year. In preparation for this meeting: Review Dwight's RRIF statement from December 31 (back of this page) Calculate Dwight's minimum RRIF withdrawal for this year The purpose of your meeting is to: Continue to develop rapport Review Dwight's annual RRIF statement with him Address his current account balance is $409,000 in comparison to his December 31 balance. Remind Dwight of the requirement for minimum withdrawals from a RRIF, and share with him his current year's minimum withdrawal amount Identify any other issues to discuss RRIF Annual Statement Client: Dwight Powell Address: 214 Broad Street Waterloo, Ontario, N4M 268 Age: 68 Account Number: R12459 Account Balance on December 31: $421,000 Investment Type: Canadian Balanced Mutual Fund Beneficiary: Estate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts