Question: QUESTION: Assume that all data are as given in the original exercise. Nick Son is SSs manager, and his bonus is based on operating income.

QUESTION:

Assume that all data are as given in the original exercise. Nick Son is SSs manager, and his bonus is based on operating income. Because he is likely to relocate after about a year, his current bonus is his primary concern. Which alternative would Nick Son choose? Explain.

WHICH OF THE FOLLOWING ANSWERS ARE CORRECT? AND SAY WHY PLEASE

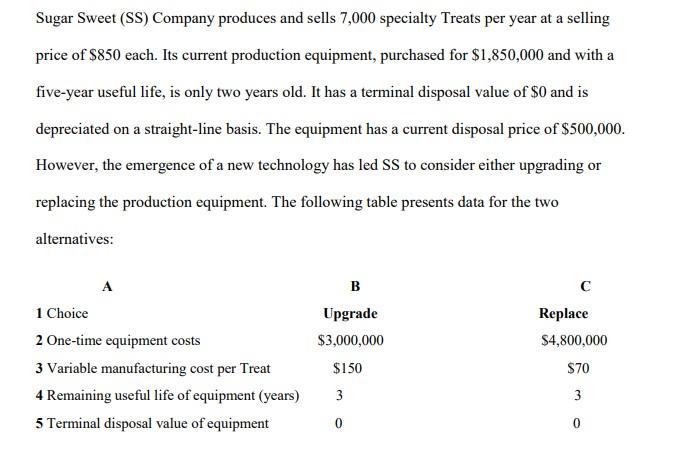

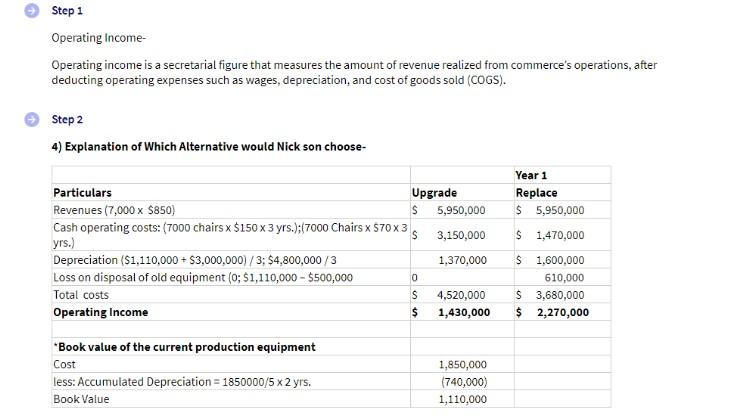

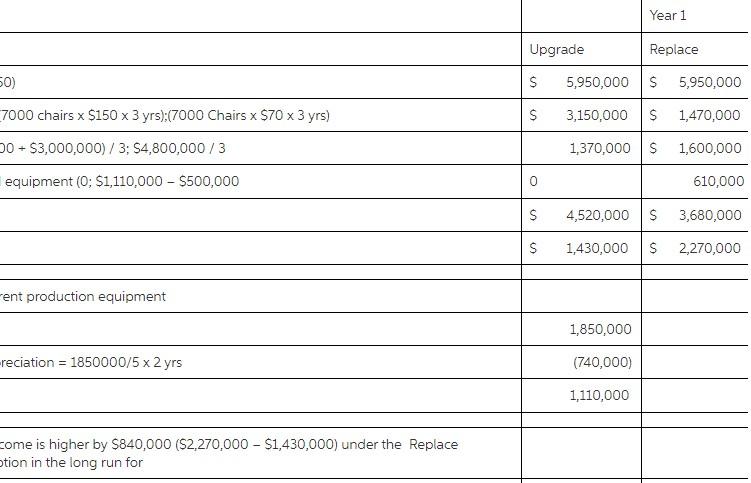

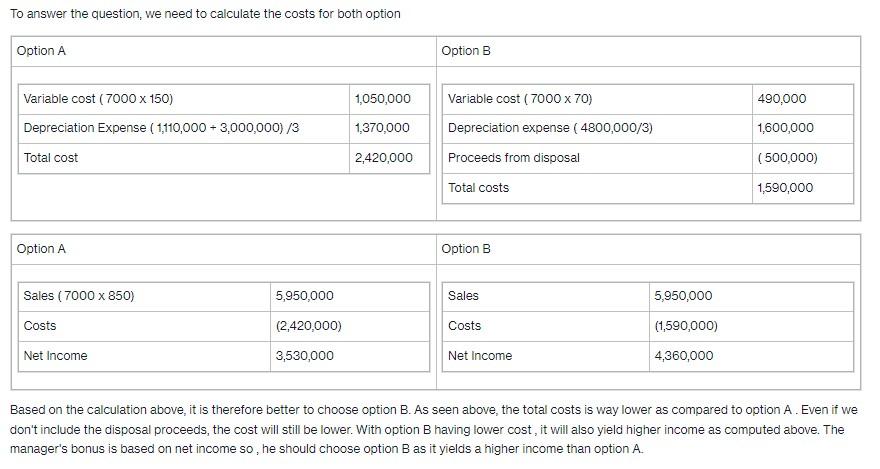

Sugar Sweet (SS) Company produces and sells 7,000 specialty Treats per year at a selling price of $850 each. Its current production equipment, purchased for $1,850,000 and with a five-year useful life, is only two years old. It has a terminal disposal value of $0 and is depreciated on a straight-line basis. The equipment has a current disposal price of $500,000. However, the emergence of a new technology has led SS to consider either upgrading or replacing the production equipment. The following table presents data for the two alternatives: B Upgrade $3,000,000 Replace $4,800,000 A 1 Choice 2 One-time equipment costs 3 Variable manufacturing cost per Treat 4 Remaining useful life of equipment (years) 5 Terminal disposal value of equipment $150 $70 3 3 0 0 Step 1 Operating Income Operating income is a secretarial figure that measures the amount of revenue realized from commerce's operations, after deducting operating expenses such as wages, depreciation, and cost of goods sold (COGS). Step 2 4) Explanation of Which Alternative would Nick son choose- Year 1 Replace $ 5,950,000 S $ 1,470,000 Particulars Upgrade Revenues (7,000 x $850) 5,950,000 Cash operating costs: (7000 chairs x $150 x 3 yrs.):17000 Chairs x 570X3 S yrs.) 3,150,000 Depreciation (S1,110,000+ $3,000,000)/3: $4,800,000/3 1.370,000 Loss on disposal of old equipment (0;$1,110,000 - $500,000 Total costs S 4,520,000 Operating Income 1,430,000 0 S 1.600.000 610,000 $ 3,680,000 $ 2,270,000 $ "Book value of the current production equipment Cost less: Accumulated Depreciation = 1850000/5 x 2 yrs. Book Value 1,850,000 (740,000) 1,110,000 Year 1 Upgrade Replace 50) $ 5,950,000 $ 5,950,000 7000 chairs x $150 x 3 yrs):(7000 Chairs x $70 x 3 yrs) $ 3,150,000 $ 1,470,000 00 - $3,000,000) / 3; 54,800,000/3 1,370,000 $ 1,600,000 equipment (0; $1,110,000 - $500,000 0 610,000 $ 4,520,000 $ 3,680,000 S 1,430,000 $ 2,270,000 -ent production equipment 1,850,000 -reciation = 1850000/5 x 2 yrs (740,000) 1,110,000 come is higher by $840,000 ($2,270,000 - $1,430,000) under the Replace otion in the long run for To answer the question, we need to calculate the costs for both option Option A Option B Variable cost ( 7000 x 150) 1,050,000 Variable cost ( 7000 x 70) 490,000 Depreciation Expense (1,110,000 - 3,000,000) /3 1,370,000 1,600,000 Depreciation expense ( 4800,000/3) Proceeds from disposal Total cost 2,420,000 (500,000) Total costs 1,590,000 Option A Option B Sales ( 7000 x 850) 5,950,000 Sales 5,950,000 Costs (2,420,000) Costs (1,590,000) Net Income 3,530,000 Net Income 4,360,000 Based on the calculation above, it is therefore better to choose option B. As seen above, the total costs is way lower as compared to option A. Even if we don't include the disposal proceeds, the cost will still be lower. With option B having lower cost, it will also yield higher income as computed above. The manager's bonus is based on net income so, he should choose option B as it yields a higher income than option A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts