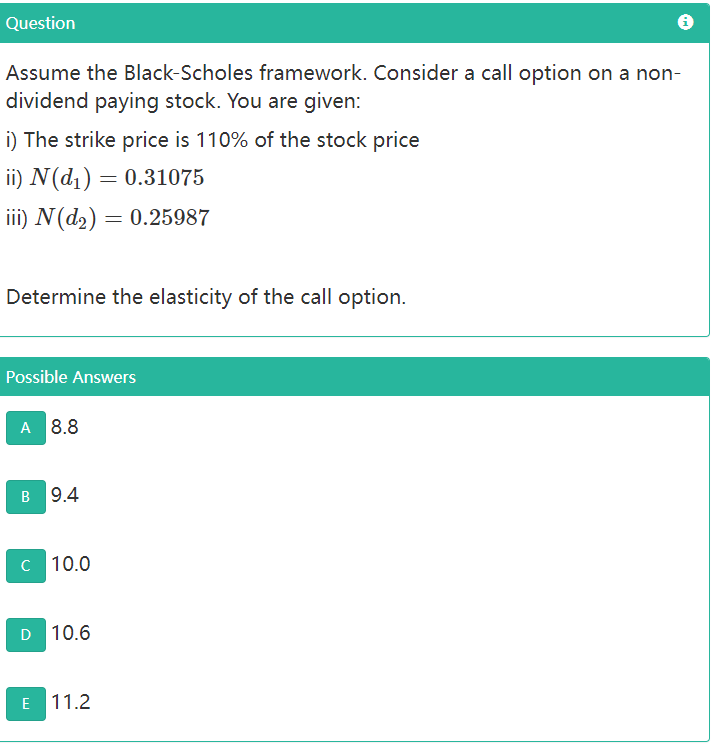

Question: Question Assume the Black-Scholes framework. Consider a call option on a non- dividend paying stock. You are given: i) The strike price is 110% of

Question Assume the Black-Scholes framework. Consider a call option on a non- dividend paying stock. You are given: i) The strike price is 110% of the stock price ii) N(di) = 0.31075 iii) N(d2) = 0.25987 ( = Determine the elasticity of the call option. Possible Answers A 8.8 B 9.4 C 10.0 D 10.6 E 11.2 Question Assume the Black-Scholes framework. Consider a call option on a non- dividend paying stock. You are given: i) The strike price is 110% of the stock price ii) N(di) = 0.31075 iii) N(d2) = 0.25987 ( = Determine the elasticity of the call option. Possible Answers A 8.8 B 9.4 C 10.0 D 10.6 E 11.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts