Question: - QUESTION Awarding when inherent interpretare dhe Meer as the public concerning the ones and resember of the tractor and QUESTION Tax Cidadania QUESTION 16

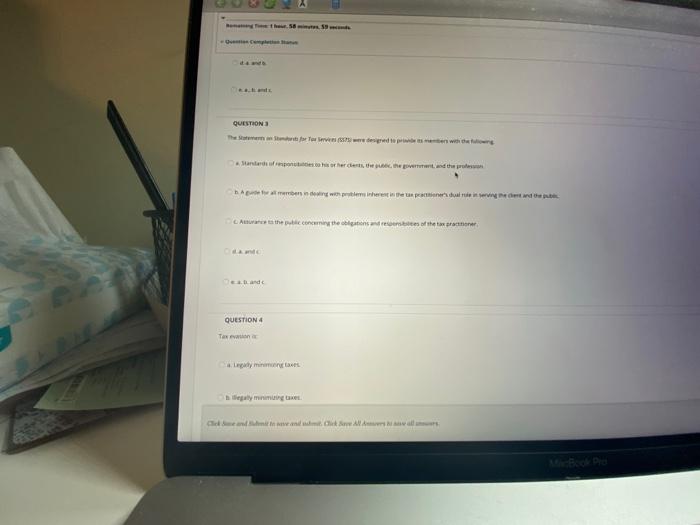

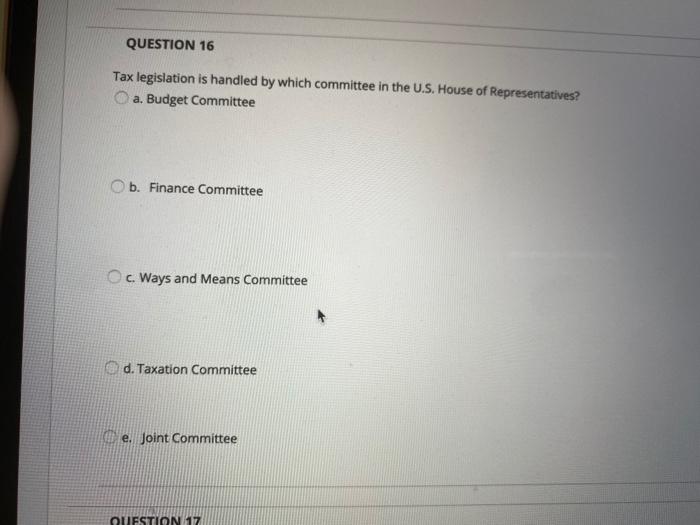

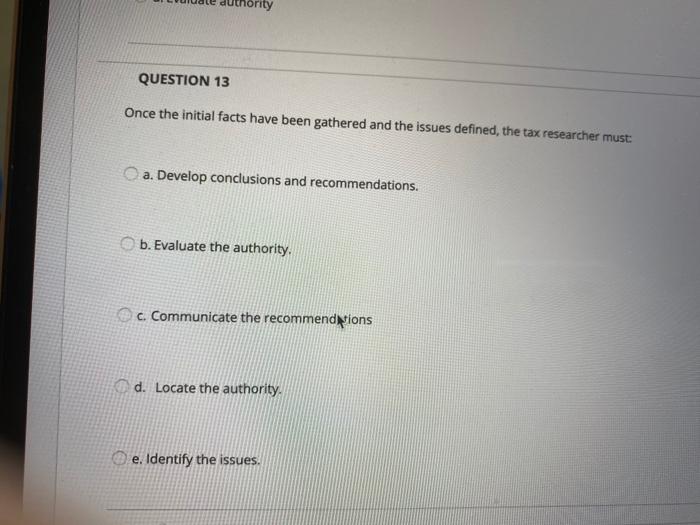

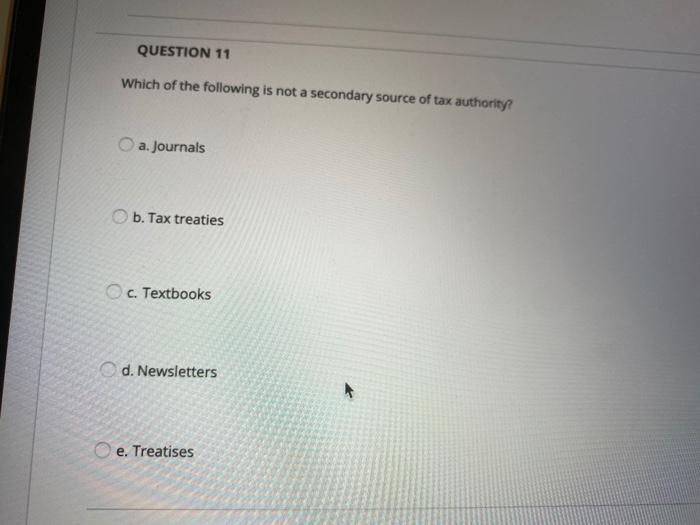

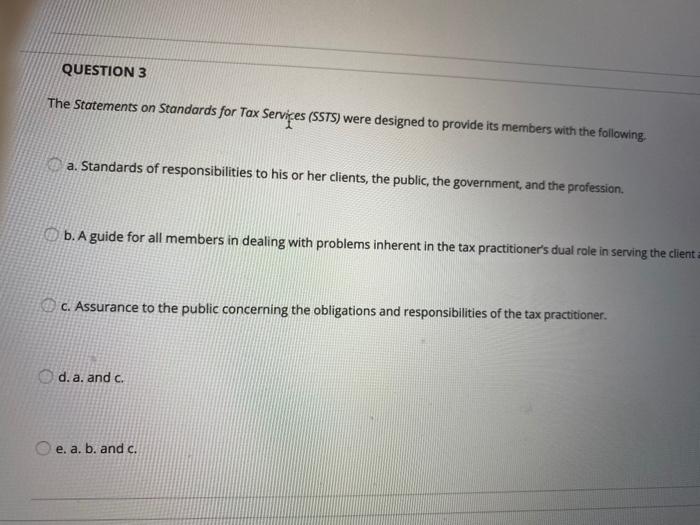

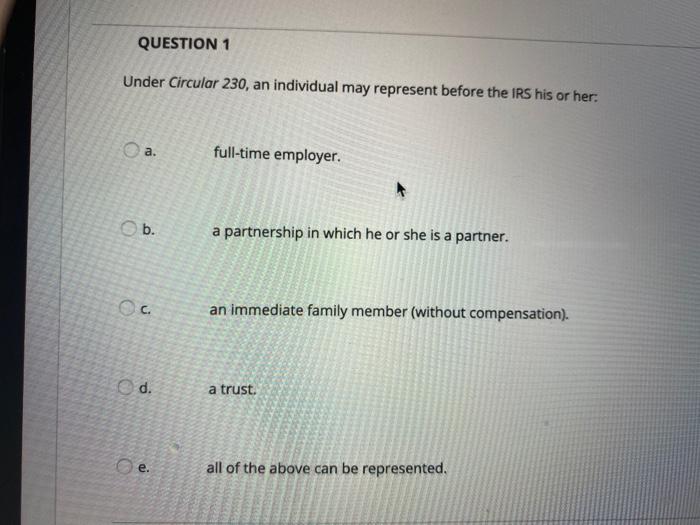

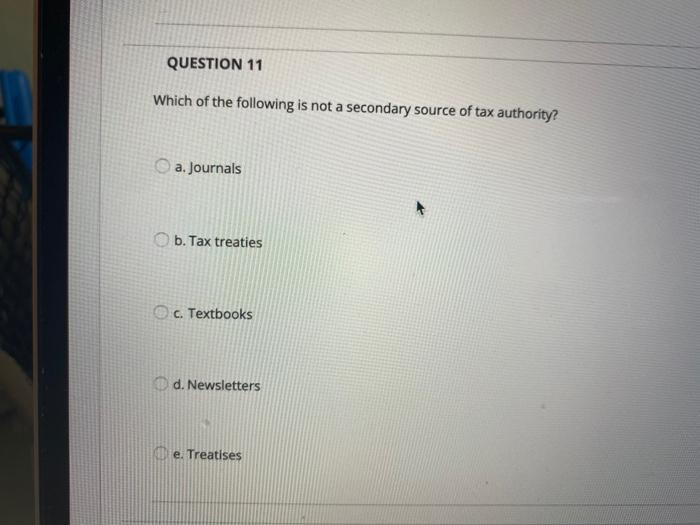

- QUESTION Awarding when inherent interpretare dhe Meer as the public concerning the ones and resember of the tractor and QUESTION Tax Cidadania QUESTION 16 Tax legislation is handled by which committee in the U.S. House of Representatives? a. Budget Committee b. Finance Committee c. Ways and Means Committee d. Taxation Committee e. Joint Committee QUESTION 17 rity QUESTION 13 Once the initial facts have been gathered and the issues defined, the tax researcher must: a. Develop conclusions and recommendations. b. Evaluate the authority. c. Communicate the recommendpions d. Locate the authority e. Identify the issues. QUESTION 11 Which of the following is not a secondary source of tax authority? a. Journals b. Tax treaties c. Textbooks d. Newsletters e. Treatises QUESTION 3 The Statements on Standards for Tax Services (SSTS) were designed to provide its members with the following a. Standards of responsibilities to his or her clients, the public, the government, and the profession. b. A guide for all members in dealing with problems inherent in the tax practitioner's dual role in serving the client c. Assurance to the public concerning the obligations and responsibilities of the tax practitioner. d. a. and c. e. a. b. and c. QUESTION 1 Under Circular 230, an individual may represent before the IRS his or her: a. full-time employer. b. a partnership in which he or she is a partner. an immediate family member (without compensation). d. a trust. e. all of the above can be represented. QUESTION 11 Which of the following is not a secondary source of tax authority? a. Journals b. Tax treaties c. Textbooks d. Newsletters e. Treatises

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts