Question: Question B - 3-3 Am X https//ezto.mheducation.com/ext/map/index.html?_con=confiexternal_browser=DalaunchUrl=https253A$62521%252Flims.mheducation.com%252F. ssment Problems i Help Save & Ex Che Required information [The following information applies to the questions displayed

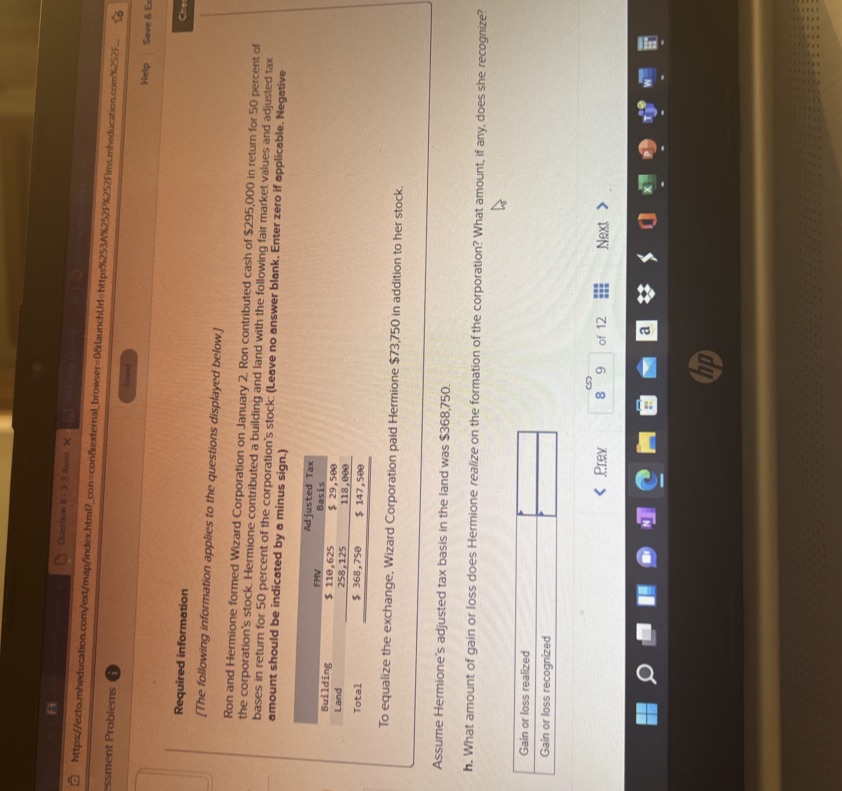

Question B - 3-3 Am X https//ezto.mheducation.com/ext/map/index.html?_con=confiexternal_browser=DalaunchUrl=https253A$62521%252Flims.mheducation.com%252F. ssment Problems i Help Save & Ex Che Required information [The following information applies to the questions displayed below.] Ron and Hermione formed Wizard Corporation on January 2. Ron contributed cash of $295,000 in return for 50 percent of the corporation's stock. Hermione contributed a building and land with the following fair market values and adjusted tax bases in return for 50 percent of the corporation's stock: (Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign.) Adjusted Tax FMV Basis Building $ 110,625 $ 29,500 Land 258,125 118,009 Total $ 368,750 $ 147,500 To equalize the exchange, Wizard Corporation paid Hermione $73,750 in addition to her stock. Assume Hermione's adjusted tax basis in the land was $368,750. h. What amount of gain or loss does Hermione realize on the formation of the corporation? What amount, if any, does she recognize? Gain or loss realized Gain or loss recognized O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts